Berkshire Hathaway is sitting on a record pile of cash at $189 billion.

That’s no reason to worry about an imminent stock market crash, according to one fund manager.

“Everybody gets exercised, they go hyperbolic about it, but it’s not that big of a number,” Chris Bloomstran said.

Berkshire Hathaway recently reported its first-quarter results, and like clockwork, a swarm of bearish investors pointed out that Warren Buffett is sitting on a record cash pile of $189 billion.

The implication, according to these commentators, is that the stock market is likely to soon suffer a massive decline because Buffett doesn’t see any value in investing his firm’s massive cash pile at the current sky-high valuations.

In fact, that couldn’t be further from the truth, according to Chris Bloomstran, fund manager of Semper Augustus, which manages about $550 million in assets and counts Berkshire Hathaway as its largest position.

In a recent interview with Business Insider, Bloomstran explained that there’s a lot more nuance to Berkshire Hathaway’s mountain of cash, and it doesn’t reflect the idea that Buffett is bearish on the stock market or that a stock market crash is imminent.

“Everybody gets excited, they go hyperbolic about it, but it’s not that big of a number,” Bloomstran said.

Putting Berkshire’s cash pile into perspective

Instead of measuring Berkshire Hathaway’s cash position on an absolute basis, investors are better off measuring the cash pile as a percentage of Berkshire’s total assets, according to Bloomstran.

And at 17.5%, Berkshire Hathaway’s current cash position is about in-line with its long-term average when measured against the firm’s total assets. Berkshire Hathaway has kept cash on its balance sheet at an average of 13% of assets since 1997, according to Bloomstran.

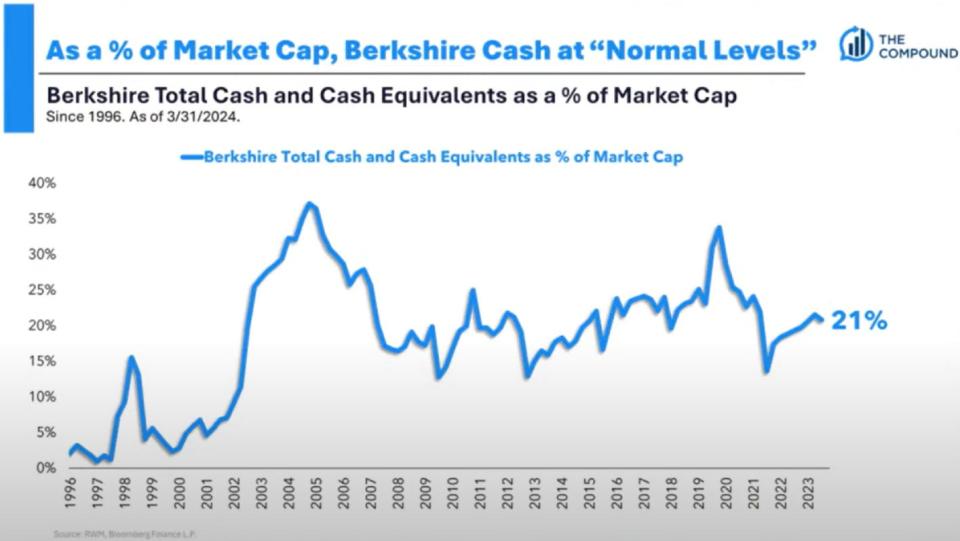

Another way to look at Berkshire Hathaway’s cash position is to measure it against the firm’s market valuation, which paints a similar picture. Berkshire Hathaway’s $189 billion cash is actually at a pretty normalized level, and well below its peak of nearly 40% in 2004.

Berkshire Hathaway is required to hold onto cash

Just because Berkshire Hathaway holds nearly $200 billion in cash doesn’t mean they can invest all of that cash if they find a big enough target.

“I think of the cash, roughly half of it is legitimately deployable,” Bloomstran said.

That’s because Berkshire Hathaway’s massive insurance operations require the company to have an ample cash reserve to fund potential insurance payouts.

While Buffett has stated that Berkshire Hathaway will maintain a permanent cash reserve of about $30 billion to fund potential insurance payouts, Bloomstran takes a more conservative approach and adds about $50 billion to that reserve level to account for a full year’s worth of potential insurance losses.

“We are thus calling $82 billion a more or less permanent cash reserve,” Bloomstran said in his annual investor letter, leaving about $110 billion available for Berkshire Hathaway to invest.

Berkshire Hathaway’s investable universe is slim

Because of the massive size of Berkshire Hathaway, there’s only a small group of companies it can invest in that will really move the needle for the conglomerate.

When you combine that with the fact that cash-equivalents like short-term Treasurys are yielding more than 5%, Buffett and and his company are taking their time to find the right investment at the right price — and that investment could come at any time, just like it did in the first quarter of 2016 when Berkshire first invested in Apple.

At the time, the S&P 500 was trading near record highs, Apple was the biggest company in the world, and Berkshire Hathaway’s absolute cash pile was at a record. None of those factors — all of which are present today — stopped Buffett from making one of the best investments in Berkshire Hathaway’s history.

“He’s limited to maybe the 100 biggest companies in the S&P 500 and maybe a handful of international businesses to be able to invest in. So, his opportunity set is expensive, but he doesn’t mind earning 5.3% in the interim, but it does not mean in any way, shape, or form that a stock market crash is imminent. He’s just trying to find great prices stable enough to put money to work. His universe is limited,” Bloomstran said.

Put together, investors shouldn’t have a bearish view on the stock market just because Berkshire Hathaway is sitting on a record pile of cash.

Take it from Buffett himself.

When asked “what is Buffett waiting for?” with regards to Berkshire’s cash pile at this year’s annual shareholder meeting, the legendary investor responded:

“We only swing at pitches we like.”

Read the original article on Business Insider

Credit: Source link