Two of the most sizzling stocks so far in 2024 are Chipotle Mexican Grill (NYSE: CMG) and Nvidia (NASDAQ: NVDA). Indeed, both businesses are considered leaders in their respective industries.

However, in addition to solid business performance, these two companies share something else in common that is fueling some heightened buying activity. Specifically, both Nvidia and Chipotle have upcoming stock splits scheduled for June.

With shares of each continuing to soar, investors may be hard-pressed as to which company represents a more compelling position in the long run.

Let’s break down the benefits and opportunity costs of owning each stock, and assess which one looks like the superior choice.

The case for and against Nvidia

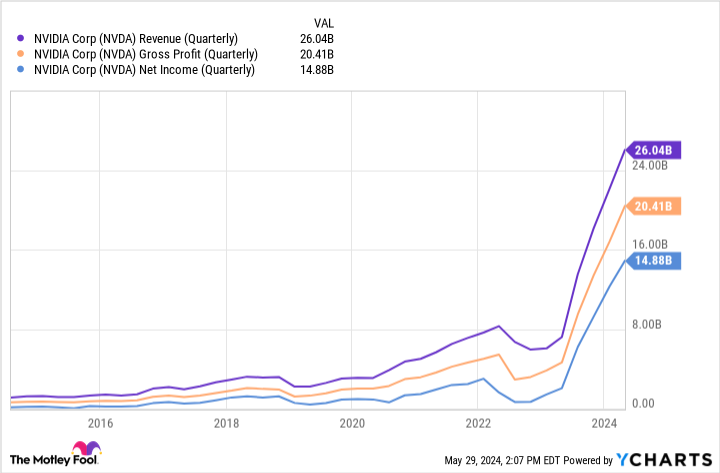

The chart below illustrates Nvidia’s revenue, gross profit, and net income over the last 10 years. Clearly, the last couple of years have witnessed outsized growth compared to prior periods.

It’s no secret that Nvidia is a major player in the artificial intelligence (AI) realm. The company’s H100, A100, and Blackwell graphics processing units (GPU) are in high demand with customers that include Tesla and Meta Platforms.

What’s really notable about the trends above is that Nvidia’s growth is accelerating across both the top and bottom lines. By generating excess cash flow, Nvidia is able to reinvest profits into other growth drivers and bolster its long-term roadmap.

While this is all positive, there are some risks that should be acknowledged. For now, Nvidia is estimated to have an 80% share of the AI chip market.

However, rising competition from Intel, Advanced Micro Devices, and even big tech firms such as Amazon and existing customers like Meta pose a threat. Each of these companies is developing its own line of chips, which should eventually encroach on Nvidia’s commanding lead.

The case for and against Chipotle

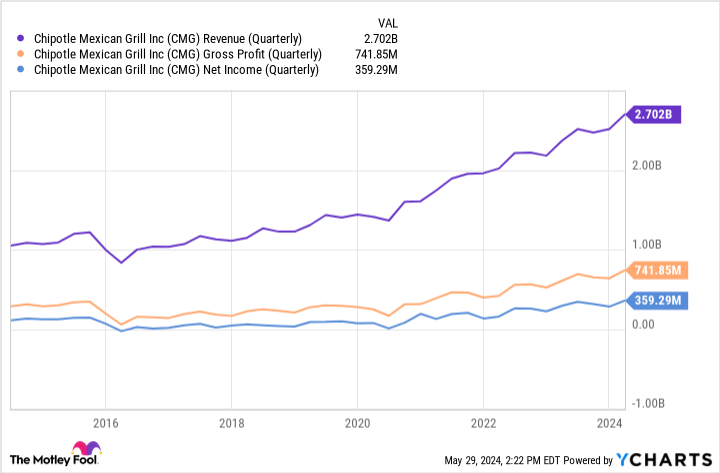

Chipotle is best known for its tasty burrito wraps and bowls. With 40 million rewards members, Chipotle has undoubtedly built a loyal customer following with strong brand equity.

One of the ways that Chipotle has been able to capture the attention of so many consumers is due to the company’s investments in digital sales strategies.

Similar to Nvidia, Chipotle has been able to fund an extremely profitable operation. Its digital sales channels have helped fuel meaningful margin expansion, which in turn has flowed to the bottom-line. Although these financial results are encouraging, Chipotle stock does carry some risk.

Macroeconomic factors such as inflation and interest rates can impact just about any business. While Nvidia is certainly not immune to these factors, I would argue that a restaurant chain such as Chipotle is more susceptible.

Consumer discretionary trends are highly sensitive and can fluctuate from year to year. I’d encourage investors to think about that dynamic as it relates to long-term growth prospects.

And the winner is?

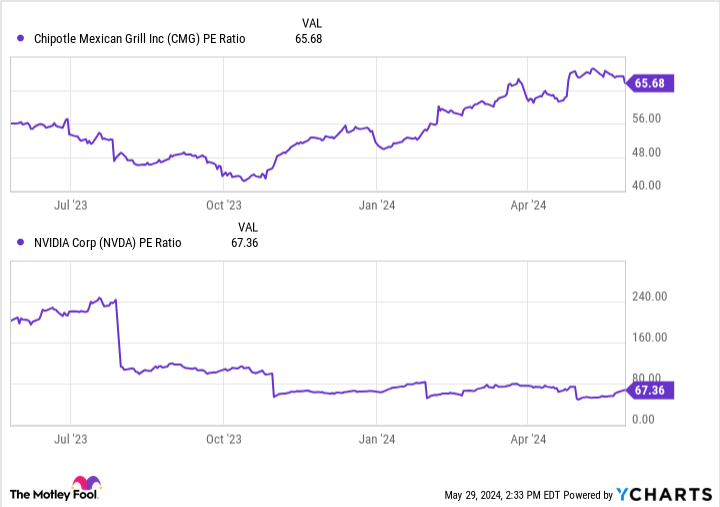

The final piece of this analysis revolves around valuation. As seen in the chart below, the price-to-earnings (P/E) ratio of Chipotle and Nvidia illustrate vastly different trends.

Over the last year, Chipotle’s P/E has risen considerably — now sitting at 65.7. By contrast, Nvidia’s P/E is far lower than it was a year ago.

Another way of looking at this is understanding that, while each stock has risen sharply in the last year, shares of Nvidia are technically cheaper than they were 12 months ago. Why? Because the company’s earnings growth is outpacing the acceleration of the stock price.

At the end of the day, Chipotle and Nvidia are two very different businesses.

The fact of the matter is that Chipotle’s fast-casual dining is a luxury purchase. While the operating results above indicate that the company can grow, it’s important to remember that Chipotle sells burritos — it’s not exactly a proprietary business.

On the contrary, Nvidia sells a product that businesses of all sizes need. And while competition exists, I think that there are stronger longer-term secular tailwinds fueling AI as opposed to the food industry. If anything, Chipotle could become a customer of Nvidia as the company doubles down on its technology investments.

Stated differently, AI is so prolific that its applications span a variety of industry sectors, including food and beverage. I don’t think the opposite is true, though. I don’t see many reasons why Nvidia would ever be a Chipotle customer.

Considering the growth narrative surrounding AI, coupled with Nvidia’s attractive valuation, I think the company is the better option compared to Chipotle.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Meta Platforms, Nvidia, and Tesla. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Chipotle Mexican Grill, Meta Platforms, Nvidia, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Nvidia vs. Chipotle: Which Could Be the Better Stock-Split Stock to Buy Now and Hold for the Next 10 Years? was originally published by The Motley Fool

Credit: Source link