The artificial intelligence (AI) craze has sent the share prices of many tech companies flying in 2024, but Super Micro Computer (NASDAQ: SMCI) and SoundHound AI (NASDAQ: SOUN) stand out. Their astronomical gains managed to eclipse even AI chip pioneer Nvidia (NASDAQ: NVDA), which has been growing at a fast pace thanks to the buoyant demand for its graphics cards.

While shares of Nvidia have gained an impressive 75% so far in 2024, Super Micro Computer has shot 209% higher, and SoundHound AI is up by 268%. But are any of these three AI stocks still worth buying at their current valuations?

All three companies seem set for solid growth

Despite Supermicro’s impressive year-to-date rise, the stock still trades at an attractive 6.6 times sales. That’s not surprising, as the company justified its rapid stock price surge with solid revenue growth. For instance, in its fiscal 2024 second quarter (ended on Dec. 31), Supermicro’s revenue more than doubled to $3.66 billion from $1.8 billion in the prior-year period.

Additionally, Supermicro raised its fiscal-year guidance to a range of $14.3 billion to $14.7 billion. At any point in that range, the company would more than double its fiscal 2023 revenue of $7.1 billion. This terrific growth can be attributed to the massive demand for Supermicro’s AI server solutions, which are used for mounting chips from Nvidia and others.

According to a forecast from Research and Markets, the AI server market will generate $24 billion in revenue in 2024. Based on Supermicro’s revenue forecast for its current fiscal year, the company controls about 60% of this market. More importantly, the AI server market is expected to clock annualized growth of 25% through 2029 and generate annual revenue of $72 billion. So Supermicro seems capable of sustaining its outstanding growth pace over the long run, especially considering that it is focused on boosting its manufacturing capacity to meet to the rising demand for AI servers.

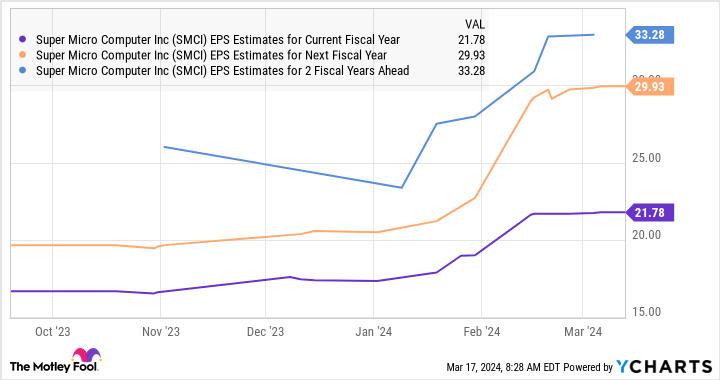

Not surprisingly, Wall Street analysts are predicting that Supermicro will deliver outstanding growth in the current fiscal year and beyond.

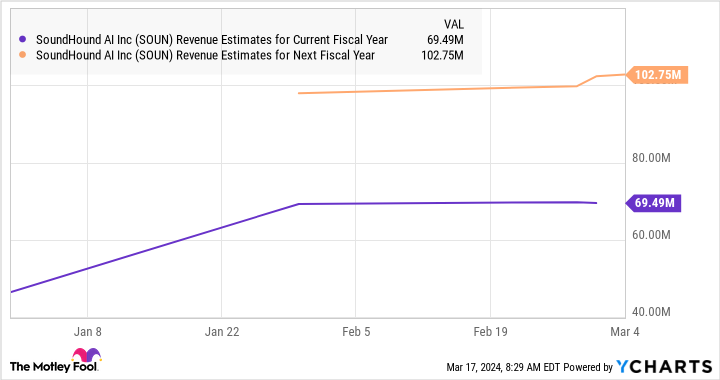

Meanwhile, SoundHound AI benefits from the growing demand for voice-enabled AI solutions. Its revenue jumped 47% in 2023 to $46 million. That was the same growth rate it recorded in 2022, and management forecast that its growth would accelerate in 2024 and 2025. The midpoint of its 2024 revenue guidance stands at $70 million, which would be a 52% increase.

Even better, SoundHound “expects its growth to accelerate with revenue exceeding $100 million” in 2025. That won’t be surprising considering the company’s revenue pipeline. SoundHound says that it has a cumulative subscriptions and bookings backlog worth an impressive $661 million, a figure that doubled on a year-over-year basis in the previous quarter.

When SoundHound speaks of “bookings,” it’s referring to “committed customer contracts,” while the subscriptions backlog is indicative of the potential revenue it could generate from its existing customers. Its huge backlog shows why SoundHound is slated to deliver solid growth in 2024 and 2025.

Finally, there’s Nvidia. It is easy to understand why its shares have rocketed nearly 500% higher since the beginning of 2023 when the AI craze started gripping the stock market. The company is a pick-and-shovel AI play, as its graphics cards have been the foundation upon which AI models are being trained. ChatGPT, for instance, was trained using a huge number of Nvidia GPUs (graphics processing units). Subsequently, all the major cloud computing providers started queuing up to buy Nvidia’s chips to power the development and rollout of AI applications.

As a result, it started ramping up the production of its flagship H100 processors, bringing down their waiting period from almost a year to three to four months. Even then, Nvidia management says that the demand for its GPUs will continue to exceed supply. That’s not surprising considering Nvidia’s monopoly-like position in the AI GPU market, which it is looking to strengthen further with the launch of its new Blackwell processors later this year. Nvidia predicts that these new processors will help it gain a bigger share of the $250 billion AI chip market. What’s more, the company’s foray into additional AI chip niches such as application-specific integrated circuits (ASICs) could help it unlock new growth opportunities.

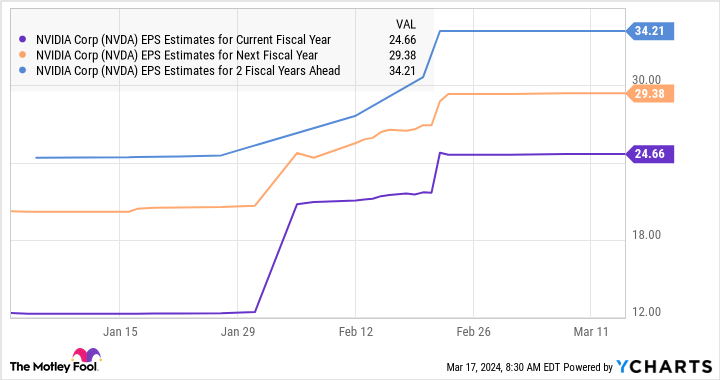

As such, Nvidia seems capable of growing at a healthy pace for a long time. In the fourth quarter of its fiscal 2024 (which ended Jan. 28), its revenue jumped 265% to $22.1 billion. Its non-GAAP earnings surged by 486% to $5.16 per share. Nvidia anticipates its revenue will jump 233% year over year in its fiscal 2025 first quarter to $24 billion. More importantly, it enjoys fat margins in the AI GPU market, which explains why its earnings are forecast to nearly double in the current fiscal year from last year’s reading of $12.96 per share.

So, the bottom line is that all three AI stocks discussed here seem primed for outstanding growth.

But which ones should you buy?

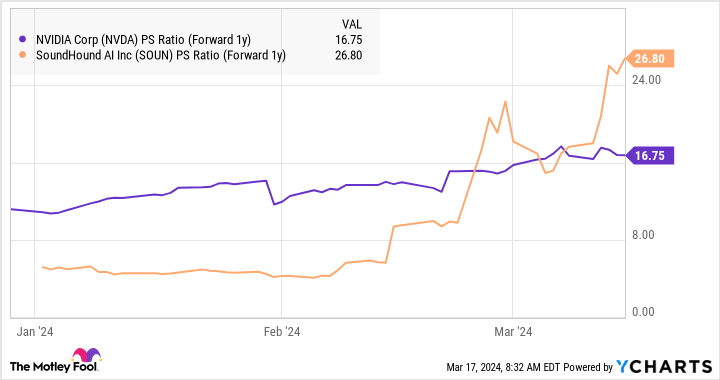

All three companies now trade at expensive valuations. While Nvidia sports a trailing earnings multiple of 73, Supermicro is trading at 83 times earnings. SoundHound isn’t profitable yet, but its price-to-sales ratio of 44 is much higher than Supermicro’s ratio. Nvidia, for comparison, trades at 36 times sales. Also, Nvidia is growing faster than the other two, and its forward sales multiple is lower than SoundHound’s.

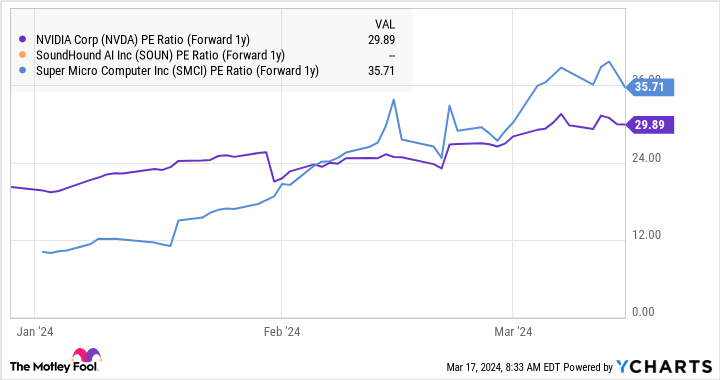

What’s more, Nvidia is cheaper than Supermicro based on the forward earnings multiple metric.

So, we can conclude that SoundHound AI has become too expensive to buy right now. Supermicro, while cheap in terms of its sales multiple, is facing margin challenges. Its non-GAAP gross margin fell to 15.5% in the previous quarter from 18.8% in the prior-year period. Nvidia’s adjusted gross margin, on the other hand, jumped 14.6 percentage points last quarter to 73.8%.

This tells us why Nvidia is cheaper when it comes to the forward P/E ratio. So investors looking to buy one of these three AI stocks would do well to buy Nvidia, considering its immense earnings power and dominant position in the AI chip market. Supermicro would also make a nice addition to their portfolios, considering its potential earnings growth, its ability to capitalize on the AI server market, and a cheap sales multiple.

Investors, however, would do well to stay away from SoundHound for now, as it is too expensive and has yet to become profitable. However, it would be a good idea to keep the stock on your watch list, considering the end-market opportunity it is sitting on.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 21, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Super Micro Computer, SoundHound AI, or Nvidia: Which Artificial Intelligence (AI) Stocks Should You Buy? was originally published by The Motley Fool

Credit: Source link