Stocks made new record highs, with the S&P 500 reaching a closing high of 4,894.16 on Thursday and an intraday high of 4,906.69 on Friday. For the week, the S&P rose 1.1% to close at 4,890.97. The index is now up 2.5% year to date and up 36.7% from its October 12, 2022 closing low of 3,577.03.

One of the hottest debates in the markets right now is if and when the Federal Reserve will pivot from its very hawkish stance and start cutting interest rates.

If you’re a little behind: The Fed began hiking rates aggressively in early 2022 in its effort to get inflation under control. It’s been on hold since last summer. And in its December summary of projections, the central bank signaled that it could cut rates three times in 2024. The present question for Fed watchers has been about when that first rate cut will happen.

For a while, futures traders were betting that the first rate cut would come with the monetary policy meeting this coming March. But more recently, those bets have been pared back with traders now assigning a 47% chance of a March rate cut, down from 83% a month ago.

A popular view is that rate cuts would be bullish for risk assets like stocks. So any developments that lower the odds of a rate cut in the near term would therefore be bearish. All other things being equal, this view makes sense.

But the world is complicated, and all other things are never equal.

The world has changed since Fed rate decisions were a much bigger deal

I’m no monetary policy economist. But as I discussed on the Investopedia Express podcast earlier this month, I think concerns about the Fed’s next move on interest rates are a bit overblown.

First of all, we’re talking about a potential 25-basis-point cut from a range of 5.25% to 5.5%. Sure, that’s not insignificant. But that’s nowhere near as big a deal as it was when we were talking about 25-, 50-, and 75-basis-point rate hikes from near 0%.

Second, all those big rate hikes early in the hike cycle were happening amid an intensifying inflation crisis. The economy was a complicated mess in 2022. Today, that crisis is largely behind us with inflation rates hovering near the Fed’s target levels. On Friday, we learned that the core PCE price index, the Fed’s preferred inflation gauge, fell to its lowest level in nearly three years.

In other words, the stakes for the upcoming Fed policy meetings aren’t nearly as high as they were in 2022 and 2023.

Third, we have to keep in mind that rate cuts and rate hikes — in and of themselves — aren’t the real issue. Rather, they represent reactions to real issues.

Putting it another way, whether or not the Fed cuts rates is not the right question. Here’s an excerpt of what I said to Investopedia’s Caleb Silver earlier this month:

… As far as whether or not they actually pivot and begin to cut or hold or whatever, I think that’s really not the right question. The question [should] be, “If they don’t cut, then why are they not cutting as they suggested in their dot plots?” Right? Is it possible that the economy heats up more than they initially modeled? Yeah, maybe that’s a good reason to not cut because they’re concerned that inflation is going to be bubbling up again.From an investor perspective and from an economic perspective, that’s not exactly the worst thing in the world that the economy isn’t falling apart. Because remember, a lot of these assumptions when it comes to the Fed pivot, in addition to inflation cooling, are also tied to the idea that the economy is also cooling — that growth is slowing and decelerating and that a lot of people have recessions on their mind. So maybe the Fed doesn’t pivot because the economy’s picking up? That’s really not that big a deal.

To reiterate, the Fed’s projection that it would cut rates in 2024 was accompanied by assumptions that economic growth would slow significantly and inflation rates would take another leg lower during the year.

That’s to say if the Fed were to change its outlook for rate cuts, it may also be the case that its outlook for the economy and inflation have changed as well.

Economic reality is proving stronger than expected

The recent reduction in March rate-cut odds followed better-than-expected monthly reports on retail sales, industrial production, housing construction, and consumer sentiment. For more, read last week’s review of the macro cross currents.

On Thursday, we learned GDP grew at a 3.3% rate in Q4, which was much stronger than the 2.0% rate expected.

Also on Thursday, we learned orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — rose 0.3% to a record $74.33 billion in December.

Core capex orders are a leading indicator, meaning they foretell economic activity. While the growth rate has leveled off a bit, they continue to signal economic strength in the months to come.

On Friday, we learned personal consumption expenditures — which represents about 69% of GDP — increased 0.7% month over month in December to a record annual rate of $19.0 trillion.

The confluence of data we’ve gotten over the past several weeks suggest economic activity is tracking stronger than many expected.

Of course, the worry is that hot economic activity could fan the flames of inflation again, which would explain why those rate hike odds are coming down — traders are betting that the Fed will keep monetary policy tighter for longer to rein in the economy to contain inflation risks.

But on balance, all this is not necessarily a bad thing.

Remember, all of 2023 was about an economy performing better than expected, avoiding a recession many expected. Meanwhile, inflation cooled amid tight monetary policy.

Importantly, the stock market rallied for much of the year, with the S&P 500 surging 24%.

The bottom line

I think we’ll probably continue to hear pundits warn that rate-cut odds are coming down and argue this is bearish for stocks.

But before buying into that argument, we have to understand the economic circumstances that would cause the Fed to put off rate cuts.

If it’s because the economy is proving to be stronger than expected, then it’s no sure thing that keeping monetary policy tight is necessarily bad news — as we learned all of last year. By the way, it is the case that the economy has been proving stronger than expected as inflation rates continue to cool. And even as the odds of a rate cut have declined, the S&P 500 has been hitting fresh record highs.

And amid all this, the debate is over a relatively small move in the Fed’s benchmark interest rate. That is to say maybe the Fed’s next move just isn’t that big of a deal.

As always, context matters — especially when we’re thinking about developments that appear bullish or bearish for stocks.

One more quick thought

While we’re on the subject, we should also consider the possible scenario the Fed begins cutting rates because the economy takes a significant turn for the worse. As Carson Group’s Ryan Detrick observed, rate cuts that were intended to stimulate the economy amid a recession came with the S&P 500 falling an average of 11.6% in the year that followed.

This is a scenario where the rising odds of a rate cut is not necessarily a bullish signal. Another reminder that context matters.

Reviewing the macro crosscurrents

There were a few notable data points and macroeconomic developments from last week to consider:

Inflation rates cools. The personal consumption expenditures (PCE) price index in December was up 2.6% from a year ago, unchanged from November’s level. The core PCE price index — the Federal Reserve’s preferred measure of inflation — was up 2.9% during the month after coming in at 3.2% higher in the prior month.

On a month over month basis, the core PCE price index was up 0.2%, up slightly from the prior month’s print of 0.1%. If you annualized the rolling three-month and six-month figures, the core PCE price index was up 1.5% and 1.9%, respectively.

While inflation rates are beginning to hover near the Federal Reserve’s target rate of 2%, the central bank has indicated that it wants prices to stay cool for a little while before it is comfortable confident inflation is under control. So even though there may not be more rate hikes and rate cuts may be around the corner, rates are likely to be kept high for a while.

For more on the implications of cooling inflation, read: The bullish ‘goldilocks’ soft landing scenario that everyone wants

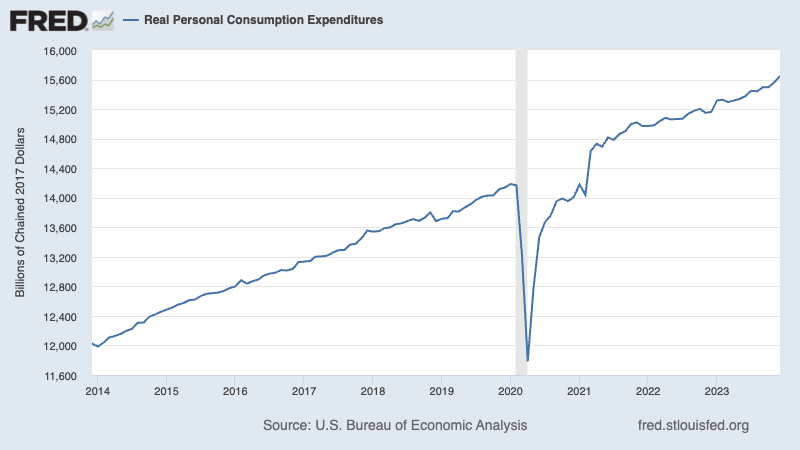

Consumers are spending. According to BEA data, personal consumption expenditures increased 0.7% month over month in December to a record annual rate of $19.0 trillion.

Adjusted for inflation, real personal consumption expenditures also rose to a new record.

For more on what’s bolstering personal consumption activity, read: Consumer finances are somewhere between ‘strong’ and ‘normal’ and The economic vibes are healing

Spending cooled with the cold. From BofA: “Total card spending per HH was down 3.0% y/y in the week ending Jan 20, according to BAC aggregated credit & debit card data. Total card spending in the South & MW was likely the most impacted by cold weather while NE spending showed some recovery y/y. Overall, spending on discretionary services – entertainment, restaurants, lodging and airlines – was the most affected.”

For more on broad economic activity, read: Economic growth: Slowdown, recession, or something else?

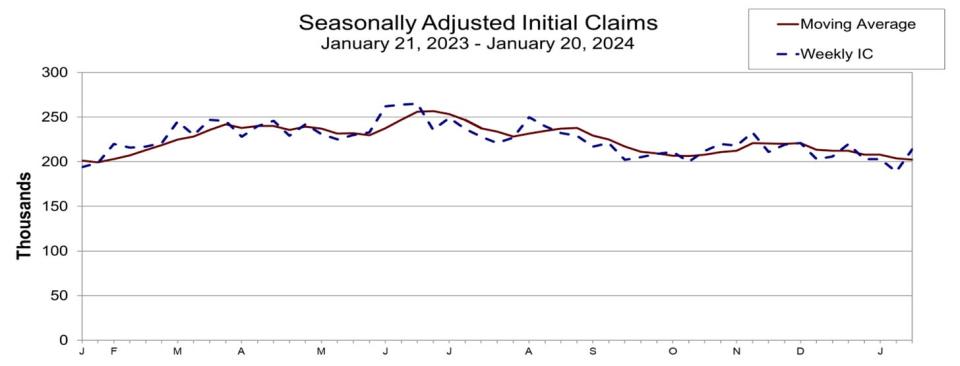

Watching layoffs. From BofA: “Despite some layoff announcement recently, both the size and frequency have been falling (Exhibit 19). Layoff announcements from Banks were also fairly muted vs. last year, other than Citi (restructuring).”

Unemployment claims rise. Initial claims for unemployment benefits increased to 214,000 during the week ending January 20, up from 189,000 the week prior. This is above the September 2022 low of 182,000, but it continues to trend at levels historically associated with economic growth.

For more on the labor market, read: The hot but cooling labor market in 16 charts and Labor market: How cool will it get?

Gas prices tick up. From AAA: “After making a brief weekend trip to $3.07, the national average for gas edged higher by one penny since last week to $3.10. The meandering journey is likely caused by low gas demand countered by slightly higher costs for oil. The result is a pump price stalemate.”

For more on energy prices, read: The other side of the oil price story

People are driving. Weekly EIA data through January 19 show gasoline demand is up from a year ago.

From DataTrek Research co-founder Nicholas Colas: “Lower oil/gas prices are an underappreciated economic tailwind as we start 2024. These not only tend to help consumer confidence but also reduce inflationary pressures on the American economy as a whole.”

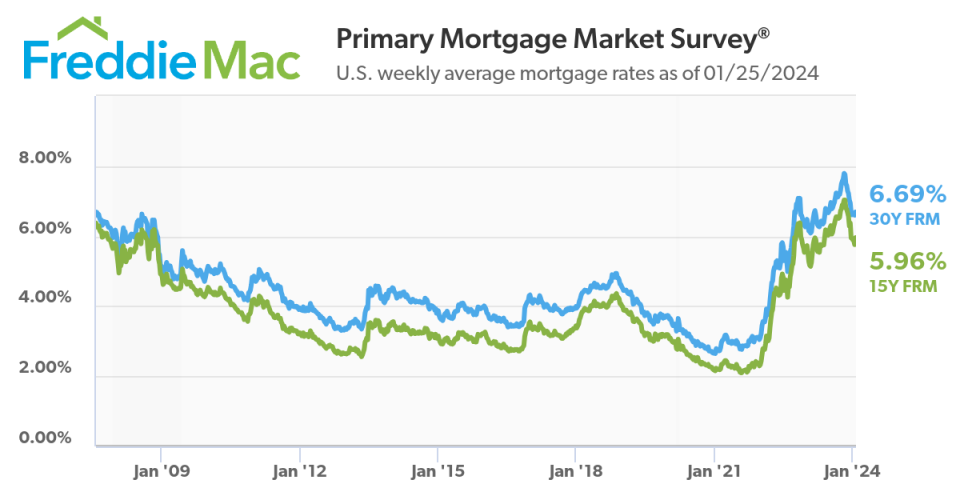

Mortgage rates tick up. According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 6.69% from 6.60% the week prior. From Freddie Mac: “Mortgage rates decreased this week, reaching their lowest level since May of 2023. This is an encouraging development for the housing market and in particular first-time homebuyers who are sensitive to changes in housing affordability. However, as purchase demand continues to thaw, it will put more pressure on already depleted inventory for sale.”

For more on home prices, read: Why home prices and rents are creating all sorts of confusion about inflation

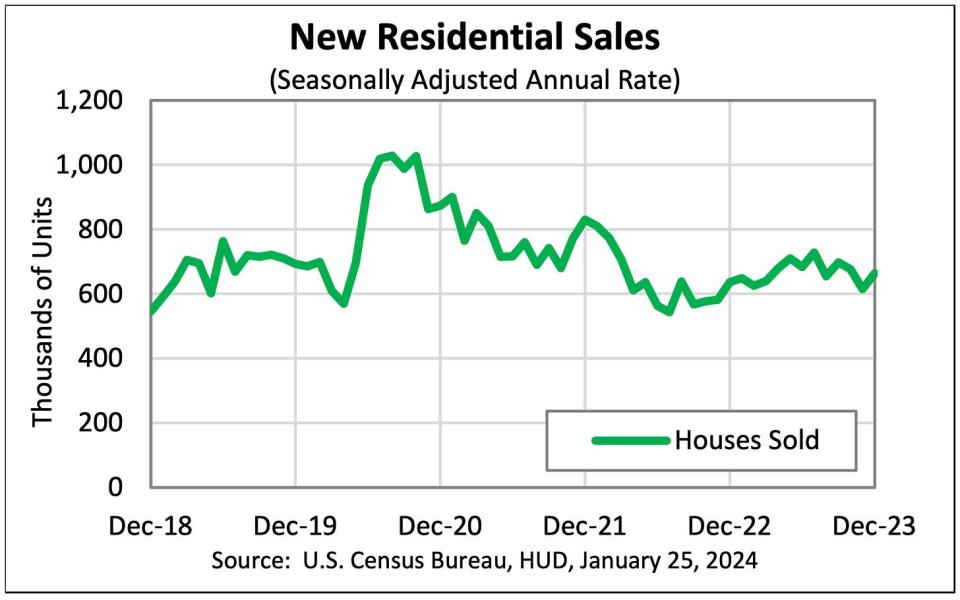

New home sales rise. Sales of newly built homes jumped 8% in December to an annualized rate of 664,000 units.

For more on housing, read: The U.S. housing market has gone cold

The economy was stronger than expected. U.S. GDP grew at a robust 3.3% rate in Q4, bolstered by a 2.8% increase in personal consumption.

For more on what’s been driving economic growth, read: 9 reasons to be optimistic about the economy and markets

Survey signals growth pickup. From S&P Global’s January U.S. PMI: “An encouraging start to the year is indicated for the U.S. economy by the flash PMI data, with companies reporting a marked acceleration of growth alongside a sharp cooling of inflation pressures. Output measured across both goods and services rose in January at the fastest rate since last June, growth momentum having stepped up a gear on the back of improved demand conditions. New orders inflows have now picked up for three months, buoyed in particular by improving sales to domestic customers, helping lift business confidence about the year ahead to the most optimistic since May 2022.”

Business investment activity is strong. Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — rose 0.3% to a record $74.33 billion in December.

Core capex orders are a leading indicator, meaning they foretell economic activity down the road. While the growth rate has leveled off a bit, they continue to signal economic strength in the months to come.

For more, read: The economy has gone from very hot to pretty good

Most U.S. states are still growing. From the Philly Fed’s December State Coincident Indexes report: “Over the past three months, the indexes increased in 25 states, decreased in 22 states, and remained stable in three, for a three-month diffusion index of 6. Additionally, in the past month, the indexes increased in 26 states, decreased in 16 states, and remained stable in eight, for a one-month diffusion index of 20.”

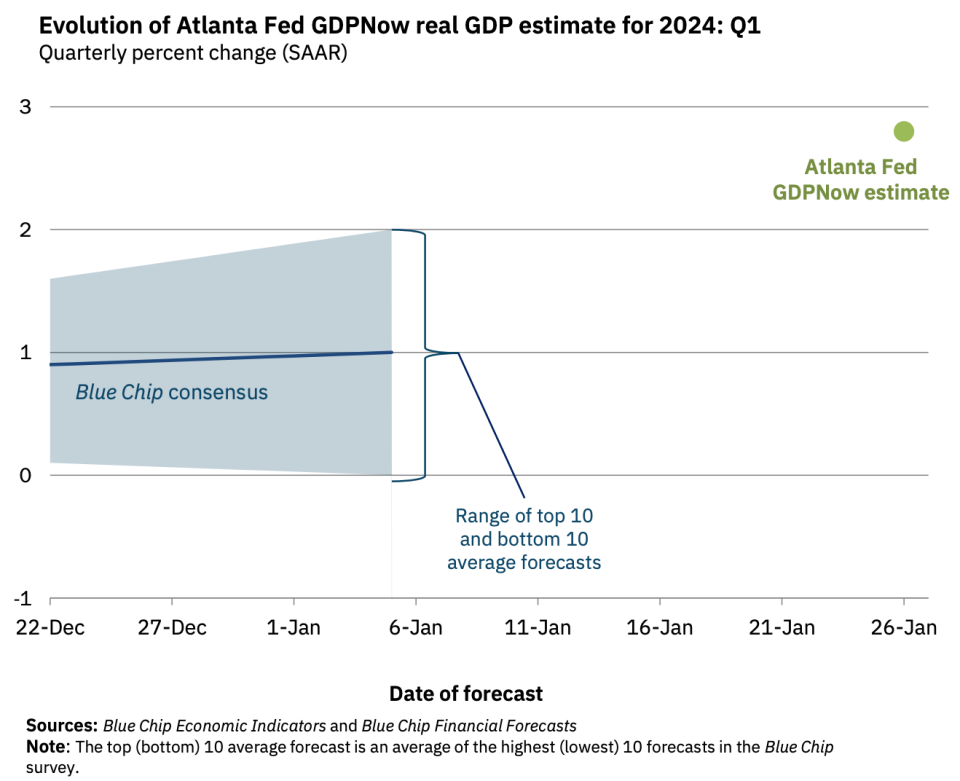

Near-term GDP growth estimates look good. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 3.0% rate in Q1.

For more on economic growth, read: Economic growth: Slowdown, recession, or something else?

Putting it all together

We continue to get evidence that we are experiencing a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

This comes as the Federal Reserve continues to employ very tight monetary policy in its ongoing effort to bring inflation down. While it’s true that the Fed has taken a less hawkish tone in 2023 than in 2022, and that most economists agree that the final interest rate hike of the cycle has either already happened or is near, inflation still has to cool more and stay cool for a little while before the central bank is comfortable with price stability.

So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g., higher interest rates, tighter lending standards, and lower stock valuations) to linger. All this means monetary policy will be unfriendly to markets for the time being, and the risk the economy slips into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms — meaning that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Also, it’s important to remember that while recession risks may be elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs, and those with jobs are getting raises.

Similarly, business finances are healthy as many corporations locked in low interest rates on their debt in recent years. Even as the threat of higher debt servicing costs looms, elevated profit margins give corporations room to absorb higher costs.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.

Credit: Source link