Kameleon007

Wells Fargo believes that the resumption of student loan payments in the U.S. should be a relatively contained headwind.

On Sunday, a pause in student loan payments for over three years due to the COVID-19 pandemic came to an end, with interest beginning to accrue on loans again on September 1 and payments due this month.

“For the roughly 43M borrowers who hold student loan debt, this means increased obligations and less ability to spend on discretionary purchases. But for the broader household sector, this is a drop in the bucket,” Wells Fargo economists Shannon Seery, Tim Quinlan and Jeremiah Kohl said in a research note on Monday.

With more than $1.6T in federal student loan debt owed, the impact of the payment resumption on the U.S. economy remains largely uncertain.

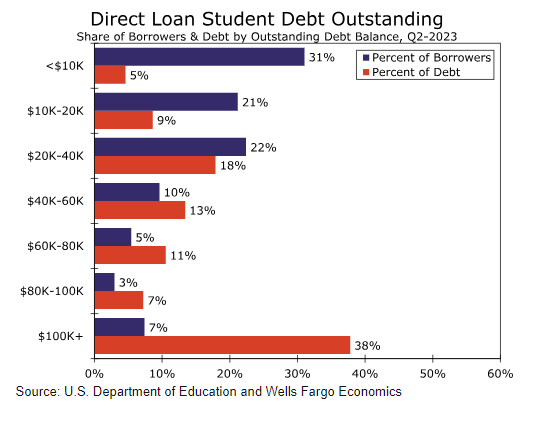

The Wells Fargo economists believe that the resumption in payments will not be detrimental to the broad household sector, as enormous student loan debts – or debts in which borrowers owe $100K or more – are constrained to only 7% of borrowers, which is equivalent to fewer than 3M people or less than 1% of the total U.S. population.

Wells Fargo broke down the percentage of borrowers and how much they owe in the following chart:

Seery, Quinlan and Kohl also said that they had seen student loan borrowers resuming payments ahead of the due date. According to their data, the U.S. Department of Education sent $6.4B to the Treasury in August, nearly five-times the monthly average from January through July. For September, the payments came in even faster.

“Monthly payments vary widely by household depending on income and debt outstanding, but we estimate the average payment to fall somewhere in the ballpark of $200-300 per month, which equates to around 5% of the U.S. median annual salary,” Seery, Quinlan and Kohl said.

Looking ahead, the Wells Fargo economists said they expected to see some weakness in real personal spending in the remaining months of 2023 as more borrowers resumed payments, but estimated the total impact would be fairly minimal, with student loan debt repayment subtracting just about 0.4% to 0.6% from total annual consumption.

“Even with a relatively contained direct macro impact, repayment is coming at a time when households’ staying power is dwindling, and will likely contribute to a slowdown in spending later this year and into early 2024,” Seery, Quinlan and Kohl added.

Student loan-related stocks include: SoFi Technologies (SOFI), Navient (NAVI), Nelnet (NNI), and SLM Corp (SLM).

More on student loans

Credit: Source link