The following is an extract from S&P Global Market

Intelligence’s latest Week Ahead Economic Preview. For the full

report, please click on the ‘Download Full Report’ link.

Download full report

US CPI, UK monthly output and labour data to watch

US inflation and activity data will be some of the highlights in

the week, while the UK also releases monthly output and labour

market reports. Additionally, final GDP and inflation data will be

due from major developed economies alongside a series of tier-2

data across the globe. S&P Global also releases key findings

from their latest Business Outlook surveys for major developed

economies, and the US Investment Manager Index on Tuesday. This

will be followed by the GEP Global Supply Chain Volatility

Index.

The key economic data of the week will be February’s US CPI,

which will be closely watched to help shape monetary policy and

growth expectations. While some stickiness may be anticipated

according to consensus expectations, further easing of inflationary

pressures should not be ruled out in the coming months given the

signals from PMI prices data, which could be supportive of eventual

rate cuts. That said, the market caution observed ahead of the

prior jobs report may well be seen again ahead of the next US CPI

update.

Insights into US investor sentiment will also be provided by the

March S&P Global Investment Manager Index due on Tuesday.

Indications as to whether the IT sector remains among the most

favoured will be especially watched, given increasing uncertainty

around the sector following the spectacular run tech so far this

year. Key drivers of US equity returns will also be scrutinised

after

February’s survey revealed that central bank policy was perceived

to be a drag on equity returns midway into Q1. Any changes to

perceptions on US and global macroeconomic environments will also

be assessed given the recent improvements observed through the PMI

data (see box).

Finally, the UK releases monthly output and employment data.

While an

intensification of price pressures, according to PMI data, may

well be at the top of concerns, the extent to which the ongoing

expansion in the UK is lop-sided will be assessed with the official

growth and employment figures. A stronger service sector

performance, across both business activity and employment gauges,

has been highlighted by PMI figures in 2024 so far. This is

important as it may further complicate the outlook for monetary

policy in the UK.

Global growth hits eight-month high in February

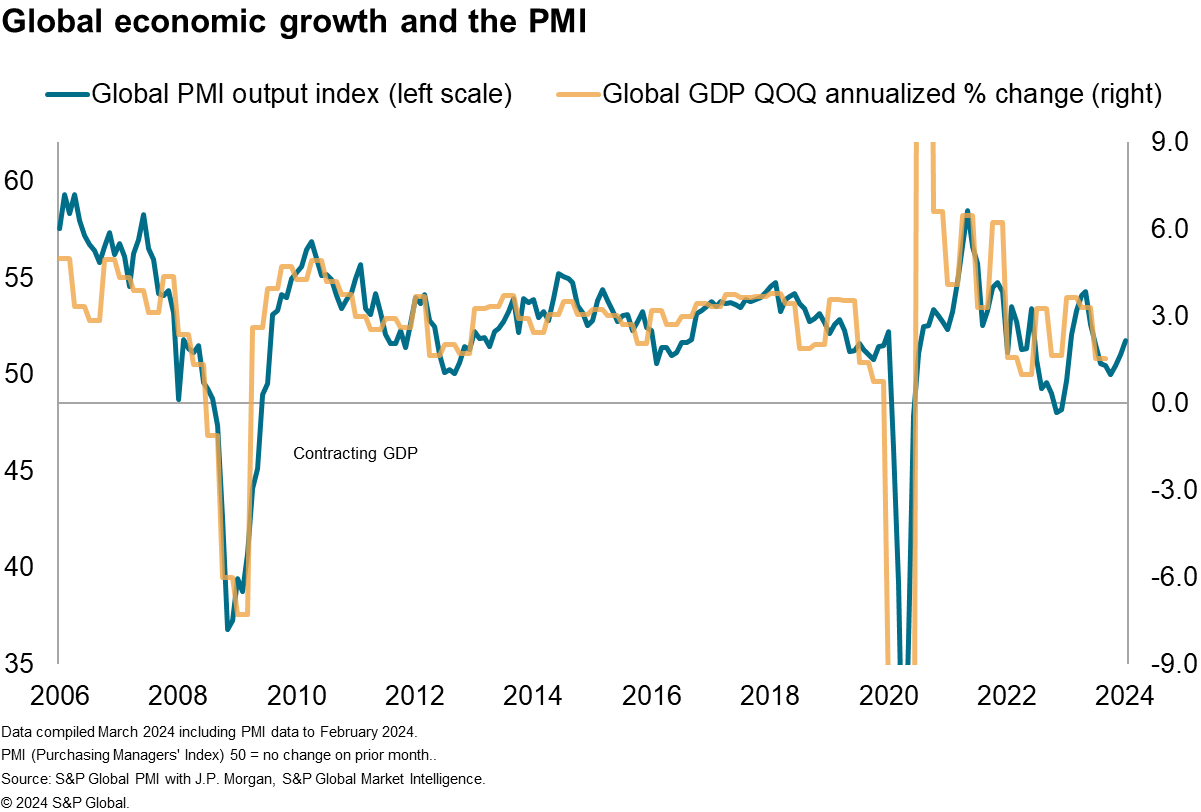

Worldwide business activity growth reached an eight-month high

in February, according to the latest Global PMI data compiled by

S&P Global.

At 52.1, up from 51.8 in January, the

headline PMI, covering manufacturing and services across over

40 economies and sponsored by JPMorgan, rose for a fourth

consecutive month, signalling accelerating growth.

Although the PMI remains below the survey’s long-run average of

53.2 and is broadly consistent with annualized quarterly global GDP

growth of approximately 2% (below the pre-pandemic ten-year average

of 3.0%), the gathering upturn allays concerns of a global

recession after the slowdown seen late last year.

Stronger demand conditions supported the latest acceleration in

growth, with a steady upturn in demand for services accompanied by

the first rise in new orders for goods in 20 months. Further modest

jobs gains were also encouraged by the upturn in orders, though the

rate of job creation remained mild.

That said, average prices charged for goods and services

globally rose at a faster rate in February. Although the pace of

increase remained among the lowest seen since mid-2021 and well

down on the strong rates seen in 2022 and early-2023, services

price inflation remained especially elevated by pre-pandemic

standards. Meanwhile, manufacturing selling prices continued to

rise modestly in the latest survey period.

Key diary events

Monday 11 Mar

Indonesia Market Holiday

Japan GDP (Q4, final)

China (mainland) National People’s Congress

Turkey Unemployment Rate (Jan)

Switzerland Consumer Confidence (Feb)

United Kingdom KPMG / REC Report on Jobs* (Feb)

Tuesday 12 Mar

Japan PPI (Feb)

Australia Building Permits (Jan, final)

Philippines Trade (Jan)

Malaysia Industrial Production (Jan)

China (mainland) M2, New Yuan Loans, Loan Growth (Feb)

Germany Inflation (Feb, final)

Turkey Industrial Production (Jan)

United Kingdom Labour Market Report (Feb)

Brazil Inflation (Feb)

India Industrial Production (Jan)

India Inflation (Feb)

Mexico Industrial Production (Jan)

United States CPI (Feb)

S&P Global Business Outlook* (Feb)

S&P Global Investment Manager Index* (Mar)

Wednesday 13 Mar

South Korea Unemployment (Feb)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Jan)

United Kingdom Trade (Jan)

Eurozone Industrial Production (Jan)

GEP Global Supply Chain Volatility Index* (Feb)

Thursday 14 Mar

India WPI (Feb)

Spain Inflation (Feb, final)

Hong Kong SAR Industrial Production (Q4)

Brazil Retail Sales (Jan)

Brazil Inflation (Feb)

United States PPI (Feb)

United States Retail Sales (Feb)

United States Initial Jobless Claims

United States Business Inventories (Jan)

Friday 15 Mar

China (mainland) House Price Index (Feb)

Singapore Unemployment (Q4, final)

Indonesia Trade (Feb)

India Trade (Feb)

Germany Wholesale Prices (Feb)

France Inflation (Feb, final)

Italy Inflation (Feb, final)

Italy Retail Sales (Jan)

United States Import and Export Prices (Feb)

United States Industrial Production (Feb)

United States UoM Sentiment (Mar, prelim)

* Access press releases of indices produced by S&P Global

and relevant sponsors

here.

What to watch in the coming week

Americas: US CPI, retail sales, industrial production

data

The highlight of the week will be Tuesday’s US CPI data for

insights into inflation conditions in the US. Consensus

expectations point to some stickiness from January at the time of

writing, which should not come as a surprise given leading

indications from PMI data. That said,

the headline CPI is expected to descend further in the coming

months to around the 2% level, according to PMI price indices.

Additionally, monthly activity data, including retail sales and

industrial production figures, will be due on Thursday and Friday

respectively. This comes after the

S&P Global US Manufacturing PMI rose to the highest since July

2022 with manufacturing output growth notably reviving in

February. Service sector growth was also sustained midway into

Q1.

EMEA: UK monthly output, labour market report, eurozone

industrial production, trade and inflation data

The UK updates January output data, including manufacturing,

services and construction output. The PMI data suggested that the

UK economy expanded in January and February. Notably, with growth

momentum having accelerated midway into the first quarter, this is

indicative of GDP growing at a quarterly rate of just less than

0.3% in Q1.

Additionally, January’s UK labour market report will be watched

after the latest KPMG and REC UK Report on Jobs survey showed that

uncertainty around the economic outlook continued to impact hiring

decisions at the start of 2024. A February update of the report

will also be due at the start of the week after PMI employment data

showed jobs growth slowed in the month.

The eurozone also updates industrial production, trade and final

inflation figures in the week.

APAC: Japan GDP, India industrial production, Indonesia

trade

In APAC, besides Japan’s final Q4 GDP reading, we will also see

various tier-2 data released around the region. India’s industrial

production figures will be a notable release given the

outperformance of the manufacturing sector, as seen via the

HSBC India Manufacturing PMI.

US Investment Manager Index and supply chain

volatility

Risk sentiment changes, key market drivers and sector

preferences among US investors will be assessed with the March

iteration of the Investment Manager Index, especially after

improvements were observed with respect to global and US

macroeconomic conditions in the most recent PMI data.

This will be followed by the GEP Global Supply Chain Volatility

Index, which will shed light on latest supply chain conditions on

Wednesday.

Download full report

© 2024, S&P Global. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers’ Index (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Credit: Source link