It’s common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Beazley (LON:BEZ). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Beazley with the means to add long-term value to shareholders.

Check out our latest analysis for Beazley

Beazley’s Improving Profits

Over the last three years, Beazley has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn’t particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Impressively, Beazley’s EPS catapulted from US$0.79 to US$1.56, over the last year. It’s not often a company can achieve year-on-year growth of 97%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

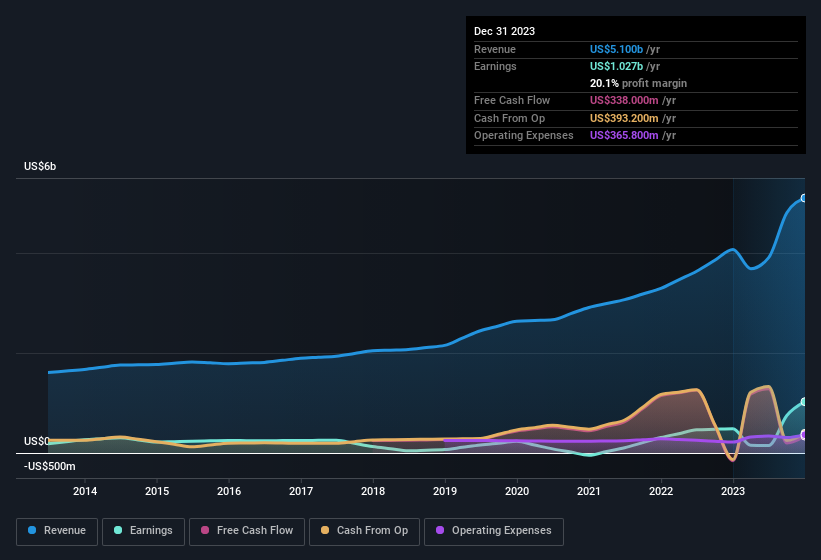

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it’s a great way for a company to maintain a competitive advantage in the market. It’s noted that Beazley’s revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The good news is that Beazley is growing revenues, and EBIT margins improved by 13.2 percentage points to 33%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don’t drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Beazley’s future profits.

Are Beazley Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don’t know the exact thinking behind their acquisitions.

Over the last 12 months Beazley insiders spent US$50k more buying shares than they received from selling them. Although some people may hesitate due to the share sales, the fact that insiders bought more than they sold, is a positive thing to note. It is also worth noting that it was Independent Non Executive Director Robert Stuchbery who made the biggest single purchase, worth UK£50k, paying UK£5.30 per share.

The good news, alongside the insider buying, for Beazley bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$10m worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Beazley To Your Watchlist?

Beazley’s earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company’s potential and that it has reached an inflection point. We’d suggest Beazley belongs near the top of your watchlist. You should always think about risks though. Case in point, we’ve spotted 1 warning sign for Beazley you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Beazley, you’ll probably love this curated collection of companies in GB that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Credit: Source link