HAYKIRDI/iStock via Getty Images

In my most recent article, I outlined four scenarios for US inflation assuming that there is no war or other event that disrupts global oil supplies. In this article, I will outline various “oil-shock” scenarios and their expected impacts on US inflation.

This subject is obviously very relevant right now, considering the potential for a war in the Middle East that could disrupt global oil supplies.

Due to limited space, the subject matter of this article will be limited in the following ways:

1. Limited to scenario analysis. In this article, we will not make any assessment of the likelihood of a war in the Middle East or of any other even that could disrupt global oil supplies. This article will merely provide our forecasts of core inflation under various “oil shock” scenarios. Our assessments of the likelihood that we assign to various oil shock scenarios are provided elsewhere.

2. Limited to estimates of core inflation. In this article, we will only provide estimates of the impact of various oil shock scenarios on core inflation – i.e. CPI ex food and energy. We do this for two reasons. First, we want to emphasize the impact of an oil shock on the broad economy, outside of the energy sector. Second, Fed policy is generally determined by core measures of inflation.

Possible Ways that Global Oil Supplies Can Be Severely Disrupted

There are several ways in which global oil supplies could be disrupted. In this article we will only mention two broad categories.

- Blockages of seaborn oil trade chokepoints. About 20% of global oil supplies and roughly one-third of all global seaborn oil trade pass through the Straight of Hormuz. The strait is roughly 20 miles wide at its narrowest point, but the shipping lanes are only two miles wide. Iran can pretty easily shut the Strait of Hormuz through mining and sinking of ships. Various estimates (including a US GAO estimate in 2006) suggest that a shut-down of the Straight of Hormuz could cause a tripling or quadrupling of global oil prices, implying an oil price that could exceed $300.

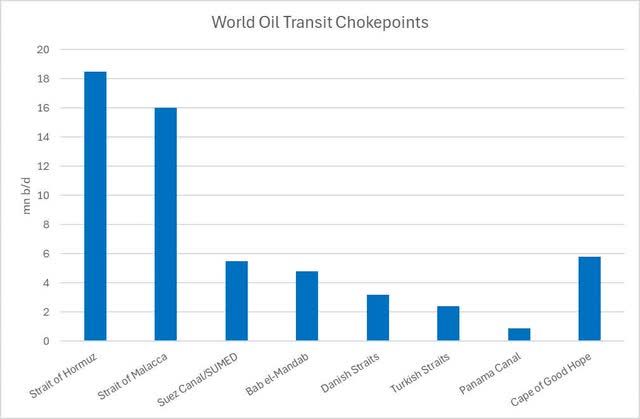

As can be seen in Figure 1, other major chokepoints that could be impacted under conditions of conflict in the Middle East would be the Suez Canal and Bab el Mandab in the Red Sea. Roughly 50% of all global seaborn oil trade would potentially be under threat in the event of potential conflicts in the Middle East region.

Figure 1: World Oil Transit Chokepoints

World Oil Transit Chokepoints (IEA)

2. Attacks on oil export infrastructure. Another major vulnerability of the global economy to a disruption to global oil supplies is potential attacks on oil export infrastructure in nations such as Saudi Arabia, Kuwait, UAE and others. It should be noted that Iran and its proxies are hostile to many oil-producing nations. Attacks on such infrastructure by Iran or proxies such as the Houthis could create disruptions of comparable magnitude to those described in the section on transit chokepoints. In an extreme case, according to EIA and GAO analyses, a shutdown of oil exports from Saudi Arabia, could cause oil prices to rise beyond $300.

Although we will not evaluate the likelihood of global oil supply disruptions via chokepoint blockages or attacks on export infrastructure, we will merely point out that such scenarios are not unlikely in the event of a war in the Middle East.

Indeed, in the context of current speculation regarding whether or not Iran might directly or indirectly attack Israel, we would like to point out the following: It is our view that that, from the standpoint of its own national interests, Iran could achieve more from disrupting global oil supplies than it could from military attacks on Israel. Direct attacks on Israel would invite massive reprisals on Iranian territory which could cause untold civilian deaths as well as irreparable damage to nuclear and other infrastructure in Iran. By contrast, threatening global oil supplies – and the massive economic dislocation that this would create — could be a way of shifting global public opinion in the direction of bringing an end to Iran-Israel conflict via reaching some sort of “accommodation” with Iran.

We also think that Russia would not be at all averse to such a scenario for two reasons. First, Russia would benefit from high oil prices. Second, Russia would gain leverage as a potential mediator due to its relatively close relationship with Iran.

We are not specifically predicting an attack by Iran on oil transit choke points or on oil export infrastructure. What we are saying is that while many are currently focused on assessing the odds of a direct attack by Iran on Israel, we think that from an investment standpoint, analysts should be more focused than they have been on the possibility of Iran disrupting global oil supplies through various means at its disposal. Although we are not making any predictions in this article, we want to point out to readers our view that this “indirect” route of action by Iran offers many potential rewards and far fewer potential risks.

Scenario Analysis: Impact by Major Sub-Category of Core CPI

Our scenario analysis is focused on the impact of various oil shock scenarios on core inflation – i.e. CPI ex food and energy. We focus on the impact core inflation for two reasons: First, we want to emphasize the impact of an oil shock on the broad economy, outside of the energy sector. Second, Fed policy is generally determined by core measures of inflation.

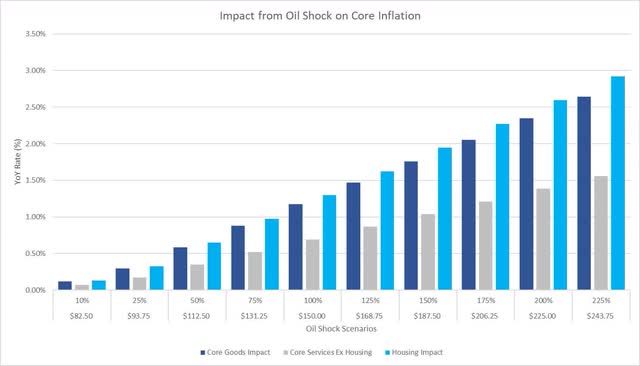

We decompose our analysis of oil shocks on core inflation in three broad CPI categories: Core Goods, Core Services Ex Housing and Housing. Our analysis has combined the insights of various papers in the academic literature as well as our own quantitative analysis.

First, in Figure 2 we present the impacts of various oil shock scenarios on the three broad categories of core CPI.

Scenario Analysis of Contributions of Core CPI Sub-Components (Investor Acumen)

In the analysis presented above, readers can see the individual contributions of the three main sub-components of Core CPI. For example, if the WTI oil price were to double (100% increase) from an average of $75 to $150 over a 6-month period, then we estimate that core goods would add 1.17% to Core CPI, Core Services Ex Housing would add 0.69% to Core CPI and the impact on housing CPI would be 1.30%. The sum of these contributions adds up to 3.8%. These contributions would then be added to the current rate of core CPI in order to forecast core CPI. The estimated contributions to core CPI would occur over 12-month period. (It should be noted that the impact on Housing in CPI statistics would be lagged by 12-18 months compared to statistics on core goods and core services ex-housing; the impact estimated here is the actual impact within 12 months, regardless of statistical lag).

In the most pessimistic scenario analyzed here (which is half as pessimistic as the GAOs most pessimistic oil shock scenarios) core inflation would be boosted from its current level of 3.8% by a combined total of 7.12 percentage points.

Scenario Analysis: Overall Impacts on Core CPI

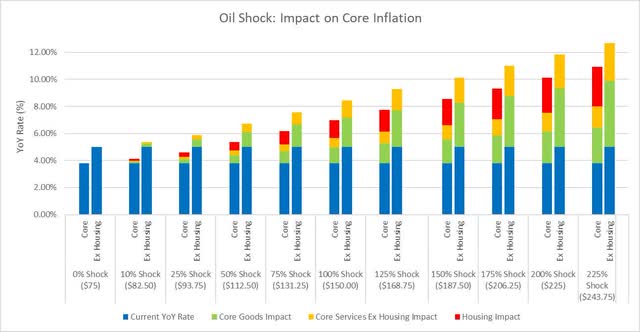

In Figure 3, we combine the estimates above and estimate the overall impact of various scenarios on Core CPI and Core CPI ex Housing.

Scenario Analysis: Forecasted Core CPI (Investor Acumen)

As can be seen in the graph above, we provide estimates what Core CPI would be under various scenarios. The blue area indicates the current rates of core CPI and core CPI ex housing. The stacked colored columns above it (green, yellow and red) represents the contributions to the increase in core CPI that we estimate will occur in the even of various oil shock scenarios. For example, in the event of an oil shock of 100%, which increases the average 6-month oil price from $75 to $150, we expect core CPI to rise from the current rate of 3.8% to 6.96%. If we completely exclude the estimated impact on housing (due to the BLS’s extremely lagged reporting of housing inflation), the rate of core CPI ex housing is estimated to increase to 8.43%.

In the most pessimistic oil price scenario depicted in this graph (which is less than half of the price rise projected in the GAO’s and EIAs most extreme oil shock scenarios) in which the oil price rises to a 6-month average of $243.75, US core inflation would rise to 10.92%.

Implications for Market Outlook

As can be seen from the detailed analysis in this article, a war in the Middle East – or any other event that significantly disrupts global oil supplies – could have an enormous impact on US core inflation. Many people think rising oil prices mainly impact “headline” CPI. However, an oil shock reverberates through the entire economy through a variety of channels and has a major impact on core CPI.

We will not go into great detail on what the implications for financial asset prices of the various oil shock scenarios described in this article. We will explore such scenarios in our other work. However, in this article, we can say this: Historically, major oil shocks have, more often than not, led to US bear markets in equities (declines of -20% or more in major indexes such as the S&P 500 and the Dow Jones Industrial Average). The most recent example of this occurred in 2022. Furthermore, we can say with high conviction that the high rates of inflation triggered by an oil shock should be expected to cause severe disruptions in US and global bond markets. US mortgage interest rates, for example, would likely move into double digits from current levels that are above 7%.

In this article we have only focused on the impacts of various shock scenarios on US core inflation. In a future article, we will go over a sensitivity analysis in which we forecast the impact of these various oil shock scenarios on US GDP. The potential shocks to US GDP are extremely severe.

For now, it should be clear that a war in the Middle East — or any other event that triggers a major disruption to global oil supplies for a prolonged period of time (e.g. six months) — would have devastating impacts on the US economy and on the prices of financial assets such as stocks and bonds.

At Successful Portfolio Strategy our portfolios are aggressively positioned to profit from such potential scenarios.

Credit: Source link