The early PMI data for January signalled a marked cooling of

inflation pressures in the US economy, in turn linked to a waning

of elevated price growth in the services economy, which had been a

key area of concern to policymakers. The latest price data from the

PMI point to inflation falling below the Federal Reserve’s 2%

target in the near future, contrasting with more stubborn inflation

being signaled by the PMIs in Europe.

US price inflation slumps to lowest since May

2020

Provisional “flash ” PMI data, published 24th January, indicated

US price pressures falling below the Fed’s 2% target for the first

time since the pandemic. Average prices charged for goods and

services rose at the start of the year at the slowest rate since

the initial 2020 pandemic lockdowns, according to companies polled

in S&P Global’s Purchasing Managers’ Index (PMI) survey.

The survey is based on data from over 1,200 firms, drawn from

representative samples of US manufacturing and service sectors,

asking firms to report on monthly changes in output, demand,

payroll numbers, costs, selling prices and other key performance

metrics.

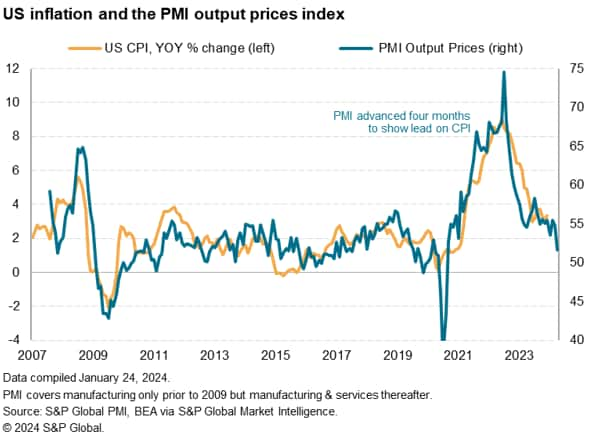

The survey has been collecting data for over 15 years, and the

PMI Prices Charged Index has a correlation of 83% with changes in

US consumer price inflation, importantly with the PMI acting with a

lead of several months. The PMI therefore provides an accurate

advance guide to future changes in inflation, months ahead of

official consumer price data.

Having peaked at 74.6 in April 2022, which was followed by a

peaking of consumer prices inflation at 9.1% in June 2022, the US

PMI Prices Charged Index has been on a broad downward trend, albeit

remaining elevated in late 2023 before sliding to 51.7 in January.

Although any reading above 50 signals an increase in prices on the

prior month, the latest reading represents only a very modest rise

in prices compared to prior months, and hints at inflation cooling

in the months ahead from the 3.4% recorded in December, to a level

perhaps as low as 1%.

US inflation below that of Europe

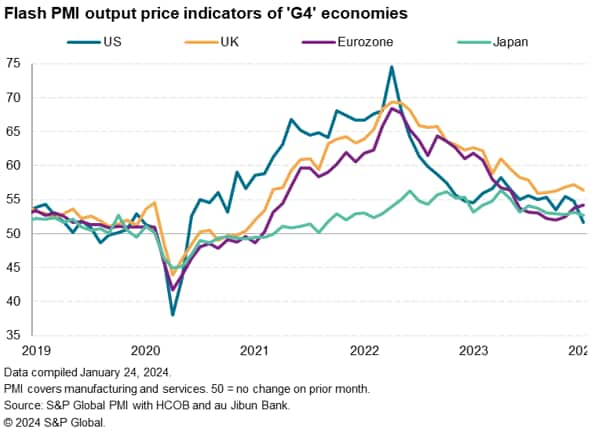

The cooling of price pressures in the US pushes the PMI price

gauge below those of the UK, eurozone and Japan, all of which also

saw flash PMI data for January released. Of note, while the US

price index has now fallen to a level consistent with inflation

falling below the central bank’s target, above target inflation is

still being signaled by the eurozone and UK PMIs, with the latter

remaining especially elevated by historical standards and the

eurozone price gauge even lifting higher for a third successive

month in January.

Service sector price growth slows sharply

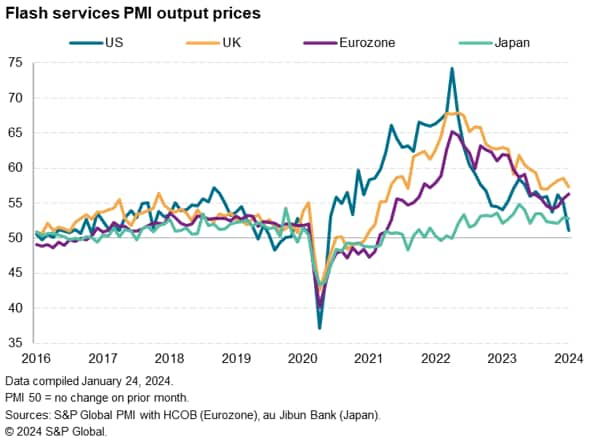

A key driver of inflation in recent months has been the service

sector, which since the post-pandemic reopening of economies has

overtaken manufacturing as the primary source of higher price

pressures. Here, January saw encouraging news, with prices charged

by service providers in the US rising at the slowest rate since May

2020, contrasting with stubbornly high rates of services inflation

in both the UK and Eurozone.

Importantly, this area of worryingly stubborn US inflation –

closely correlated with core inflation – is therefore now seeing

much cooler price pressures than any time in the past two and a

half years.

Manufacturing prices edges higher

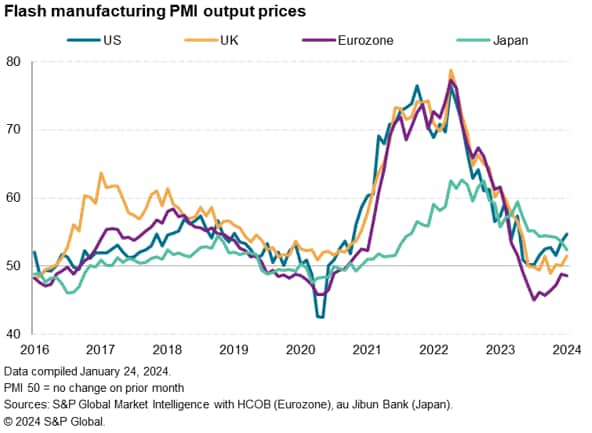

Alas, the picture of falling price pressures is not complete.

The rate of output price inflation across US manufacturers

accelerated for the second consecutive month, with the latest

increase the largest recorded since April 2023. Producer price

rises were often linked to global supply chain disruptions, as well

as adverse weather, with US manufacturing prices rising faster than

recorded in Europe, the UK and Japan.

Although the latest rate of price increase in the US

goods-producing sector remains well below that seen during much of

the pandemic, the data suggest the disinflationary impact of lower

goods prices has passed, and that inflation could be given some

support from rising goods prices in the months ahead. The evolution

of supply disruptions in the Red Sea at a time of constrained

shipping in the Panama Canal will be a key development to monitor

in this respect.

Policy divergence

For now, however, the sharp cooling of overall price pressure in

the US flash PMI surveys has been viewed by many analysts as

opening the door to cuts by the Federal Reserve, at the same time

as more elevated price pressures in the eurozone and UK likely act

as deterrents to any imminent loosening of policy by the European

Central bank and Bank of England.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P

Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers’ Index (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Credit: Source link