Emerging markets are pushing Tron to become the top blockchain for USDT and other fiat-backed stablecoin transfers.

Matias’ online shop, which he runs out of Buenos Aires, is an example of crypto reaching mainstream. Most shoppers at Ditel are using stablecoins to buy electronics.

But they’re not using the blockchain most crypto insiders would likely guess (or hope). Argentines are not paying for iPhones via the Bitcoin network. They’re not using Ethereum either.

They’re paying with Tron.

Matias, who asked that The Defiant only use his first name to protect his privacy, estimated that roughly 95% of his customers chose USDT on Tron as the form of payment. The store owner said he believed Tron’s low fees and quick transactions contributed to the network’s popularity.

Not Just Argentina

This Argentine shop is a reflection of a broader trend, which shows emerging economies are gravitating towards Tron.

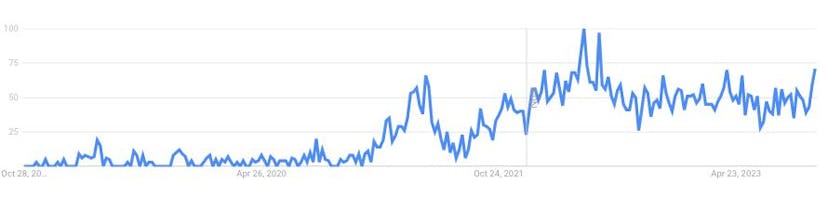

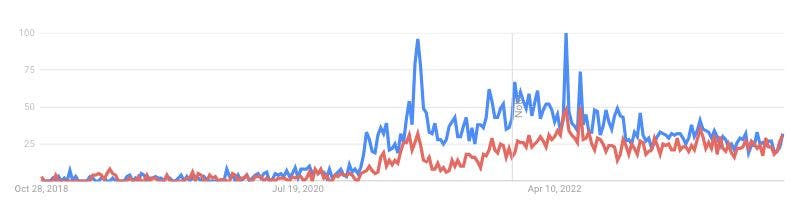

Worldwide searches on Google for “USDT Tron,” have grown during the bear market with the most interest coming from Nigeria, Côte d’Ivoire, and Pakistan, in that order.

Conversely, searches for “USDT Ethereum,” where the stablecoin is also the largest dollar-pegged asset, have trended downward since early 2022. At this point it’s a toss-up which blockchain is searched with “USDT,” despite Ethereum’s market capitalization dwarfing Tron’s by a multiple of over 26.

Activity in emerging markets is pushing Tron to the top in terms of stablecoin activity.

Start for free

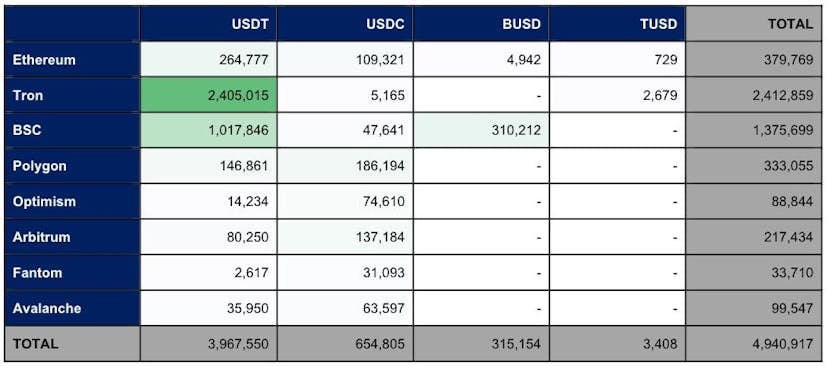

A recent paper on stablecoins from a major hedge fund turned heads thanks to a chart which presented the Tron blockchain as the clear leader for fiat-backed stablecoin transactions.

The paper, authored by employees of Brevan Howard, a hedge fund with $23.4B in assets under management and a budding interest in crypto, showed Tron with over 2.4M weekly active addresses interacting with stablecoins.

The figure topped the numbers of Ethereum, as well as Layer 2s built on Ethereum like Optimism and Arbitrum.

Payments Network

Key indications show Tron is being extensively used as a network for straightforward transfer payments.

Data from Allium, a data provider which worked with the Brevan Howard team to develop the stablecoin report, showed that the median USDT transaction on Tron fluctuated between $100 and $300 dollars over the last three years. USDT is the largest stablecoin in crypto with a $84.2B market capitalization.

There was also an even distribution of amounts above and below that range indicating that a somewhat wide range of parties are using Tron to send USDT. By contrast, Allium’s data showed that stablecoin volume on Ethereum consisted mostly of large transactions worth over $100,000.

Cheaper Transactions

Tron has a key advantage over Ethereum — it’s cheaper to use. At the time of writing it costs about $3.50 to send USDT on Ethereum, according to Etherscan.

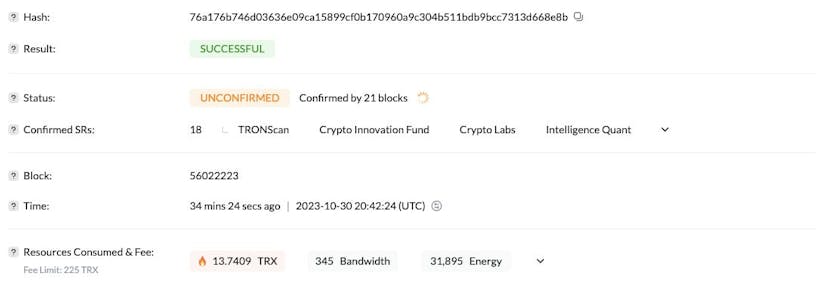

Data for transaction fees on Tron isn’t readily available, but based on The Defiant’s own test transaction using the network, it cost roughly 13.7 TRX to send USDT. TRX is the native token of Tron. At current prices of $0.095, that means the transfer cost roughly $1.30.

Matias said he believed Tron’s low fees and quick transactions contributed to the network’s popularity.

Diego Diaz, who works in payments at an Argentine bank, agreed.

“The Tron network is popular because it’s fast and affordable,” he said. “It’s also widely used in markets not regulated by the government.”

Diaz added that any fintech company in Argentina which uses cryptocurrencies offers USDT on Tron. With regard to Layer 2s, which have been heralded as a cheaper way to transact while retaining Ethereum’s security, Diaz said the solutions were less well-known

Tron doesn’t beat Layer 2s on price — USDT transfers on leading solutions like Arbitrum and Optimism were, at $0.11, roughly an order of magnitude cheaper than Tron.

Why Stablecoins

Stablecoins transfers over cheap and fast networks are one of the most popular use cases in emerging markets as users there often grapple with devaluing local currencies and capital controls.

Fernando Volpe, who operates a peer-to-peer exchange called Calypso and is also Argentine, said Argentina’s strict controls on official purchases of dollars have driven people to crypto. In the South American nation there are different rates of exchange depending on how the dollars will be used and limits for how much foreign currency individuals can buy.

Stablecoins also help people to avoid holding the Argentine peso, a currency that has suffered inflation of over 100% year-over-year for much of 2023. “Since the peso is constantly devalued, people find refuge in stablecoins and the dollar,” Volpe said.

Diaz said many people take their salaries in USDT to avoid inflation and then convert the stablecoin to pesos for daily expenses. The platforms where people receive their salary also helps with privacy, Diaz said. The bank employee declined to name specific companies because he maintains a working relationship with them, he said.

“These platforms offer them a way to safeguard their cryptocurrencies away from the government’s scrutiny and save money easily,” Diaz added.

Everyone Else Uses It

Using stablecoins helps people to sidestep capital controls and inflation. And since they care about preserving their savings and not yield farming or flipping NFTs, they’ll go for the option with the cheapest fees and highest volume.

Matias, who operates the e-commerce store, says he uses USDT on Tron because everyone else uses it and he wants to accept currencies that people hold.

Volpe’s peer-to-peer exchange runs through the messaging Telegram and facilitates people trading between Pesos and dollar-pegged stablecoins. He says he facilitates sales of USDT on Tron every day.

Lack of Decentralization

To be sure, Tron doesn’t have the reputation of holding up crypto’s value of decentralization. The blockchain relies on a system of “super representatives,” 27 parties which need to be voted in to validate transactions. This is in contrast to Ethereum’s proof-of-stake system which has nearly 1M validators, according to Beaconscan.

Tron’s founder, Justin Sun, has also consistently generated controversy — the whitepaper outlining Tron’s design received accusations of plagiarism from leaders in the crypto space like Vitalik Buterin.

Sun controversially canceled a charity lunch with Warren Buffet, before finally making the date six months later. And in March, the Securities and Exchange Commission accused Sun of selling unregistered securities, paying celebrities for undisclosed advertising,

When discussing Tron’s reputation, Volpe suggested that people had other priorities.

“When they see that the network works for them, they do not pay attention to security,” he said.

Regardless, Tron’s success as a network for stablecoin transfers is an important development for the crypto space whose proponents have often emphasized the technology’s ability to “bank the unbanked.”

It looks like success in that mission is coming from an unlikely contender in Tron.

Credit: Source link