Last updated:

Why Trust Cryptonews

Key Takeaways:

- The uneven drop may signal a shift toward coins with stronger on-chain resilience.

- Deep altcoin dips could spark a reevaluation of risk, prompting a realignment of strategies.

- Investors might soon favor assets with stable fundamentals and robust network support.

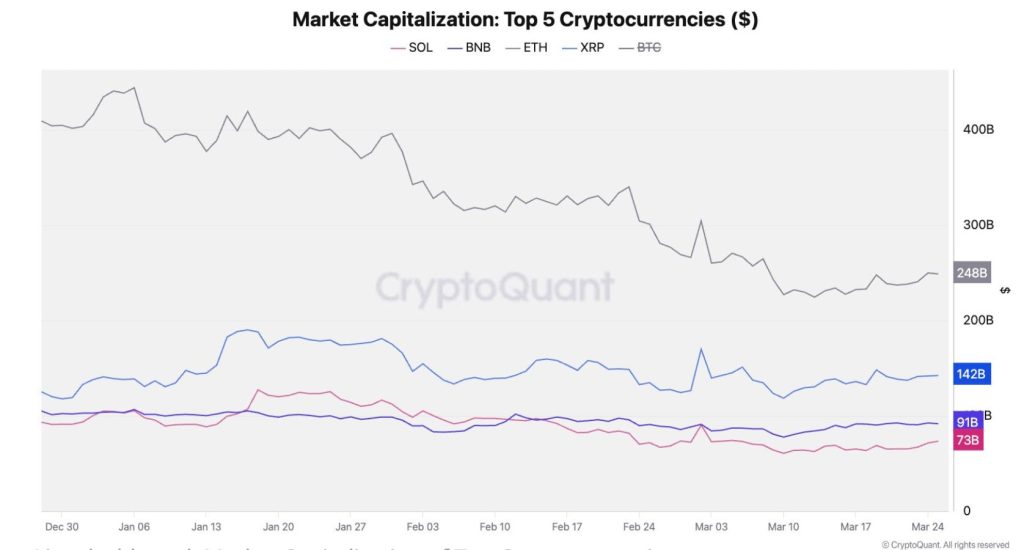

The top five cryptocurrencies by market capitalization lost a combined $659 billion between January and March 2025, according to a Thursday report by CryptoQuant.

Ethereum (ETH) and Solana (SOL) took the hardest hits during the downturn, while Bitcoin (BTC) and Binance Coin (BNB) showed more stable performance.

XRP, which saw a surge earlier in the cycle, failed to maintain its gains.

CryptoQuant: BTC and BNB Withstand Market Pressure

CryptoQuant’s analysis showed that BTC and BNB weathered the market drop better than their peers.

Each asset declined by around 20% from its most recent all-time high, marking a milder correction compared to the rest of the top five.

Their relative strength stood in contrast to the sharp pullbacks seen in Ethereum and Solana, both of which saw more severe losses.

XRP, despite a market cap rally following the 2024 U.S. Presidential Election, also slipped behind in recent weeks.

ETH/BTC Ratio Fell 72% Since September 2022, CryptoQuant Data Shows

Another key metric highlighted in the report is Ethereum’s falling value relative to Bitcoin.

Since September 2022, the ETH/BTC ratio has dropped by 72%, reaching its lowest level since January 2020.

Historically, such dips have sometimes preceded a reversal, but for now, Ethereum remains under pressure against Bitcoin.

Mixed Signals from XRP Performance

XRP experienced a sharp rise in market capitalization following regulatory optimism in late 2024. Its valuation jumped from $30 billion in early November to $141 billion by March 2025.

This growth was supported by increased activity on the XRP Ledger (XRPL), where active addresses spiked from 15,000 to 109,000.

However, that momentum has since faded. As of now, daily active addresses have settled between 20,000 and 40,000, based on CryptoQuant’s latest data.

The report paints a clear picture of how leading digital assets are moving in different directions. While Bitcoin and BNB have held their ground more effectively, ETH, SOL, and XRP have struggled to keep pace.

CryptoQuant’s findings underscore the uneven impact of the current market correction and suggest that the next few months could be key in determining whether these trends deepen or reverse.

Frequently Asked Questions (FAQs)

The split may drive a reallocation of capital toward coins that deliver steady network metrics and lower volatility, potentially redefining market norms and investment strategies.

Investors might adopt more disciplined approaches by diversifying holdings and emphasizing assets with proven fundamentals, leading to a strategic reassessment of exposure and risk tolerance.

Expect growing interest in projects that blend strong network effects with scalable, low-cost solutions, attracting long-term capital and sparking renewed innovation in blockchain protocols.

Credit: Source link