The PHLX Semiconductor Sector index is off to a strong start in 2024 with gains of 11% so far. That’s not surprising as some of its key components such as Nvidia (NASDAQ: NVDA), AMD, Broadcom, and Taiwan Semiconductor Manufacturing have already jumped nicely thanks to their solid earnings reports — which have revealed that these companies are benefiting from the growing adoption of artificial intelligence (AI) chips.

However, there’s one PHLX Semiconductor Sector component that has failed to step on the gas thus far: Micron Technology (NASDAQ: MU). Shares of the memory manufacturer are up just 5% in 2024. However, a recent development has given Micron stock a nice boost. Shares of the chipmaker jumped 4% on Feb. 26.

Let’s see why that happened and check why this semiconductor stock could go on a bull run following this development.

Supplying chips for Nvidia’s next-gen AI GPU

In a press release dated Feb. 26, Micron pointed out that it has commenced the volume production of its high bandwidth memory 3E (HBM3E) chip. The company added that this particular chip “will be part of NVIDIA H200 Tensor Core GPUs, which will begin shipping in the second calendar quarter of 2024.” Micron claims that HBM3E consumes 30% less power than what competitors offer.

It is not surprising to see Micron landing the HBM spot in Nvidia’s upcoming processors. In its December 2023 earnings conference call, Micron pointed out that its HBM3E chip was in the final stages of qualification with Nvidia. Now that the company has won this business from Nvidia, it seems on its way to achieving its target of generating “several hundred millions of dollars of HBM revenue in fiscal 2024.”

The good thing for Micron is that demand for Nvidia’s upcoming H200 processors is already solid. Nvidia management remarked on its latest earnings call that demand for its next-generation products will be greater than supply. So the possibility of Micron selling out its entire output of HBM3E chips cannot be ruled out, especially considering that fellow memory manufacturer SK Hynix has already sold out its HBM inventory for 2024.

More importantly, Micron is reportedly boosting its HBM production capacity so that it can serve the growing demand for this memory type not only from Nvidia but also from other customers. In November 2023, the chipmaker reportedly opened a new facility dedicated to producing HBM3E on a mass scale. It is also worth noting that Micron is working on a bigger HBM3E memory size that could be rolled out next month.

All this indicates that the company is on track to make the most of the growing demand for HBM, a product that is in tremendous demand thanks to its deployment in AI processors. Market research firm Yole Group estimates that the HBM market could generate an annual revenue of almost $20 billion in 2025, up from $5.5 billion last year and an estimated $14.1 billion in 2024. By 2029, global HBM revenue is expected to jump to $38 billion.

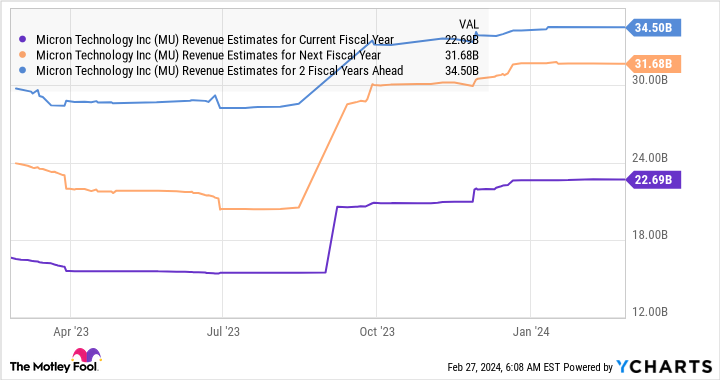

As such, Micron could win big from this market in the long run, especially considering that it has already landed a significant customer in the form of Nvidia, which dominates the global AI chip market hands down. Not surprisingly, Micron’s top-line growth is set to accelerate significantly in fiscal 2024, 2025, and 2026.

Big stock upside could be in the cards

As the chart above indicates, Micron’s revenue is expected to jump to almost $23 billion in fiscal 2024. That would be a big increase over the fiscal 2023 reading of $15.5 billion. By fiscal 2026, Micron’s top line is expected to close in on the $35 billion mark, which means that the company is expected to more than double its revenue in the space of just three fiscal years.

Micron is currently trading at 6 times sales. While that’s higher than the S&P 500 index’s sales multiple of 2.8, the potential growth that this AI stock could deliver means that it seems worthy of a premium valuation. That’s especially true considering that other chipmakers benefiting from AI adoption are trading at higher sales multiples.

So, if Micron Technology maintains its price-to-sales ratio of 6 after three years and indeed delivers $35 billion in annual revenue in fiscal 2026, its market capitalization could jump to $210 billion. That would be a 112% increase from current levels, which is why investors should consider buying this chipmaker before its stock market rally gains momentum.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

This Artificial Intelligence (AI) Stock Is About to Go on a Bull Run was originally published by The Motley Fool

Credit: Source link