Summary of key points: –

- Trifecta of favourable events about to pay dividends for the Aussie dollar

- US dollar bulls now under pressure

- NZ business confidence soars higher again

Trifecta of favourable events about to pay dividends for the Aussie dollar

The Australian dollar has staged a remarkable turnaround in global FX markets over recent days. Up until the US Federal Reserve’s meeting last Thursday, the Aussie dollar was struggling to hold above 0.6300 against the USD. It is now trading two cents higher at 0.6515.

Over recent months the Aussie had always been under selling pressure due to Australian short-term interest rate at 4.10% compared to 5.50% for the USD, meant that currency speculators selling the AUD were rewarded with forward points their favour. A good reason to keep selling the Aussie unit. Both to us and to financial/investment markets around the world the Reserve Bank of Australia (“RBA”) appeared to have been far too complacent in their responsibility to bring down Australia’s inflation rate to 2.50% target. The RBA had been on hold with interest rate adjustments since May, always citing that they needed to observe more economic data before being able to decide as to whether their interest rates needed to go higher, or not, to get the inflation rate down. The Australian September quarter’s inflation result released on 25th October started to cause doubts as whether the RBA could continue with its benign monetary policy approach. The 1.20% inflation increase in the September quarter was well above prior consensus forecasts and confirmed the persistent price pressures in the Australian economy we have been highlighting for some time – wages, rents, electricity and transport.

Two events over recent days have caused a fresh wave of AUD buying and a third event this coming Tuesday 7th November should add to the AUD buying and push the AUD/USD exchange rate up another one of two cents higher to 0.6600 or 0.6700: –

- First leg of the trifecta on Wednesday 1 November: The USD was sold in global FX markets against all currencies following the US Federal Reserve’s meeting, wherein Governor Jerome Powell confirmed that the risks with monetary policy setting were now evenly balanced between “doing too much” with interest rate increases and “not doing enough” with interest rate hikes. The markets concluded that the Fed had finally finished with interest rate increases, therefore negative for the USD currency value.

- Second leg of the trifecta on Friday 3 November: The Non-Farm payrolls jobs data in the US was much weaker than expected for the month of October. Just 150,000 new jobs were added in the US economy, below prior forecasts of +180,000 to +190,000. The unemployment rate increased to 3.90% and wage increases were soft again at +0.20% for the month (average hourly earnings). The employment data confirmed that the resilience in the US economy through their summer months was coming to an end and the outlook was deteriorating. The US dollar was again sold with the USD Dixy Index tumbling from 106.80 on 1 November (prior to the Fed’s meeting) to 104.91 at the market close on Friday 3 November.

- Third leg of the trifecta on Tuesday 7 November: The RBA meet on Tuesday and are now widely expected to recommence interest rate increases with a 0.25% hike from 4.10% to 4.35%. It is not only the stubbornly high wage-push inflation that has pressure on the new RBA Governor, Michelle Bullock, to act decisively with a rate hike, the International Monetary Fund produced a report on the Australian economy last week also stipulating that higher interest rates were required to control inflation. Australian interest rate forward market pricing is now 63% probability of a 0.25% increase, up from below 50% just a week ago. There is enormous political pressure on Ms Bullock not to lift rates as the highly leveraged mortgage belts in Melbourne and Sydney feel the stress and pain.

It has become very clear that Michelle Bullock has no tolerance for allowing inflation to reduce slowly to reach their 2.50% target by 2025. She wants to see inflation down in 2024 and therefore needs to hike interest rate now to achieve that. The six-month hiatus since May with no change to Australia interest rates should now be seen for what it is – a bumbling monetary policy mistake, as they have prolonged the inflationary pain on Aussie households for much longer than was necessary.

It would be a major surprise if the RBA did not increase their interest rates on Tuesday. Whilst a rate hike is largely priced into the AUD/USD exchange rate already, the confirmation should see the AUD higher again and the Kiwi dollar will follow it as it always does.

US dollar bulls now under pressure

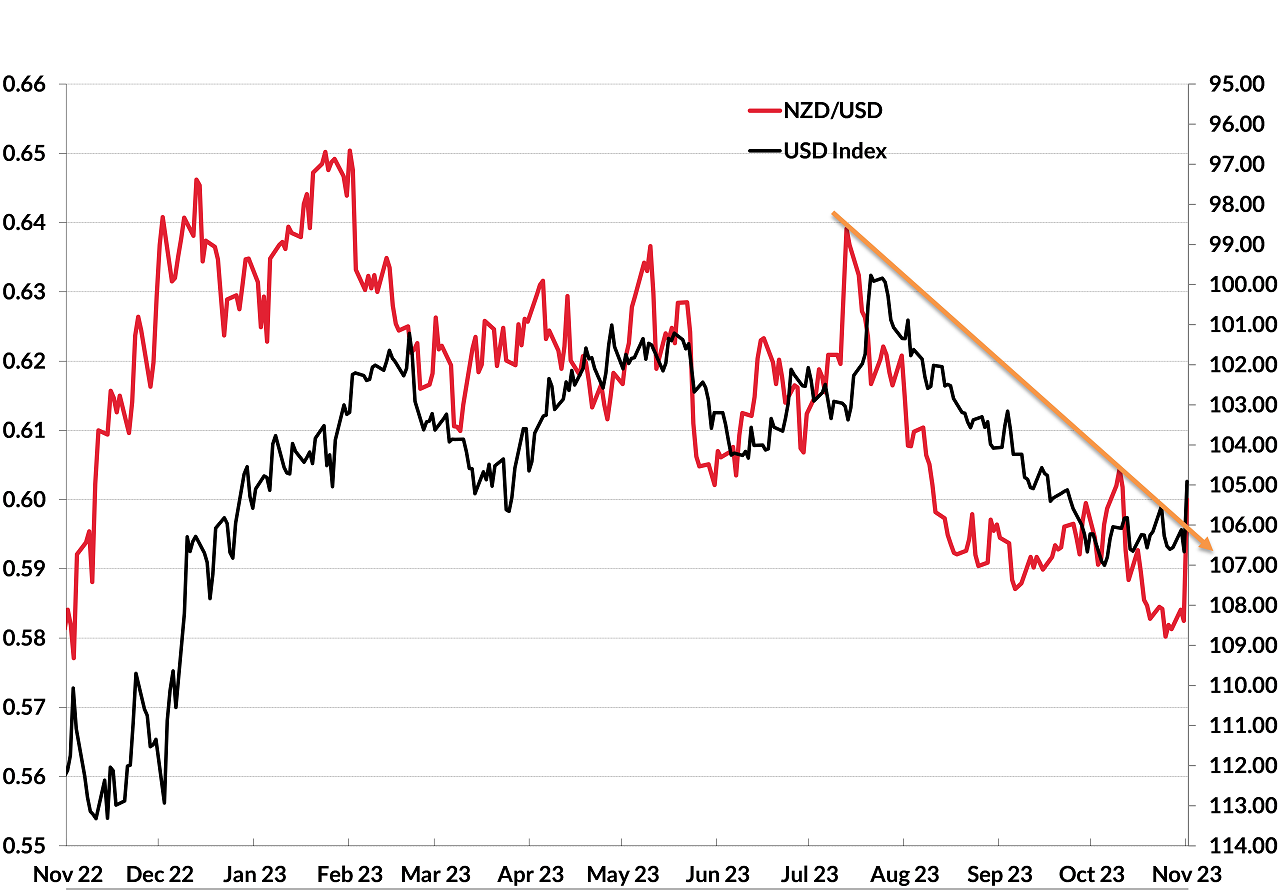

The latest bout of USD strength through July/August/September (black line in the chart below on the inverted USD Index, right-hand axis) pushed the NZD/USD exchange rate from 0.6300 to below 0.5900 (red line on chart). The dramatic reversal in sentiment and direction of the USD over recent days has seen the Kiwi dollar at 0.6000, and therefore break above its four-month downtrend line. The USD Index has broken-out below its four-month uptrend line, and it appears destined for further depreciation back to 100 on the USD Index. Such a USD fall would see the NZD/USD rate back at 0.6300 a lot earlier than most have been anticipating.

What has forced the change in the USD direction from appreciation to depreciation is US 10-year bonds yields doing suddenly plummeting from 5.00% at the start of last week to 4.57% today. The vibes from the Fed meeting and the weak jobs data reversing the direction of Treasury Bond yields. US dollar bulls are hastily reversing their long-USD positions as the scenario for next year of US interest rates decreasing well ahead in time of all others starts to become a higher probability.

The household spending activity that kept the US economy stronger through their summer months is now waning under the weight of high credit card debt, auto loan defaults, student loan interest being paid again and savings from Covid cheques running out. US household savings levels are now well below the 3.00% historical average. The Fed cannot ignore these recent weaker trends in their economy, and whilst the Fed do not want to talk about interest rate cuts next year, the markets will progressively price-in interest rate decreases over coming months. All of which is very negative for the US dollar’s value.

US two-year Government Treasury bond interest rates peaked at 5.25% two weeks ago and now trade sharply lower at 4.84%. Should the weaker data on the US economy continue over coming weeks/months, the two-year rate should continue to decrease to well below 4.50%. New Zealand two-year Government Bond yields are 5.20% and are widely expected to stay at around that level for all of 2024. The current NZ:US interest rate differential of 0.36% is set to increase to closer to 1.00% over coming months. The question for FX markets is whether a 1.00% interest rate differential in favour of the NZ dollar is enough to attract in global funds to the NZD, seeking an alternative to holding a depreciating US dollar? We have not seen the “carry trade” inflows drive the Kiwi dollar higher for quite some time, however the currency/interest rate environment is rapidly changing to provide a decent probability of that occurring.

NZ business confidence soars higher again

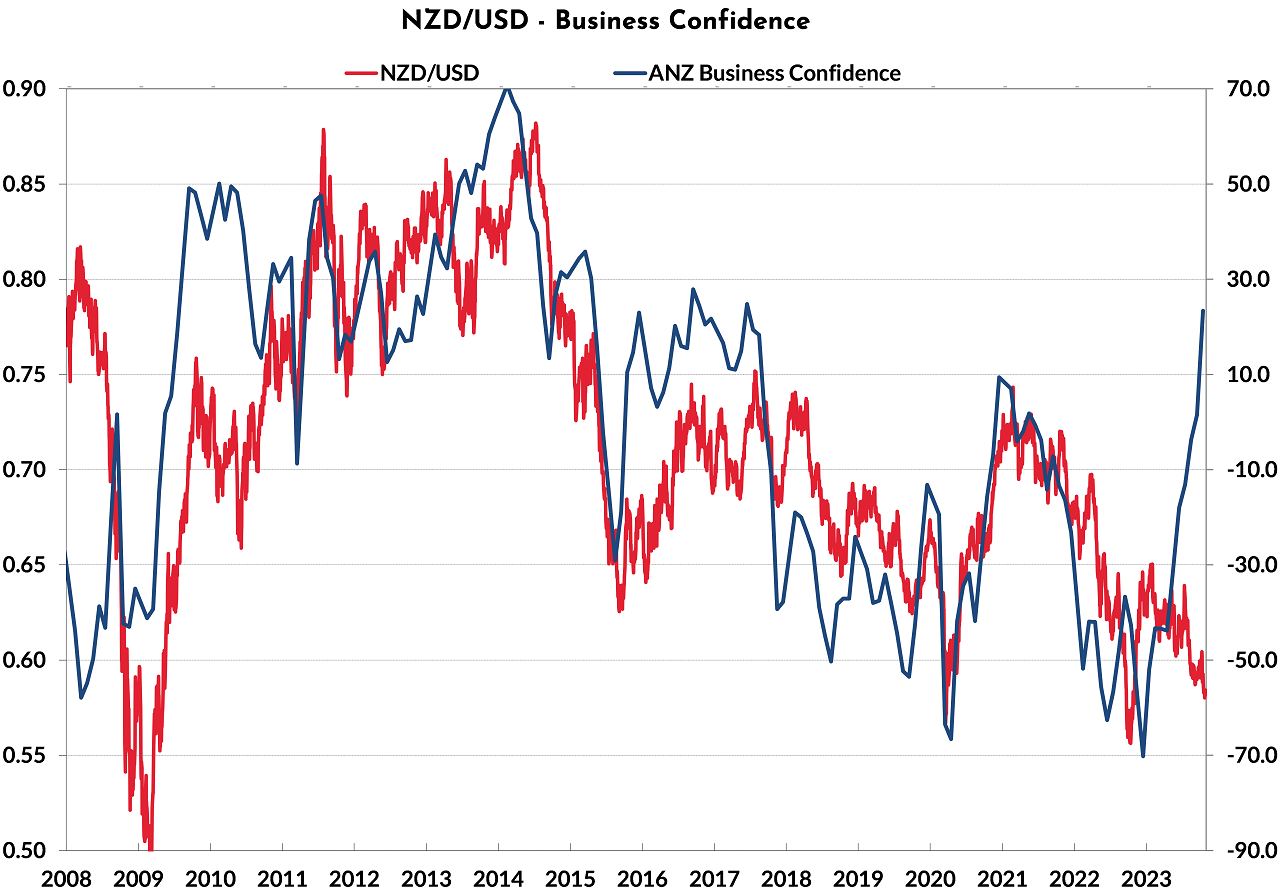

Our 15 October FX Markets report highlighted the stellar recovery in business confidence levels in New Zealand. The uplift in sentiment was due to business firms being able to hire workers again after two to three frustrating years of labour shortages. Adding to the increased confidence about the business trading environment in 2024 was the change in Government which everyone is hoping will lead to less burdensome regulatory red tape. The monthly business confidence index roared up another 21 points in October (refer chart below). From business despair only a few short months ago to high expectation of improvement today, the change has been unbelievably stunning.

The long-term relationship between the NZD/USD exchange rate value and NZ business confidence levels is undeniable as the chart demonstrates. Whilst the overall movements in the US dollar against all currencies is the dominant influence over the NZD/USD rate direction, local factors do have an impact at the margin. It cannot be stated that the NZD/USD exchange rate always automatically follows business confidence levels in a “cause and affect” way, however the connection comes about through how offshore investors and traders see New Zealand. If business confidence is plummeting in New Zealand, the attitude an offshore investor/trader would be that if the local business folk have no confidence in their own economy, why should they have any confidence to invest in New Zealand. Conversely, local businesses being much more confident about their own economy will encourage offshore players to take a look at investing in New Zealand as the economy is likely to out-perform others. Exchange rates are “relative” prices at the end of the day.

Add in an increasing interest rate differential drawing in funds to New Zealand, the NZD/USD does seem more likely to follow business confidence higher from here.

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

Credit: Source link