Personal-finance guru Suze Orman thinks most consumers are, or soon will be, in dire straits, facing an environment of higher interest rates, higher inflation, and elevated volatility in stocks and bonds.

“ ‘Most of America today has absolutely no money, if you look at it.’”

Orman’s comments, made on CNBC on Wednesday afternoon, came as SecureSave, an emergency-savings-account company that she co-founded, has published a survey finding that 67% of workers cannot afford an emergency $400 expense and that 74% of Americans are living paycheck to paycheck.

Robert Powell’s Retirement Portfolio: Who gives the best retirement advice? Suze Orman and Dave Ramsey or economists?

Kristi Rodriguez, senior vice president of the Nationwide Retirement Institute, said last fall that Americans’ monthly expenses have outpaced the growth of their personal incomes.

“Households are spending more, not as much because they want to, but because they have to, with increased costs for essential items,” she was quoted as saying by MarketWatch’s Quentin Fottrell.

See: U.S. consumer mood improving, according to final University of Michigan sentiment reading for January

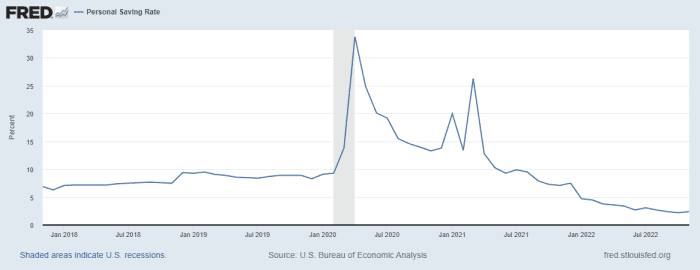

Indeed, the personal savings rate has plunged to around 2.4% from a pandemic peak of 33%, according to the most recent data available from the U.S. Bureau of Economic Analysis.

U.S. Bureau of Economic Analysis

Orman explained the fall in savings this way on the CNBC program “Fast Money”:

They were so flush with cash ’cause during the pandemic they had no place to spend the money that unemployment was giving them, extra unemployment, all kinds of stimulus checks. They didn’t have to pay their mortgage, their rent, their student-loan payment. And here we are now, a year or two later, interest rates are through the roof, for most of them…rent they can’t afford, they can’t buy a house, they can’t buy eggs, they can’t buy a car.

She speculated that “soon they’ll be using their credit cards, not being able to pay it,” she said.

Orman also noted that the repossession of cars, where borrowers have defaulted on automobile loans, are surging to levels not seen in four years.

Opinion: Household wealth dropped by $13.5 trillion from January to September, second-worst destruction on record

According to rating agency Fitch, for the lowest-income consumers, the rate of loan defaults now exceeds 2019’s numbers. Data from Cox Automotive show that delinquencies for subprime borrowers, those viewed as the least creditworthy, were at 7.11% last month, marking the highest rate of delinquencies since 2006.

Orman’s comments about the fiscal instability of Americans are at odds with the views of other experts who say the consumer looks healthy despite tumult in the S&P 500

SPX,

Dow Jones Industrial Average

DJIA,

Nasdaq Composite Index

COMP,

and the perceived safety of Treasury bonds, notably the benchmark 10-year Treasury

TMUBMUSD10Y,

Earlier this month, JPMorgan Chase CEO Jamie Dimon said Americans’ “balance sheets are in good shape,” adding that they are spending 10% more than in the pre-COVID period. That said, Dimon is predicting a mild U.S. recession, as a base case.

On Thursday, data showed that the U.S. economy grew at a sturdy 2.9% annual pace in the fourth quarter, at least partly supported by consumers who spent at a solid pace of

undefined,

according to data on gross domestic product. That said, many economists say the U.S. faces tough odds to repeat its performance amid rising interest rates, even as data early Friday showed inflation, as gauged by the Fed-preferred PCE index, at a 15-month low in December.

So what’s Orman buying in the face of the headwinds she is anticipating?

She says she is avoiding tech stocks and is 80% in cash, with the rest of her funds sitting in Treasurys with maturities of no more than six months

TMUBMUSD06M,

which are currently yielding 4.8%.

Sign up! Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Credit: Source link