There is no hotter stock in the world than Nvidia (NASDAQ: NVDA) right now. The company’s H100, A100, and new Blackwell semiconductor chips are widely regarded as superior to the competition. Considering Nvidia’s impressive roster of graphics processing units (GPU), the company is undoubtedly enjoying the moment as generative AI applications take off.

While this is encouraging, investors may be surprised to learn that Nvidia has many other services beyond GPU chips and data center services. Let’s dive into one of Nvidia’s secret, under-the-radar businesses and assess why this specific operation may be the most important of all.

Looking beyond chips and data centers

Nvidia reports its revenue into two categories: compute and networking, and graphics. When Nvidia was founded in the early 1990s, the company’s original mission was to improve graphics processing capabilities for video games.

While gaming is still a critical component of Nvidia, the company’s largest businesses now sit under compute and networking. Admittedly, compute and networking — and gaming — are fairly general terminologies. What do they actually mean?

According to Nvidia’s filings, the compute and networking segment primarily consists of the company’s data center, robotics, and artificial intelligence (AI) businesses, whereas the graphics operation accounts for Nvidia’s GPU business.

During the company’s first quarter of fiscal 2025 (ended April 30), compute and networking generated $22.7 billion in revenue — an increase of 408% year over year. One of the subtle catalysts in the compute and networking business is Nvidia’s compute unified device architecture (CUDA) platform. CUDA is a program that allows developers to write software applications that work in parallel with Nvidia’s GPUs.

While this might not seem like much on the surface, the CUDA infrastructure is incredibly important for Nvidia. Let’s find out why.

Why is CUDA important for Nvidia?

Right now, industry analysts estimate that Nvidia holds a staggering 80% market share of AI-powered chips. One leading use case for AI chips relates to training and inferencing AI models. Specifically, these applications are needed in order to build large language models (LLMs) such as ChatGPT, Anthropic, Claude, Gemini, and more.

CUDA is so lucrative for Nvidia because it provides the company with a complementary service that can be layered on top of its leading GPU hardware products. This is a major differentiator for Nvidia as it allows the company to sell both hardware and software services related to AI development.

Moreover, as competition within the chip space continues to heat up, CUDA provides Nvidia with some flexibility beyond semiconductors. Furthermore, considering software tends to carry much higher margins than hardware, I’m optimistic that Nvidia’s gross profit and cash flow profiles won’t take much (if any) of a material hit should the company start to lose some of its market share in the chip space.

Is Nvidia stock a buy right now?

Shares of Nvidia have soared 156% so far in 2024. Not only does this handily eclipse the generous returns of the S&P 500 and Nasdaq Composite, but Nvidia briefly became the largest company in the world by market cap this week.

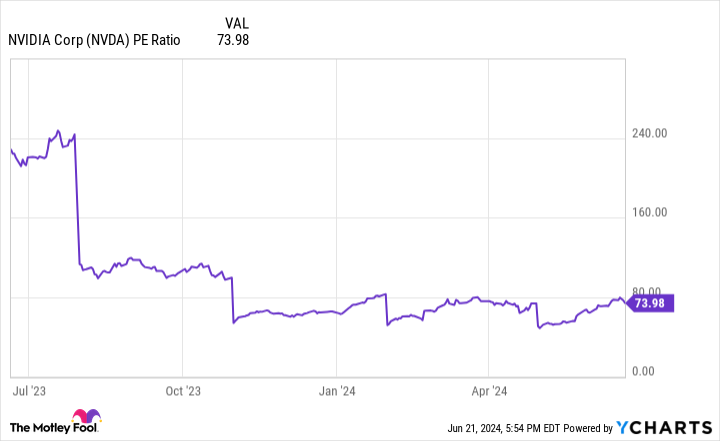

NVDA PE Ratio data by YCharts

While this might imply that Nvidia stock has gotten pricey, a look at the chart above might suggest differently. The company’s current price-to-earnings (P/E) multiple around 74 is actually materially lower than where it was just a year ago.

This dynamic suggests that even though Nvidia stock has been soaring, the company’s profits have increased at a faster pace. Technically, this means Nvidia stock is less expensive now than it was last year on a P/E basis.

I see Nvidia as long-term call option on the AI landscape. Given that the company has a commanding lead in the chip space, coupled with its CUDA software business, I think Nvidia has a bright future for years to come as it relates to the ongoing proliferation of AI development.

Although shares of Nvidia are experiencing some momentum right now, long-term investors may still want to consider adding to an existing position or begin building one.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Adam Spatacco has positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Surprise! Nvidia Has a Secret Business Outside of Chips, and It’s Already Generating Billions of Dollars. was originally published by The Motley Fool

Credit: Source link