Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

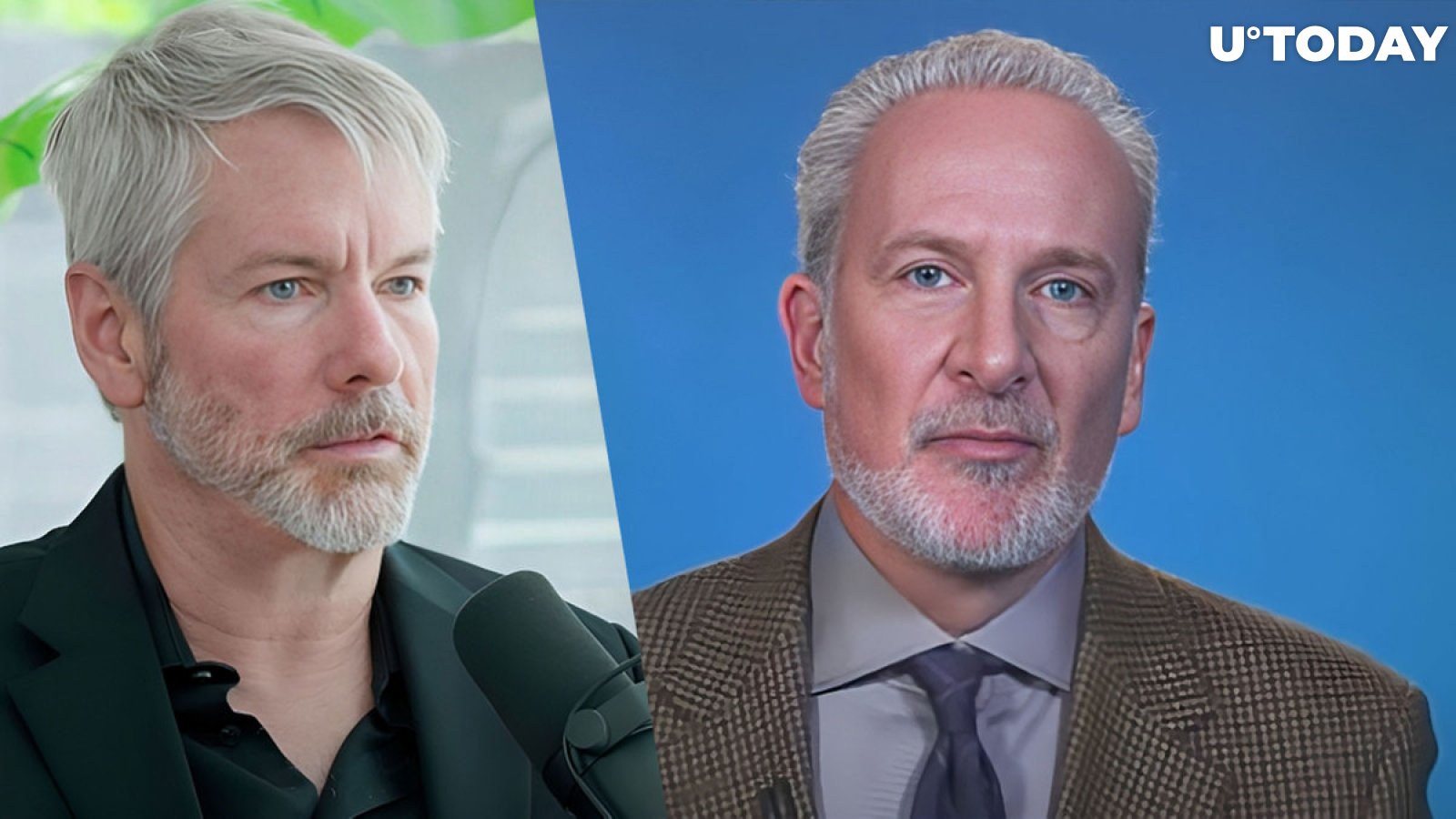

In the latest twist in the ongoing saga between crypto enthusiasts and skeptics, MicroStrategy CEO Michael Saylor’s announcement of a new Bitcoin purchase has sparked a heated debate, with renowned gold advocate Peter Schiff leading the charge against the move.

Saylor took to social media to reveal that MicroStrategy had acquired an additional 9,245 BTC, amounting to approximately $623 million. This acquisition, financed through convertible notes and surplus cash, brings MicroStrategy’s total Bitcoin holdings to a staggering 214,246 BTC, acquired at an average price of $35,160 per BTC.

However, Peter Schiff wasted no time in criticizing Saylor’s strategy, citing Bitcoin’s recent 15% dip from its recent highs. He warned of potential losses for MicroStrategy, suggesting that if Bitcoin were to plummet to $20,000, the company could face a $3.25 billion shortfall. Even worse, Schiff predicts a scenario where the BTC price drops to $10,000, leaving MicroStrategy down a staggering $5.5 billion.

Bitcoin price puzzle

The timing of Schiff’s critique aligns with Bitcoin’s recent decline, as the cryptocurrency experienced a more than 6% drop in the past 24 hours, hitting a low of $64,300, the lowest since early March. Schiff’s pessimistic outlook echoes his previous skepticism toward Bitcoin’s volatility, citing historical crashes and warning against overreliance on the Bitcoin ETF as potential triggers for a catastrophic market collapse.

Will the mega collapse of the crypto market repeat, according to Schiff’s forecast? The question is open. Black swans are no exception, especially in such an unpredictable and young market as that of cryptocurrencies.

However, even apart from that, Bitcoin managed to recover and update its maximum price, demonstrating more than 400% growth since 2023.

Credit: Source link