Another wave of student debt relief has rolled in for nearly 153,000 borrowers in the U.S.

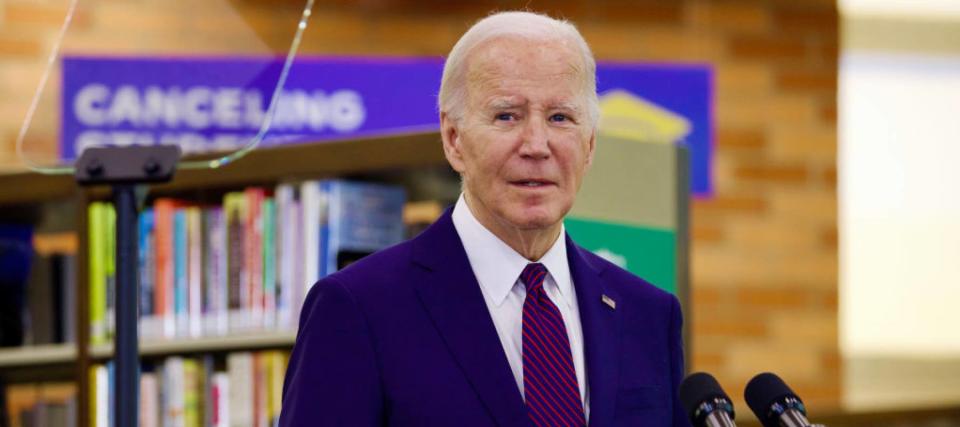

The Biden administration announced on Wednesday it will wipe out $1.2 billion in student debt for certain borrowers who took on loans of $12,000 or less for college.

To qualify, borrowers must have made at least 10 years of repayments and be enrolled onto the government’s new Saving on a Valuable Education (SAVE) Plan.

“We are once again sending a clear message to borrowers who had low balances: if you’ve been paying for a decade, you’ve done your part, and you deserve relief,” said U.S. Secretary of Education Miguel Cardona.

According to CNBC, more than half of House Republicans and 40 GOP senators (including Minority Leader Mitch McConnell) actively oppose the Biden administration’s debt relief policy.

Earlier this month, they filed briefs with the with the U.S. Supreme Court, arguing the forgiveness plan should be ruled “unlawful.” These briefs will be heard in the country’s highest court via oral arguments on Feb. 28.

McConnell criticized the move this week on X, formerly Twitter, calling it a “slap in the face” to those who had already paid off their loans and made considerable professional and personal sacrifices to avoid student debt. “President Biden’s inflation is crushing working families, and his answer is to give away even more government money to elites with higher salaries,” the GOP leader said in his statement.

Here’s how this latest wave of student debt relief will work.

SAVE-ing struggling borrowers

The SAVE plan aims to help borrowers who are more likely to struggle with repaying their loans.

According to the Department of Education (DoE), the majority of federal student loan borrowers in default originally borrowed $12,000 or less, hence that being the eligibility criteria for this wave of SAVE plan relief.

For every $1,000 borrowed over the $12,000 threshold, those enrolled in SAVE will get relief after an additional year of payments. For example, if you borrowed a $14,000 federal loan, you can get your student debt wiped out after making payments for 12 years.

The DoE estimates this fresh batch of relief will help nearly 153,000 borrowers with almost immediate effect. Others, who are eligible for early relief, but not yet enrolled in the SAVE plan, will receive a reminder from the DoE to sign up as soon as possible.

It is worth doing because all borrowers on the SAVE plan are in line to receive debt forgiveness after 20 or 25 years, depending on whether you have loans for graduate school.

Ongoing fight for debt cancelation

The Biden administration has now approved loan relief for nearly 3.9 million borrowers — and according to Cardona: “Our historic fight to cancel student debt isn’t over yet.”

Washington’s latest $1.2 billion debt wipe out follows a huge announcement on Feb. 15 whereby President Biden proposed expanding student debt forgiveness to those facing financial “hardship” — and giving the DoE the power to define that “hardship.”

The administration also wiped out $4.9 billion in student loan debt for 73,600 borrowers in January, by making fixes to the income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF) programs.

U.S. Under Secretary of Education James Kvaal said millions of student loan borrowers are counting on the Biden administration to “fix the broken student loan system and provide the forgiveness they earned and have been waiting for.”

He said the new SAVE plan relief demonstrates President Biden’s ongoing “commitment to student debt cancellation.”

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Credit: Source link