The price of crude oil fell after a cartel of oil-producing nations led by Saudi Arabia surprised the market by issuing a statement that failed to include an expected pledge to cut production by another million barrels per day.

Brent crude, which is used to price the sale of two-thirds of the world’s oil, had climbed by 5.1pc over the last three days to more than $84 (£66) a barrel in the run up to Thursday’s meeting of the Opec+ group of 23 oil-exporting countries.

The online gathering of producers aimed to prop up the declining price of oil and has ended with an agreement to cut output by at least another one million barrels per day by early next year.

Saudi Arabia, the de facto leader of the group, has already been cutting supply by a million barrels a day since the summer and will extend the time period of these cuts as well.

But Brent Oil fell after the Opec+ meeting issued a statement that avoided a united commitment to cuts in production. The price is down 2.47pc on yesterday.

Oil prices had fallen 8pc this month before its recent rally amid concerns about global demand next year and as the Israel-Hamas war failed to impact supplies.

The meeting had originally been scheduled for Sunday but was delayed after disagreements from some of the alliance’s smaller nations over their contributions to the cuts.

The Opec+ group pumps more than 40pc of the world’s oil, meaning cuts to supply potentially have huge implications for petrol prices.

In related news, Opec+ announced that major oil producer Brazil will join the group from January. UBS analyst Giovanni Staunovo said: “Considering that Brazil is a large oil producer and is driving oil production growth it is important to have them on board, but it seems that they are not cutting production like Mexico.”

Read the latest updates below.

06:17 PM GMT

Signing off

That’s it for today. Join Chris Price in the morning for all the latest markets and business news. I’ll leave you some of the latest business news and commentary from The Telegraph:

05:57 PM GMT

BP ramps up bet on solar energy with £254m deal to take full control of panel business Lightsource

BP is pushing ahead with plans to invest in solar energy after striking a £254m deal to take full control of panel business Lightsource.

The takeover forms part of the strategy pursued by former chief executive Bernard Looney, as he sought to increase BP’s investment in renewable energy.

The oil giant announced on Thursday that it will buy the 50pc of Lightsource that it does not already own.

This marks a notable shift for the oil company after it offloaded an earlier solar power business in 2011 over fears it did not make enough money.

BP first bought a 43pc stake in Lightsource in 2017 – which was later increased to 50pc.

The renewables company initially had a series of solar farms in locations such as Truro, Cornwall, and Northern Ireland, but BP’s investment fuelled expansion to the US and India.

Mr Looney spearheaded BP’s shift to green energy during his time in charge and his abrupt departure in September increased speculation that the business could water down its net zero ambitions.

There has been heightened scrutiny of BP’s share price over the past five years, which has fallen by around 6pc over the period.

This has become more acute as investors raised concerns over the cost of BP’s clean energy transition and as other oil companies shifted away from renewables.

05:36 PM GMT

FTSE 100 up, FTSE 250 down at market close

The FTSE 100 rose 0.41pc today. Cardboard packaging companies were the top gainers, with Smurfit Kappa gaining 4.74pc and DS Smith up 2.25pc. Water companies made the biggest losses, with Severn Trent dropping 4.23pc and United Utilites down 3.02pc.

Meanwhile the FTSE 250 lost 1.27pc, with Pets at Home rising 3.69pc and housebuilder Crest Nicholson rising 3.06pc. Auction Technologies was drowing in red ink, down 23.02pc, after putting out results that made investors think there would be profit downgrades in the future. Dr Martens was down 21.43pc.

05:02 PM GMT

Dr Martens shares tumble after fourth profit warning in 12 months

We mentioned earlier that Dr Martens shares have fallen by a quarter after issuing its fourth profit warning in twelve months. Daniel Woolfson has more:

The British boot maker’s valuation sank to an all-time low on Thursday after it revealed sales in the US dropped by almost a fifth over the last six months.

Kenny Wilson, chief executive at Dr Martens, said the London-based business had received fewer wholesale orders for its shoes, adding: “It is likely that given the challenging backdrop, it will take longer to see an improvement in US results than initially anticipated.”

The company kicked off the year with a warning on profits after “significant operational issues” emerged at a Los Angeles warehouse.

In its latest results, Dr Martens said pre-tax profits were down 55pc over the six months to September, compared with the same period last year.

The boot chain took off more than 50 years ago after a Northamptonshire-based family bought an air-cushioned sole from an army doctor to make boots more comfortable.

In recent years, the boots – commonly nicknamed ‘DMs’ or ‘Docs’ – have been worn by celebrities such as Kendall Jenner and Bella Hadid.

Despite its troubles across the Atlantic, demand for boots in Europe, the Middle East has remained strong, with sales growing 9pc to £194.2m over the half-year to September 30.

04:33 PM GMT

French economy shrinks as German unemployment hits highest level since 2021

We reported earlier that the French economy has gone into reverse and unemployment is rising in Germany in the latest signs that the eurozone faces recession. Tim Wallace has more:

Both countries are now on recession-watch, as they are now halfway to meeting the usual definition of recession, which is two consecutive quarters of falling GDP.

Ms Lagarde has insisted that “even having a discussion on a cut is totally premature”.

But combined with the fall in inflation, which covered falling energy prices and slowing increases in food, goods and services costs, the gloomy economic outlook raises pressure on the ECB to reduce rates from the current record high of 4pc.

Claus Vistesen at Pantheon Macroeconomics said the numbers “ought to provide a rethink on the key messaging”.

“It is one thing to signal that rates will remain higher for longer due to underlying upside inflation risks post Covid and the war in Ukraine, a message we agree with. It is quite another to ignore reality, and the reality now is that the Bank’s forecasts in September, which have underpinned relatively hawkish communication in the past month, now look hopelessly out of date,” he said, predicting a rate cut in March.

Andrew Kenningham at Capital Economics said he expects a rate cut by the middle of next year.

“With headline and core inflation likely to trend down in the new year it will be hard for the ECB to ignore the extent to which the inflationary tide is turning,” he said.

“With near-recession conditions set to drag on and inflation likely to be close to 2pc by the middle of 2024, we now think the case for the Bank to ease up on monetary policy by then will be too strong for the ECB to resist.”

04:22 PM GMT

Former Sky chief Darroch joins Disney board as activist investors circle

Disney has tapped former Sky boss Sir Jeremy Darroch to join its board as the entertainment giant comes under pressure from two activist investors. James Warrington reports:

Sir Jeremy, who stepped down from Sky in 2021 after 13 years at the helm, will take up his role on Disney’s board in January.

James Gorman, the outgoing chief executive and chairman of Morgan Stanley, will also join as a director in February.

The appointments come after activist Nelson Peltz increased his stake in Disney as he prepares a new assault on the company, including a bid for several board seats.

ValueAct Capital, a San Francisco-based investment firm, has also started to build its holding amid concerns that the House of Mouse is significantly undervalued.

Disney said the appointments highlight its focus on the long-term performance of the company, its succession planning process and increasing shareholder value.

Sir Jeremy, who succeeded James Murdoch at Sky, is credited with transforming the company from a satellite broadcaster into one of Europe’s largest multi-platform TV providers.

Disney said the veteran media executive would provide valuable insights into streaming, content investment and brand evolution.

03:36 PM GMT

Handing over

That is all from me for another day. You will still get all the latest right here from the Opec+ meeting and more from my colleague Alex Singleton.

Earlier today, Lloyds Banking Group revealed it is to close a further 45 branches across its network as face-to-face banking continues to disappear from the high street.

The company is shutting 22 Halifax branches, 19 Lloyds branches and four Bank of Scotland sites.

See the bank closure hotspots in Britain and find out below if your local branch is closing:

03:18 PM GMT

Brazil to join Opec+ oil alliance

Brazil will reportedly join the Opec+ alliance of oil-producing nations.

The largest economy in South America will join the group of nations who are in effect honourary members of the cartel.

The Organization of the Petroleum Exporting Countries (Opec) is made up of Iran, Iraq, Kuwait, Saudi Arabia, Venezuela, Libya, the United Arab Emirates, Algeria, Nigeria, Ecuador, Angola, Equatorial Guinea and Congo.

However, the Opec+ group also includes allies like Russia, Mexico and Kazakhstan. Brazil is expected to join this group.

03:09 PM GMT

FTSE energy stocks climb after oil cuts announcement

BP has climbed near the top of the FTSE 100 as it emerged that the Opec+ cartel will cut oil supplies by another one million barrels per day.

The oil giant has gained 2.8pc, while its peer Shell has risen nearly 2pc.

Overall, the energy sector across the FTSE 350 has gained as much as 2.8pc today.

03:05 PM GMT

French ministers banned from using WhatsApp

French ministers have been ordered to ditch WhatsApp for a homegrown alternative in a push for “technological sovereignty”.

Our technology editor James Titcomb has the latest:

Prime minister Élisabeth Borne has told ministers and top officials to switch to Olvid, which Ms Borne’s office claimed was more secure than popular messaging apps like WhatsApp and Signal.

Government officials have been told “to replace other instant messaging services in order to strengthen the security of exchanges”.

A circular from Ms Borne’s office said: “The main consumer instant messaging applications are playing an increasingly important role in our day-to-day communications. However, these digital tools are not without security flaws, and so cannot guarantee the security of conversations and information shared via them.”

Read why French politicians have long held concerns about over-reliance on American technology.

02:47 PM GMT

Opec+ agrees to extra supply cuts

The Opec+ cartel of oil producing nations has agreed to cut supplies by an extra one million barrels per day.

The cuts are in addition to the one million barrels a day of cuts Saudi Arabia has been carrying out since the summer.

The Gulf nation said it would extend the timeframe of the cuts, according to delegates at the virtual gathering of the alliance today.

02:33 PM GMT

Wall Street rises at the open as inflation eases

US stock markets have jumped higher after the latest figures on inflation indicated that interest rates could be cut in the first half of next year.

The Dow Jones Industrial Average rose 166.15 points, or 0.5pc, at the open to 35,596.57.

The S&P 500 opened higher by 4.29 points, or 0.1pc, at 4,554.87, while the Nasdaq Composite gained 6.56 points, or 0.1pc, to 14,265.05 at the opening bell.

02:26 PM GMT

Mulberry bemoans more cautious customers

Handbag maker Mulberry said that the economic climate had “deteriorated”, making customers more cautious in their spending and reported a widening of its loss.

Pre-tax loss rose from £3.8m in the first half of last year to £12.8m in the six months to the end of September.

The increased loss came despite a rise in revenue, by as much as 38pc in the US, though a much narrower 6pc in the UK. Across the group, revenue increased by 7pc to £69.7m.

The company said that its losses were partly due to a large jump in some of its software costs, and the money it has to spend to operate new shops in Sweden and Australia.

Chief executive Thierry Andretta said: “Against a challenging macro-economic backdrop, which is impacting the entire luxury landscape, we have continued to invest in our long-term future.”

Shares have risen 1.8pc.

02:10 PM GMT

Apple loses bid to block investigation into mobile dominance

Apple will face an investigation by the competition watchdog after judges ruled the probe should not be blocked.

The tech giant will be the subject of a full investigation by the Competition and Markets Authority (CMA) into its dominance in mobile browsers. Alphabet Inc’s Google will also be examined.

It comes after the Court of Appeal overturned an earlier ruling by the Competition Appeal Tribunal after Apple argued that the CMA had “no power” to launch such an inquiry.

Judge Nicholas Green said in a written ruling that the CAT had “lost sight” of the CMA’s role to “promote competition and protect consumers”.

Sarah Cardell, chief executive of the CMA, welcomed the decision which she said “gives the CMA the backing it needs to protect consumers and promote competition in UK”.

01:51 PM GMT

Jobless claims inch upwards in US

Slightly more Americans filed for jobless claims last week, pushing the overall number of people in the US collecting unemployment benefits to its highest level in two years.

Applications for unemployment benefits rose by 7,000 to 218,000 for the week ending November 25, the Labor Department reported.

Jobless claim applications are seen as representative of the number of layoffs in a given week.

However, overall, 1.93m people were collecting unemployment benefits the week that ended November 18, about 86,000 more than the previous week and the most in two years. Continuing claims have risen in nine of the past 10 weeks.

The four-week moving average of jobless claim applications, which flattens out some of weekly volatility, fell by 500 to 220,000.

Claims:

1/ Big W/W increase in continuing claims, though much (not all) of it is reflecting funky seasonal adjustment: +81K. (And +255K since 9/23)

The increase using 2017 seasonal adjustment factors was more muted: +33K. (+62K since 9/23) pic.twitter.com/7UdMCZNPiE

— Guy Berger (@EconBerger) November 30, 2023

01:34 PM GMT

US inflation falls further than expected

The Federal Reserve’s preferred measure of US inflation fell further than expected in October in a further sign that interest rate cuts will come in the first half of next year.

The personal consumption expenditure (PCE) index stood at 3pc in the year to October, down from 3.4pc and lower than the 3.1pc expected.

Core PCE, which excludes volatile food and energy prices, slowed from 3.7pc to 3.5pc.

01:25 PM GMT

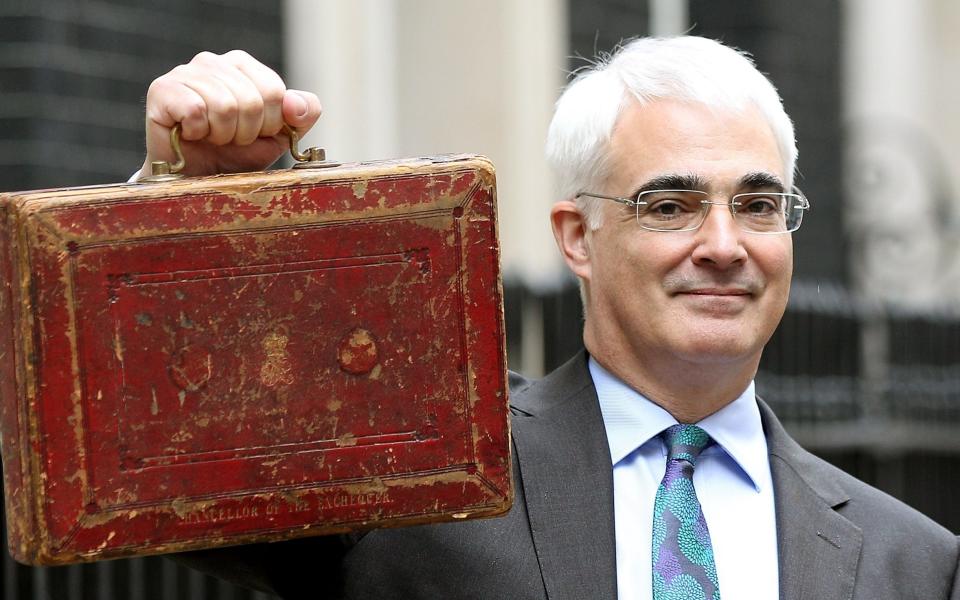

I relied on Darling’s wisdom, calmness in a crisis and humour, says Brown

The former prime minister Gordon Brown, who was Alistair Darling’s predecessor as chancellor before appointing him to the role during his premiership, said he is “deeply saddened”:

I am deeply saddened by the death of Alistair Darling. I, like many relied on his wisdom, calmness in a crisis and his humour. I send my deepest condolences to his loving wife Maggie and their children Calum and Anna. He will be missed by all who knew him.

— Gordon Brown (@GordonBrown) November 30, 2023

01:21 PM GMT

Darling was ‘a great man, but never expected to be treated as one’

Lovely words from Torsten Bell, chief executive of the Resolution Foundation:

Alistair was the man who not only gave me my career, but served the beef at my wedding and the cake at our last chat just a few weeks ago. I’ll be forever grateful to have known him, and sad not to be able to share another bottle of wine with him

— Torsten Bell (@TorstenBell) November 30, 2023

01:19 PM GMT

Politicians pay tribute to Alistair Darling

After the death of former chancellor Alistair Darling, Labour leader Sir Keir Starmer said:

I am deeply saddened to learn of the passing of Alistair Darling. My heart goes out to his family, particularly Maggie, Calum and Anna, whom he loved so dearly.

Alistair lived a life devoted to public service. He will be remembered as the Chancellor whose calm expertise and honesty helped to guide Britain through the tumult of the global financial crisis.

He was a lifelong advocate for Scotland and the Scottish people and his greatest professional pride came from representing his constituents in Edinburgh.

I consider myself incredibly fortunate to have benefited from Alistair’s counsel and friendship. He was always at hand to provide advice built on his decades of experience – always with his trademark wry, good humour.

Alistair will be missed by all those whose lives he touched. His loss to the Labour Party, his friends and his family is immeasurable.

The present Chancellor, Jeremy Hunt, has offered this kind tribute:

A sad day – I want to pay particular tribute to one of my predecessors, Alistair Darling. One of the great Chancellors, he’ll be remembered for doing the right thing for the country at a time of extraordinary turmoil. My deepest sympathies to his family.

— Jeremy Hunt (@Jeremy_Hunt) November 30, 2023

01:14 PM GMT

Wall Street on track for strongest November in three years

US stock investors are eagerly awaiting inflation data out shortly that is expected to add to the narrative of easing inflation and an end to the Federal Reserve’s cycle of interest rate rises.

The three main indexes are on course for their strongest November since 2020, with the S&P 500 and the tech-heavy Nasdaq also poised for their biggest monthly percentage gain since July 2022.

All eyes are now on the personal consumption expenditure (PCE) index – the Fed’s preferred inflation gauge – for October, which is expected to show inflation eased in the previous month.

A pause in rate hikes has been fully priced in for the upcoming December meeting of the Fed.

In premarket trading, the Dow Jones Industrial Average was up 0.6pc, the S&P 500 had gained 0.3pc and the Nasdaq 100 was up 0.3pc.

01:02 PM GMT

Former Labour chancellor Alistair Darling dies aged 70

Alistair Darling has died after a short illness aged 70, his family has confirmed.

Our Scottish political editor Simon Johnson has the latest:

Darling served as Chancellor in Gordon Brown’s government after Tony Blair stood down as Prime Minister.

He later led the victorious Better Together campaign in the 2014 independence referendum, defeating Alex Salmond’s nationalists.

The former Edinburgh South West MP stepped down from the Commons in 2015 and later retired from the Lords.

Read the latest on this breaking story.

12:56 PM GMT

Opec+ ‘agrees preliminary deal to cut oil production’

Opec+ oil producers are likely to agree output cuts of at least 1 million barrels per day for early next year, according to reports.

Under the deal, Saudi Arabia would extend its voluntary cut of one million barrels per day, which it has had in place since July, along with additional contributions from other members, Reuters reported.

Saudi Arabia, Russia and other members of Opec+ pump more than 40pc of the world’s oil, or some 43m barrels per day.

They currently have cuts of about 5m barrels per day in place.

12:49 PM GMT

Family statement after Alistair Darling’s death

A statement issued on behalf of the family of former Labour chancellor Alistair Darling said:

The death of Alistair Darling, a former Chancellor of the Exchequer and long-serving member of the Labour cabinet, was announced in Edinburgh today.

Mr Darling, the much-loved husband of Margaret and beloved father of Calum and Anna, died after a short spell in Western General Hospital under the wonderful care of the cancer team.

12:48 PM GMT

Former Chancellor Alistair Darling dies, aged 70

Former chancellor and veteran Labour politician Alistair Darling has died aged 70, a spokesman on behalf of his family said.

12:04 PM GMT

Pound heads for biggest monthly gain this year

The pound has eased against the dollar today but remains on track for its biggest monthly gain in a year.

Sterling was last down 0.4pc at $1.26 in a month where it has benefitted from pressure on the US currency from growing expectations for the Federal Reserve to cut rates earlier than many other central banks.

The pound has made more modest inroads against the euro. The common currency lost 0.8pc against the pound in November and is worth about 86p.

Trade Nation senior market analyst David Morrison said: “As investors expect the next Fed move to be a cut, it’s plain to see why the dollar is under pressure while sterling is making gains.”

Traders believe the Bank of England will have to keep rates higher for longer than most other major central banks next year, given UK inflation is still way above target.

Money markets show traders estimate the Bank of England will deliver its first rate cut by August, compared with April for the European Central Bank and May for the Federal Reserve.

11:50 AM GMT

December train strikes will still go ahead

Commuters still face another wave of strikes and rail disruption starting this week, as train drivers plan a run of walkouts and ban on overtime in the run-up to Christmas.

Train drivers represented by Aslef are in a separate dispute to RMT members, who have voted to accept a pay offer.

The disruption is the latest blow to travellers who have been hit with 18 months of disruption since unions began their pay dispute with the Government and train operating companies.

Here is everything you need to know about the next wave of industrial action.

11:36 AM GMT

Aslef show follow RMT’s lead, says Transport Secretary

After RMT members voted to accept the terms of the pay offer presented by rail operators, Transport Secretary Mark Harper said:

This is welcome news for passengers and a significant step towards resolving industrial disputes on the railway, giving workers a pay rise before Christmas and a pathway to delivering long overdue reforms.

It remains the case that the train drivers’ union Aslef continue to block their members from having a say on the offer that would take train drivers’ median salaries from £60,000 to £65,000 for a 35-hour, four-day week.

Aslef should follow the RMT’s lead and give their members a say.

11:18 AM GMT

Unity gets results, says RMT boss as members end pay dispute

As the RMT voted to end its long-running pay dispute, General Secretary Mick Lynch said:

Our members have spoken in huge numbers to accept this offer and I want to congratulate them on their steadfastness in this long industrial campaign.

We will be negotiating further with the train operators over reforms they want to see. And we will never shy away from vigorously defending our members terms and conditions, now or in the future.

This campaign shows that sustained strike action and unity gets results and our members should be proud of the role they have played in securing this deal.

11:15 AM GMT

RMT votes to end rail strikes

RMT members have voted overwhelmingly to accept a deal to end their long-running dispute over pay and conditions, the union announced.

11:15 AM GMT

Tesla to launch ‘radical’ Cybertruck

Tesla is poised to start deliveries of its long-delayed Cybertruck electric pickup today, after chief executive Elon Musk tempered investor expectations of what he called a “radical” product.

Tesla’s first new model in nearly four years is critical to its reputation as a maker of innovative vehicles.

At a time when the company is battling softening electric vehicle (EV) demand and rising competition, Cybertruck is also key for generating sales, although not to the extent of the company’s high-volume Models 3 and Y.

Mr Musk said “we dug our own grave with Cybertruck,” warning that it would take a year to 18 months to make the vehicle a significant cash flow contributor.

Pricing for the vehicle is expected to be revealed at an event scheduled to begin at 8pm UK time.

After saying in 2019 the truck would be priced at $40,000, Mr Musk has not offered an updated price despite rising raw material costs.

10:59 AM GMT

Sweeping rail faults delay commuters

Did you have a miserable journey into work this morning? You were not alone.

Rail commuters suffered disruption as several major routes were disrupted by a series of infrastructure failures.

Great Western Railway and Elizabeth line services between London Paddington and Reading were being forced to run at a reduced speed due to a broken rail, which was expected to cause delays throughout the day.

The operator said the problem was discovered in the area around Hayes & Harlington station, west London, early on Wednesday, with Network Rail unable to carry out a full repair until Thursday night.

The defect was at a set of points used to transfer trains from one track to another.

Separate points failures were disrupting South Western Railway trains at London Waterloo – the UK’s busiest railway station – and Thameslink services between Sutton and Luton.

Thameslink was being prevented from running trains between Wimbledon and Sutton due to the fault between Wimbledon and Wimbledon Chase.

Meanwhile, all lines were closed between Birmingham New Street and Longbridge because emergency services were dealing with an incident.

10:40 AM GMT

Bond markets hold gains as eurozone inflation falls

Eurozone bond prices held on to recent gains as inflation data came in lower than expected, putting them on track for the biggest monthly gain in well over a year.

Euro zone inflation slowed to 2.4pc in November from 2.9pc in October, well below expectations of a fall to 2.7pc.

Separate figures on Thursday showed that German unemployment rose in November and the French economy contracted in the third quarter, bolstering investors’ bets that the European Central Bank will cut interest rates in early 2024.

Germany’s 10-year bond yield, the benchmark for the bloc, fell one basis point to 2.42pc. Yields move inversely to prices.

The yield was on track for its biggest monthly drop since July 2022, at 40 bps, reflecting the strong rally in prices.

Meanwhile, the yield on 10-year UK gilts has gained more than three basis points to 4.13pc as a Bank of England survey showed bosses expect inflation to remain over 3pc in three years’ time.

10:17 AM GMT

First interest rate cut forecasts brought forward as eurozone inflation falls

Economists expect the European Central Bank to begin cutting interest rates in June rather than September after inflation fell more sharply than expected in the single currency bloc.

Eurozone inflation fell from 2.9pc in October to 2.4pc in November as core inflation, which excludes volatile food and energy prices, fell from 4.2pc to 3.6pc, ahead of estimates of a drop to 3.9pc.

Andrew Kenningham, chief Europe economist at Capital Economics, said it is “ becoming increasingly untenable for policymakers to claim that they are not even thinking about rate cuts”. He said:

Policymakers won’t want to declare victory prematurely and are sure to reiterate at December’s ECB meeting that it is far too early to cut rates.

Moreover, inflation is likely to rebound to at least 3pc in December as energy inflation rises. And the labour market is still very tight by pre-pandemic standards.

Nonetheless, with headline and core inflation likely to trend down in the new year it will hard for the ECB to ignore the extent to which the inflationary tide is turning.

With near-recession conditions set to drag on and inflation likely to be close to 2pc by the middle of 2024, we now think the case for the Bank to ease up on monetary policy by then will be too strong for the ECB to resist.

Wow, the disinflation process in the eurozone is really speeding up. Another whopper of a drop in core inflation looks really encouraging. Weak demand and faded supply-side problems bring inflation close to target again. Dovish voices should grow louder on the back of this. pic.twitter.com/tgCyVyLN2V

— Bert Colijn (@BertColijn) November 30, 2023

10:07 AM GMT

Eurozone inflation falls more than expected to 2.4pc

Inflation in the eurozone fell more than expected in November, according to initial estimates.

Prices rose 2.4pc over the last year across the single currency bloc, lower than the 2.7pc predicted by economists had down from 2.9pc in October.

10:03 AM GMT

Bosses fear inflation will remain above 3pc in three years’ time

UK bosses think inflation will still be above the Bank of England’s 2pc target in three years time, a closely-watched survey shows.

Chief financial officers in Britain expect price rises to stand at 4.4pc in a year’s time and 3.2pc in three years, according to the Bank of England’s Decision Maker’s Panel.

It comes a day after Bank of England governor Andrew Bailey insisted he was a “realist” about the UK’s growth prospects following policymakers’ forecasts that the economy will flatline next year, with roughly a 50pc chance it will fall into recession..

09:44 AM GMT

Shoppers begin Christmas shopping earlier, says Lidl

Lidl has said shoppers have begun preparing for Christmas early as the discount retailer reported an 11pc uptick in customers over the past six weeks.

The German discounter said it has been selling two mince pies every second since September, and said that one in five Panettones purchased in the UK this year will be bought from Lidl.

Kantar data showed that shoppers have switched over £685m of spending to Lidl over the course of the year.

Lidl GB chief executive Ryan McDonnell said:

It goes without saying that the past year has been challenging for so many people but, despite this, we can see that shoppers have been in the Christmas spirit since as early as September when the first Christmas lines went on sale.

Over the past six weeks alone we’ve seen a massive surge in the number of customers coming through our doors and it’s clear that households are getting prepared well ahead of celebrations.

09:32 AM GMT

Oil prices ahead of crucial Opec+ meeting

OPEC+ meets today as the group seeks to resolve a deadlock on oil quotas and considers further production cuts to shore up flagging crude prices.

Group leader Saudi Arabia is pressing fellow alliance members to join it in restraining supplies in order to stave off a renewed oil surplus next year.

A deeper collective cutback of 1m barrels a day or more will be discussed when ministers from the Opec cartel (the Organization of Petroleum Exporting Countries) and its allies hold their video conference.

Brent crude prices have risen 0.6pc today toward $84 a barrel, while US-produced West Texas Intermediate has climbed 0.5pc above $78.

09:10 AM GMT

German unemployment hits highest level since 2021

Germany’s unemployment rate unexpectedly rose to its highest level in two and a half years in a sign of weakness in Europe’s largest economy.

The percentage of jobseekers grew to 5.9pc in November, up from 5.8pc the previous month, according to Germany’s Federal Labour Office.

The number of people out of work increased by 22,000 to 2.7m, slightly above estimates.

Andrea Nahles, the head of Germany’s Federal Labour Office, said:

The economic slump is leaving its mark.

Employment is now only growing marginally and demand for workers continues to weaken.

09:01 AM GMT

French economy shrank in third quarter, revised data show

France’s economy shrank slightly in the third quarter, official data showed Thursday, while the inflation weighing on consumers eased in November.

Gross domestic product (GDP) in the eurozone’s second-largest economy retreated by 0.1pc in the three months to September, statistics authority INSEE said, returning close to flatline following a strong second-quarter expansion.

INSEE pointed to revitalised household consumption over the three months, counterbalanced by slowing investments and falling exports.

Today’s figure was a revision of an earlier estimate that showed the economy expanding slightly in the third quarter.

Monthly inflation data showed that year-on-year price growth in France slowed to 3.4pc in November.

INSEE pointed to falling inflation for services, energy and consumer goods including food – a sore point among squeezed French households that has had the government scrambling for solutions.

08:41 AM GMT

UK markets fall ahead of Opec+ meeting

The FTSE 100 has slipped after rising earlier ahead of a meeting of the Opec+ cartel today.

The energy and exporter-heavy FTSE 100 had risen 0.2pc but has since fallen 0.2pc, while the FTSE 250 midcap index has now lost 0.5pc.

Industrial metal miners led gains early on, rising 1.2pc as prices of most base metals and iron ore advanced.

Meanwhile oil and gas edged up 0.7pc as Brent crude prices gained 1pc ahead of expected production cuts by the Opec+ cartel of producers.

The domestically-focused FTSE 250 and the FTSE Small Cap index are on track sharp monthly gains as the pound rallied against the dollar this month, while the blue-chip FTSE 100 was set for marginal gains.

The focus will switch later to the personal consumption expenditures (PCE) report in the United States due later in the day, which is the US Federal Reserve’s preferred measure of inflation.

NatWest Group added as much as 3.3pc after JP Morgan upgraded the bank’s stock to “overweight” from “neutral”.

Dr Martens slumped 23pc after the bootmaker forecast its annual revenue to decline and profit to be below market expectations.

08:34 AM GMT

Metro Bank in talks to cut opening hours

Metro Bank said it was in talks with the City regulator, the Financial Conduct Authority, about the changes planned to its branch opening days and extended store hours.

At present it is open seven days a week.

The cost cutting comes after Metro Bank shareholders on Monday approved a funding package worth £925m to secure its future on Britain’s high streets.

Shareholders gave the green light to a capital fundraise which will see Colombian billionaire Jaime Gilinski Bacal become a majority shareholder in the group with a 53pc stake.

Metro Bank shares have gained 3.6pc in early trading.

08:14 AM GMT

Dr Marten’s shares plummet after profit warning

Boot maker Dr Marten’s shares have plunged 23pc in early trading after the company said it is set to miss expectations amid another slump in sales.

08:13 AM GMT

X boss defends Elon Musk’s X-rated outburst against advertisers

The chief executive of X, formerly known as Twitter, has defended the social network’s billionaire owner Elon Musk after he told companies joining the growing advertising boycott against the platform to “go f— yourself”.

Linda Yaccarino said the Tesla and SpaceX boss had given a “candid interview” and said that “enabling an information independence that’s uncomfortable for some people”.

Mr Musk said that he did not want those companies to advertise because they were trying to “blackmail” him with money.

Read on for details and here is Ms Yaccarino’s tweet:

Today @elonmusk gave a wide ranging and candid interview at @dealbook 2023. He also offered an apology, an explanation and an explicit point of view about our position. X is enabling an information independence that’s uncomfortable for some people. We’re a platform that allows… https://t.co/PSmSKRkJSq

— Linda Yaccarino (@lindayaX) November 30, 2023

08:03 AM GMT

UK markets open higher ahead of Opec+ meeting

UK markets opened higher ahead of the meeting of the Opec+ group of oil-producing nations today, where they are expected to set out plans to cut global supplies.

The energy-heavy FTSE 100 was up 0.2pc to 7,437.48, while the domestically-focused FTSE 250 gained 0.4pc to 18,458.23.

08:01 AM GMT

Mitchells & Butler suffers loss after property writedowns

Pub and restaurant operator Mitchells & Butlers slumped a loss despite increasing revenues as the value of its property portfolio weakened.

The All Bar One and Browns owner said it suffered a pre-tax loss of £13m in the year to September, even as revenues grew 13pc to £2.5bn.

Its property portfolio was written down by £192m to a value of about £4bn, following a decrease of £282m the previous year.

However, it said its cost headwinds would reduce to about £65m over the course of the year despite increases to the National Living Wage as reductions in energy prices and slowing food inflation take effect.

Chief executive Phil Urban said:

We are delighted by the continued strength of our trading performance, and resilience in the face of unprecedented cost headwinds.

We have achieved good growth in underlying profit, excluding government support, with like-for-like sales growth across all of our brands, and record outperformance against the market.

Whilst we remain mindful of the pressures that the UK consumer is facing, the strength of our sales growth alongside an abating cost environment gives us confidence for the financial year ahead.

07:47 AM GMT

Dr Martens blames profit warning on mild autumn

Dr Martens has warned that earnings for the year are set to miss expectations amid another slump in sales.

It came as the boot maker revealed that sales fell by 5pc to £395.8m in the six months to September 30, as it was hampered by particularly challenging trading in the US.

The company said pre-tax profits were down 55pc to £25.8m and would take a hit of about £5m over the year.

It said it has been knocked by warm weather at the start of the autumn/winter season, although trading in Europe, the Middle East and Asia Pacific improved in recent weeks.

Chief executive officer Kenny Wilson said: “We are undoubtedly facing some more challenging headwinds in the US, but we are continuing to invest in the business, we continue to have faith in our iconic brand, and we continue to believe in the long-term growth potential of the business.”

07:38 AM GMT

Lloyds to shut 45 bank branches

Lloyds Banking Group is shutting another 45 branches across its network and the Halifax and Bank of Scotland brands amid the ongoing shift away from high street banking.

The group is shutting 22 Halifax branches, 19 Lloyds branches and four in the Bank of Scotland business.

It comes just a week after NatWest Group said it plans to close another 19 branches, mostly in the early part of next year.

The latest closures now bring the total number of high street branches closed across the sector to 623 so far this year.

07:37 AM GMT

Unemployment lowest since 1970s, suggests ONS ‘experimental’ data

The UK unemployment rate fell to 3.5pc in the spring, according to initial findings from experimental new official data, suggesting the jobs market is more resilient than previously thought.

The data, which would leave the percentage of jobseekers matching its lowest levels since the 1970s, was quietly released last month in a spreadsheet by the Office for National Statistics (ONS).

It contrasts with official estimates which put the unemployment rate at 4.2pc for the second and third quarters of the year.

The ONS has not focused on the figures, which it said are “very early” and “indicative only” results of its new Transformed Labour Force Survey.

It suggested the unemployment rate was 3.5pc in the three months to May and 3.8pc in the three months to June.

The data could increase pressure on the Bank of England to keep interest rates higher for longer to avoid strong employment levels fuelling inflation.

07:25 AM GMT

Metro Bank to cut 20pc of staff after £925m rescue deal approved

Metro Bank has said it will cut hundreds of jobs and will review its seven day opening strategy after shareholders approved its £925m rescue deal.

The challenger bank, which employed more than 4,000 people as of 2022, said the plans would help it save £50m a year, an improvement on its previous cost reduction plans, which were expected to save £30m annually.

The company, which has faced criticism for its focus on branches as banks increasingly switch to digital services, said it remains committed to stores and the high street but “it will transition to a more cost-efficient business model, investing in automation for service and back-office operations and improving digital channels, particularly for deposits”.

Chief executive Daniel Frumkin said:

The support shown from our investors through this transaction will allow Metro Bank to accelerate its growth plans, with the new capital allowing us to unlock the potential in the business and deliver sustainable profitable returns as we strive to be the number one community bank.

We remain committed to stores and the high street but will transition to a more cost-efficient business model while remaining focussed on customer service.

These actions alongside other initiatives to reduce costs are expected to deliver savings of up to £50m per year on an annualised basis.

07:10 AM GMT

Good morning

Thanks for joining me. New experimental data from the Office for National Statistics indicates that unemployment may have been as low as 3.5pc in the three months to May.

The data, which statistician said is “very early” and “only indicative”, would put the percentage of jobseekers at the same levels as the lows of the 1970s.

5 things to start your day

1) Selfridges shareholder Signa files for insolvency | Questions over department store ownership as cash crunch topples Rene Benko’s empire

2) Ottolenghi forced to cut restaurant opening hours amid chef shortage | Chain admits struggles hiring talented staff in wake of Covid and Brexit

3) Inside the scramble to save Saga from sinking under a mountain of debt | Chief executive Euan Sutherland’s departure comes at a crucial juncture for the business

4) Tom Stevenson: With a turbulent year ahead, investors can’t afford to sit on the fence | We indulge in scenario analysis without the benefit of a crystal ball

5) Why Sunak’s national security tsar Oliver Dowden may be the man to decide The Telegraph’s fate | Tory MPs are pressing the Deputy Prime Minister to intervene in Abu Dhabi’s takeover of this newspaper

What happened overnight

Asian shares were mostly higher ahead of an update on US consumer inflation and a meeting of the Opec+ oil producers in Vienna.

Tokyo’s Nikkei 225 closed up 0.5pc, or 165.67 points, to end at 33,486.89, while the broader Topix index climbed 0.4pc, or 10.43 points, to 2,374.93.

The Hang Seng in Hong Kong was up 0.2pc at 17,024.43. The Shanghai Composite index added 0.2pc to 3,026.43.

South Korea’s Kospi was flat at 2,520.14. In Australia, the S&P/ASX 200 advanced 0.4pc to 7,062.90. In Bangkok, the SET fell 0.4pc. India’s Sensex lost 0.3pc and Taiwan’s Taiex edged 0.1pc higher.

The members of OPEC+, whose oil income props up their economies, are due today to try to forge a consensus on production cuts after postponing a meeting originally set for Sunday.

The Dow Jones Industrial Average of 30 leading American businesses rose 0.04pc on Thursday to 35,430.42, while broader S&P 500 lost 0.1pc to close at 4,550.58. The Nasdaq Composite index, which heavily features technology companies, dropped 0.2pc to 14,258.49.

The yield on benchmark 10-year US Treasury bonds was down six basis points to 4.278pc, from 4.336pc late on Tuesday.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month, then enjoy 1 year for just $9 with our US-exclusive offer.

Credit: Source link