Feature China / Contributor / Getty Images

Key Takeaways

Major U.S. stock indexes were slightly higher at midday Tuesday, as U.S.-traded shares of Chinese companies rose after Beijing unveiled a stimulus package to boost China’s economy.

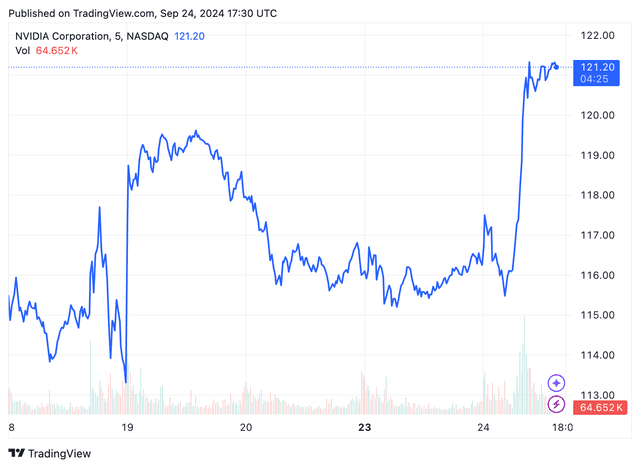

Nvidia shares climbed as Morgan Stanley analysts said the chipmaker is seeing strong demand for its Hopper and Blackwell GPUs.

Shares of Freeport-McMoRan, Newmont, and other gold miners gained as the price of gold hit another record high.

Major U.S. stock indexes were slightly higher at midday Tuesday after China announced a new stimulus package to boost China’s economy. The S&P 500 and Dow climbed to record highs, while the Nasdaq was also in the green.

U.S.-traded shares of Chinese companies and shares of U.S.-based companies with significant exposure to China surged, with Caterpillar (CAT) leading gains in the Dow. Las Vegas Sands (LVS) and Wynn Resorts (WYNN) were also higher.

Shares of Freeport-McMoRan (FCX), Newmont (NEM), and other gold miners advanced as the precious metal hit another all-time high.

Shares of artificial intelligence darling Nvidia (NVDA) also climbed as Morgan Stanley analysts said the chipmaker is seeing strong demand for its Hopper and Blackwell GPUs.

Visa (V) shares slumped on reports U.S. regulators will file a lawsuit against the credit card company, accusing it of hurting consumers by monopolizing payment processing technology. Shares of other credit card providers dropped as well.

Shares of Regeneron Pharmaceuticals (REGN) lost ground after a federal judge ruled against the biotech firm’s claim that Amgen (AMGN) infringed on the patent for its Eylea eye treatment. Amgen shares were lower as well.

Oil futures climbed and the yield on the 10-year Treasury note rose. The U.S. dollar gained versus the yen, but fell to the euro and pound. Most major cryptocurrencies were lower.

Read the original article on Investopedia.

Credit: Source link