Stocks may crash 30% and a recession could hit within months, Gary Shilling said.

The star forecaster said stocks are super pricey and flagged several signs of economic strain.

Shilling predicted the housing market would rebound in time, and dismissed de-dollarization fears.

A legendary market prophet has warned that overpriced stocks may come crashing down, and a recession might strike within months.

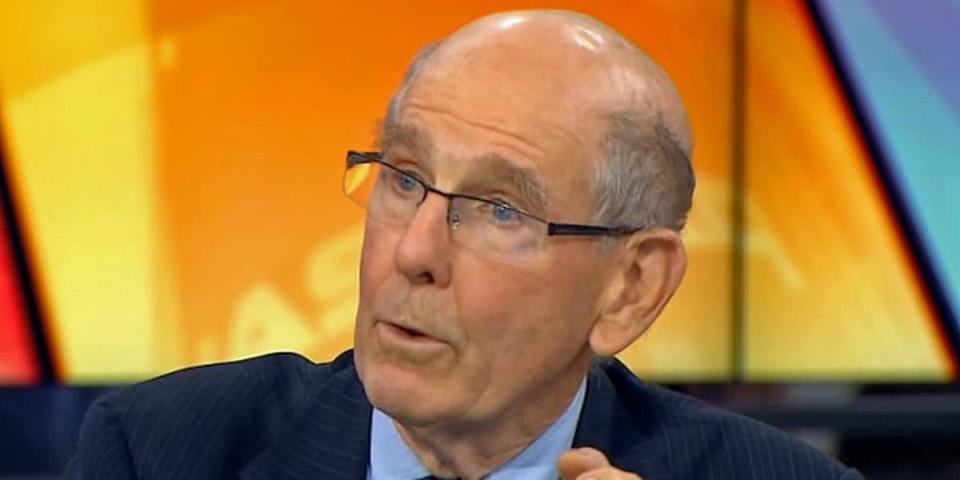

“Stocks are very, very expensive now” relative to both corporate earnings and rival assets like Treasury bonds, Gary Shilling recently told the Retirement Lifestyle Advocates radio show.

“If we wake up one of these days and find that a major company has gotten into trouble, and that triggers a huge sell-off in stocks, I wouldn’t be at all surprised,” he added.

Shilling was Merrill Lynch’s first chief economist and launched his own economic consultancy and investment-advisory firm in 1978. The president of A. Gary Shilling & Co. is known for making several prescient market calls over the past four decades.

The star forecaster noted the Shiller price-earnings ratio for the S&P 500 is about 45% higher than the long-term average, indicating stocks are historically overvalued.

He also cautioned that a handful of stocks make up a big chunk of the stock market’s current value. Shilling described that kind of concentration as “always dangerous” because it suggested investors “really don’t like the rest of the stock market and therefore the bulk of the economy.”

“This has been a wildly speculative kind of market,” Shilling said, comparing the run-up in the “Magnificent Seven” tech stocks to the “Nifty Fifty” bubble in the early 1970s that centered on names like Winnebago and Polaroid.

Shilling warned the S&P 500 could tumble by 20% to 30%, although the decline “could even be bigger than that.” He recently told Business Insider the benchmark index could plummet below 3,500 points — a 32% plunge from its current level of about 5,100 points.

The veteran economist issued a similar warning in his “Insight” newsletter for March. “Rampant speculation seems destined for a big downfall,” he wrote, singling out bitcoin as a “purely speculative vehicle.”

Cracks in the economy

Shilling reeled off a bunch of red flags that suggest a recession is looming. He pointed to the prolonged decline in the Leading Economic Index, pressure on housing starts, waning consumer demand and confidence, small businesses scaling back their hiring plans, a softening labor market, and the Federal Reserve raising interest rates from almost zero in early 2022 to more than 5% by last summer.

Looking at the past seven recessions, Shilling emphasized that they struck an average of 26 months after the Fed began raising rates. It’s been about two years since the first rate increase in this cycle, suggesting “the economy is due for a downturn,” he said.

“The odds are very much in favor of a recession,” he added, noting there’s only been one soft landing since World War II.

Even so, Shilling predicted it would take time for the economy to capitulate. Companies have held off on firing workers after facing labor shortages in recent years, and consumers have kept spending by tapping their pandemic savings and racking up record amounts of credit-card debt, he said.

Homes and dollars

Shilling also shared his outlook for the frozen US housing market, the national debt, and the dollar, predicting a “considerable revival” in housing activity over the next three or four years as mortgage rates drop.

He also flagged the risk of a future “debt bomb,” as spiraling federal borrowing leads to the government spending more and more of its budget just paying the interest it owes.

As for the greenback, Shilling said he wasn’t worried about “de-dollarization” or the end of dollar dominance in currency markets.

“There’s really no other option than the dollar,” he said. “It’s the cleanest sock in the laundry. It’s the tallest midget. It’s the slowest falling rock. Whatever it is, it’s the best of the lot.”

It’s worth pointing out that Shilling has been sounding the alarm on stocks and the economy for a long time, yet both have defied his bleak predictions and performed surprisingly well. But in light of his long-term track record and decades of experience, plenty of investors remain happy to hear him out.

Read the original article on Business Insider

Credit: Source link