Bitcoin options expiry day is here, and this Friday is a month-ending event with a very large notional value expiry. Moreover, selling pressure has been mounting on crypto markets due to Grayscale offloading and miners selling, will the options add to the pressure?

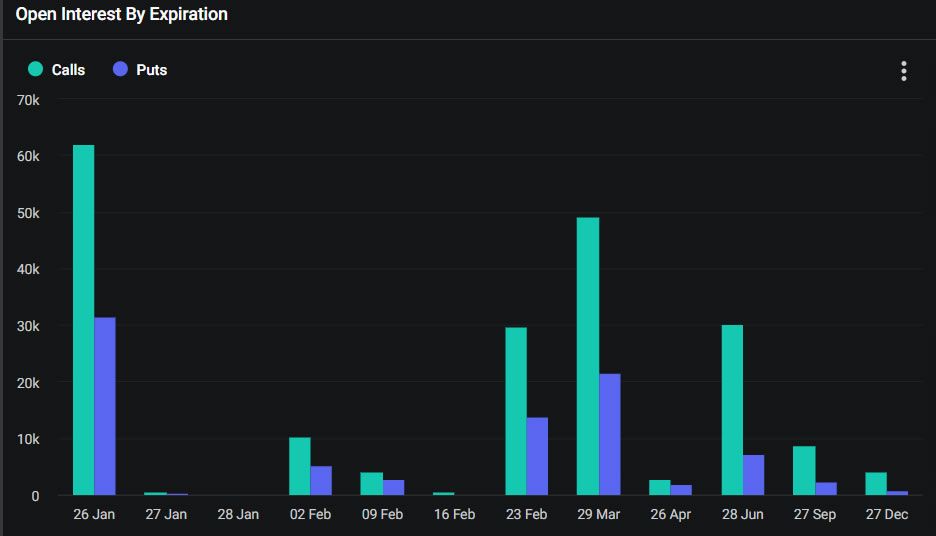

Around 93,600 Bitcoin options contracts will expire on January 26. This week’s end-of-month expiry event is much larger than last week’s, so it could have a bigger impact on spot markets.

Bitcoin Options Expiry

The notional value for this week’s huge batch of expiring Bitcoin options contracts is $3.4 billion, according to Deribit. The put/call ratio is 0.51, which means there are twice as many calls or long contracts being sold as puts or short contracts.

There is still a lot of open interest at the $50,000 strike price, with 22,719 call contracts at that level. However, the trend is down in the short term so the short sellers could be in profit with put contract OI highest at the $40,000 strike price.

Greeks Live commented that options block trades dominated Bitcoin options trading yesterday due to month-end shifts.

Block calls and block puts each accounted for 30% of the volume,

“Which was largely made up of four liquidating block trades and several diagonal spreads. To put it bluntly, the big players see little risk of a short-term spike (within a month), but big swings before May.”

Read more: How To Trade Bitcoin Futures and Options Like a Pro

In addition to the big Bitcoin options expiry today, there are 931,610 Ethereum options contracts expiring on January 26.

These have a notional value of $2.07 billion and a put/call ratio of 0.31. This means that sellers of long or call contracts vastly outnumber those selling short or put contracts, suggesting a bearish outlook for Ethereum among derivatives traders.

Impact on Crypto Markets

Crypto markets have gained 0.5% over the past 24 hours to reach $1.64 trillion. However, the short-term trend is still down as markets continue to correct from their recent mid-cycle rally.

Bitcoin prices had reclaimed $40,100 during the Friday morning Asian trading session. Moreover, the asset hit an intraday low of $39,538 in late trading on January 25.

Ethereum prices were up 0.5% at $2,224 at the time of writing but down 10% over the past week.

Bitcoin selling pressure from Grayscale and miners is keeping the bears in control at the moment. Meanwhile, Celsius is moving large amounts of ETH to exchanges in preparation for distribution to creditors, which is putting downward pressure on Ethereum markets.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

Credit: Source link