Wall Street Journal columnist Bill McGurn and GOP strategist Ford O’Connell discuss the state of the U.S. economy as President Biden touts Bidenomics and his green agenda on ‘The Evening Edit.’

The U.S. economy may not technically be in a recession, but most Americans believe it is.

That’s according to a recent survey conducted by Bankrate, which found 59% of U.S. adults feel like the economy is in a recession, defined by two consecutive quarters of negative growth.

A majority of American adults believe the U.S. economy is in a recession, according to a recent Bankrate survey. (REUTERS/Andrew Kelly/File Photo / Reuters Photos)

Regardless of income, households said they are feeling the pressure at about the same amount. Sixty percent of respondents in the lowest-income households, making under $50,000 a year, said the economy feels like it is in a recession. Of those in higher-income households making more than $100,000 annually, 61% agreed.

Gen Xers, ages 43-58, were the age group most likely to say the U.S. is in a recession at 65%, followed by millenials (ages 27-42) at 60%, baby boomers (ages 59-77) at 58%, and Gen Z (ages 18-26) at 55%.

FED WILL RATHER RISK A RECESSION BEFORE THEY LET INFLATION REBOUND: RONALD KRUSZEWSKI

Households with children younger than 18 were the most likely to say the economy is in a recession at 66%. Sixty-three percent of parents with children aged 18 or older agreed, along with 54% of adults with no kids.

An earlier Bankrate survey gives weight to those feelings, with 50% of Americans saying their overall financial situation has declined since the 2020 presidential election.

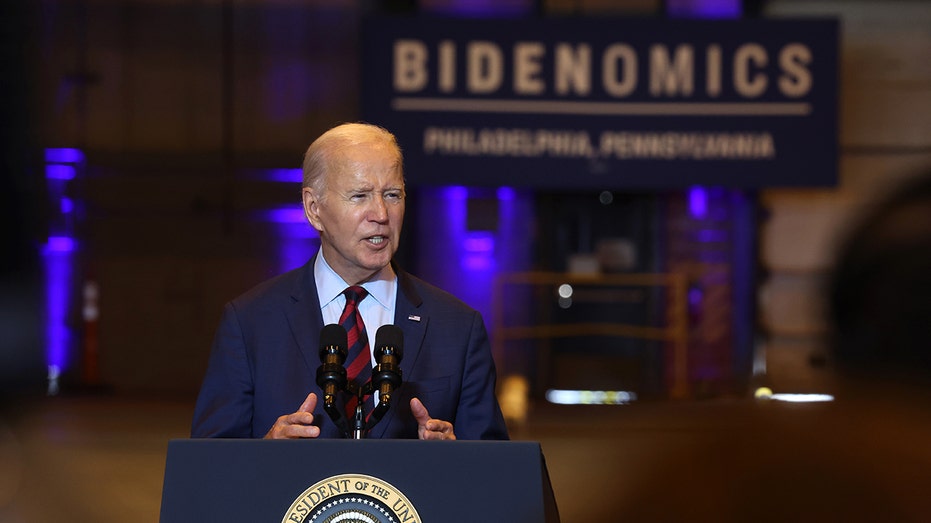

President Biden speaks on renewable energy at the Philly Shipyard July 20, 2023, in Philadelphia, (Spencer Platt/Getty Images / Getty Images)

The latest findings indicated nearly two-thirds of Americans, 66%, say the current economic environment – including factors such as elevated inflation, rising interest rates and changes in income or employment – has negatively impacted their finances this year, and 85% of those who agree the economy is in a recession share that same sentiment.

INFLATION IS NOT TRANSITORY, IT’S ‘PERMANENT’: JIM GRANT

More than three in five adults (64%) told Bankrate they have changed their financial habits this year because of the economic environment, and that jumps to 81% among those who believe the economy is in a recession.

Nearly two-thirds of Americans say the current economic environment has negatively impacted their finances in 2023. (Michael Nagle/Xinhua via Getty Images / Getty Images)

“Americans seem to be evaluating the economy with different metrics than experts,” said Bankrate analyst Sarah Foster. “While economists are watching carefully for broad-based declines in growth, households focus on whether they can afford their needs and the occasional wants while still having enough money left over to put toward key financial goals like saving for emergencies and retirement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“Americans judge the economy’s strength by their own individual experiences living within it, and nationwide numbers often don’t tell the same story as their finances.”

Credit: Source link