Liquid restaking protocols now hold $8.5 billion worth of Ether.

Ethereum’s restaking sector continues to balloon, with the total value locked in liquid restaking tokens tagging new all-time highs.

On April 1, the TVL of liquid restaking token (LRT) protocols jumped 4% to a new high of above $8.5 billion, according to DeFi Llama. The milestone follows sustained growth from top LRT projects, with Renzo leading the charge with weekly growth of 51.4% and a monthly gain of 191% to tag $2.2 billion TVL.

Swell was the second-strongest performing LRT in percentage terms, with 33.5% in seven days and 109% for the month to arrive at $261.1 million. EtherFi, the sector’s largest protocol, also enjoyed 17.5% weekly and 78% monthly growth to post new highs near $3.38 billion.

With EigenLayer, the pioneering Ethereum restaking protocol, currently boasting a TVL of $12.4 billion and sitting 1% below its all-time high, LRTs are sitting at a record high in terms of their overall restaking dominance.

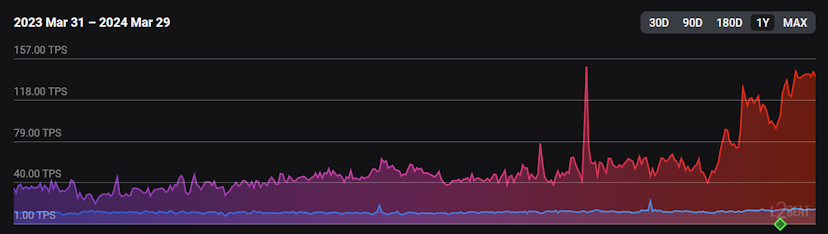

EtherFi’s recently airdropped ETHFI token has also been rallying strong, bucking the down price action typically associated with airdropped tokens. Currently trading at $6.45, although ETHFI is down 24% from its all-time high three days ago, the token is up 55.5% from its opening price on March 18, according to CoinGecko. ETHFI is also up 123% from its all-time low on March 19. While liquid restaking continues to drive activity on Ethereum’s base layer, Layer 2 networks are currently hosting surging volume on decentralized exchanges. Linea, Base, and Arbitrum are all outperforming the Ethereum mainnet by 24-hour throughput, with the networks hosting 30.4 transactions per second (TPS), 25.8 TPS, and 20.4 TPS over the past day compared to 15.1 TPS on Ethereum, according to L2beat. The activity on Base and Linea comprise new all-time highs for the networks, with TPS jumping 73.5% and 68.4% respectively. Combined L2 throughput is currently sitting at more than 10.5 times that of Ethereum’s Layer 1, based on a seven-day moving average. Base is enjoying meteoric growth across the board, with network TVL up 62.7% in seven days at $3.2 billion. The TVL of Base-native DeFi protocols is also at a high of $1.2 billion after jumping 150% since the start of March, according to DeFi Llama. Base’s growth has been propelled by memecoin traders migrating onto the network, with Uniswap tweeting that daily volume for its Base deployment exceeded $1 billion for the first time on March 31. The network’s top memecoin is DEGEN, which is up more than 1,000% in two weeks. DEGEN’s eye-watering gains have been propelled by the token finding new utility as a vehicle for grants funding on Base, in addition to becoming the network token for the project’s newly launched Layer 3 network, Degen Chain. On March 1, Tom Kysar, product manager at Augur, tweeted that Degen Chain had already attracted $60 million in network TVL and was ranked eighth by on-chain volume.

Credit: Source link