Proof of Concept Under MAS’ ‘Project Guardian’ Explores Using DeFi Tools To Efficiently Administer Alternative Assets

Amid the ongoing crypto rally, major financial institutions continue to explore how blockchain technology can make their operations more efficient.

JP Morgan’s Onyx digital assets unit and $500B asset manager Apollo Global have joined forces with the Monetary Authority of Singapore for a proof-of-concept demonstrating how tokenization can streamline and automate portfolio management. The PoC aims to address the historical challenges of trading and administering alternative assets, often seen as operationally intensive and cumbersome to manage within traditional portfolios.

“By leveraging the power of blockchain technology, we have shown how the construction and management of discretionary portfolios could be revolutionized,” said Tyrone Lobban, Head of Onyx Digital Assets, which currently processes billions of dollars in trades on a daily basis.

Onyx leveraged LayerZero, a cross-chain messaging protocol, to connect with a permissioned Avalanche subnet, facilitating subscriptions and redemptions of funds offered by WisdomTree.

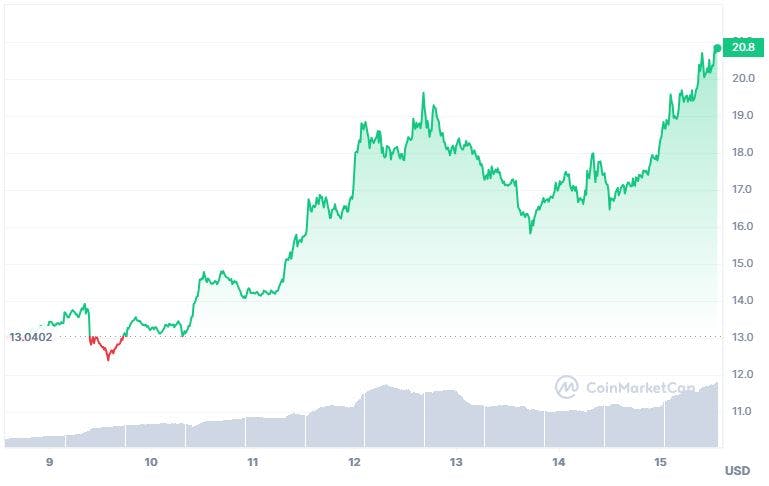

AVAX is up 60% in the past week, making it the best-performing digital asset in the top 20.

The project concluded that tokenization simplifies the management of alternative assets (alts) by replacing manual processes with automated, smart contract-driven operations for payments and investor register updates. This allows wealth managers to more easily include alts in client portfolios.

Additionally, using smart contracts for discretionary portfolios demonstrated the potential for mass, automated rebalancing of numerous portfolios. Interoperability protocols across different blockchain platforms expand the range of investable assets without needing to transfer underlying assets from their original ledgers.

Citi Tests Tokenized Forex

Meanwhile, Citibank has developed a blockchain-based application for pricing and executing bilateral spot foreign exchange (FX) trades.

Start for free

Also developed under MAS’ Project Guardian initiative, the application offers real-time streaming of price quotes and records trade executions on-chain for immutable, secure record-keeping of trade data.

“We are taking steps towards building foundational capabilities to offer liquidity, pricing and risk management to our global clients wherever they choose to trade – be it on traditional rails or on blockchain,” said Sam Hewson, Head of FX Sales at Citi.

Citi collaborated with T Rowe Price and Fidelity International on the project, which uses a private permissioned instance of the Avalanche blockchain. It’s not yet available for clients but has been tested using USDSGD.

Credit: Source link