DEXs Catering To U.S. Users Could Be Classified As Brokers And Required To Implement KYC Procedures

The DeFi community is up in arms over new tax guidance from the U.S. Treasury Department for crypto exchanges, hosted wallet providers, and payment processors.

On Aug. 25, The Treasury Department released a nearly 300-page-long document in response to the 2021 Infrastructure Investment and Jobs Act, which outlined crypto token reporting requirements for various ecosystem participants. The proposed changes are slated to take effect for the 2025 tax year.

The rules make an effort to provide clarity, with definitions for what businesses constitute crypto brokers as well as a new tax form, 1099-DA, that such brokers will be required to file.

Decentralized exchanges (DEXs), NFT trading platforms, and wallet providers that offer services related to the trading of digital assets appear to be deemed brokers, meaning they would be required to comply with the proposed regulations.

The proposed rules impose reporting requirements for brokers of all types of digital assets, including stablecoins, cryptocurrencies, and non-fungible tokens (NFTs). These intermediaries would also be required to collect and share information about their customers with the IRS.

Crypto miners are exempted from the new tax rules.

Community Reactions

The proposed rules have drawn widespread criticism from Industry observers, with analyst Miles Deutscher warning that the new rules might extinguish the DeFi sector in the U.S.

Gabriel Shapiro, general counsel at Delphi Labs, said “…it looks pretty bad.”

If deemed to be brokers, it’s unclear whether and exactly how DEXs like Uniswap, NFT platforms like OpenSea, or wall providers like MetaMask will go about implementing KYC measures to continue serving U.S. customers.

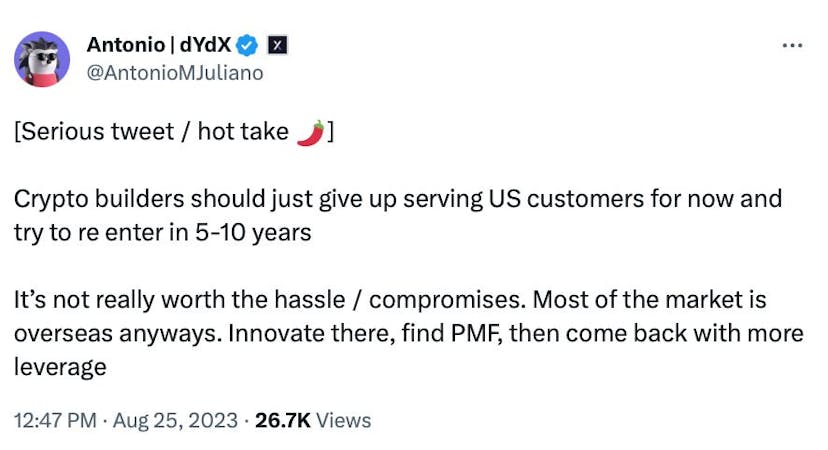

dYdX founder Antonio Juliano suggested that crypto engineers ought to opt out of operating in the U.S. until there is regulatory clarity.

The Treasury Department said that the proposal is part of a broader effort to address tax evasion risks presented by digital assets and ensure equal rules for everyone.

However, until the regulations are finalized and the laws take effect in 2025, potentially affected platforms can continue operating unfettered, according to the IRS.

Credit: Source link