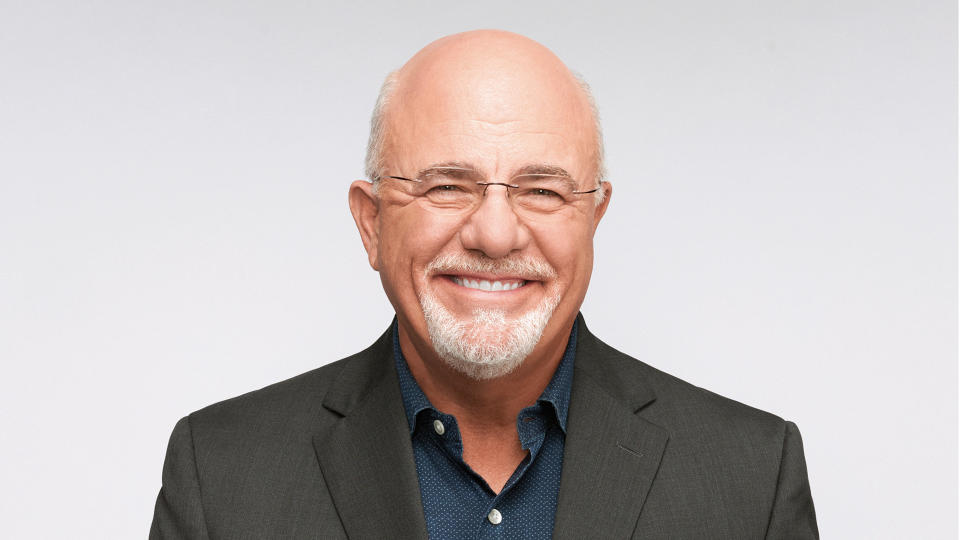

Dave Ramsey is well-known for his direct, plain-speaking approach to personal finance. In an Oct. 24, 2023, podcast episode of “The Ramsey Show,” the host explained how important a person’s relationship with and attitude toward money affects their overall wealth.

I’m a Mechanic: What I Drive and 3 Cars I Steer Clear Of

Find Out: Pocket an Extra $400 a Month With This Simple Hack

One of his specific examples focused on the car-buying process, which is rife with opportunities for people to dig themselves into financial holes.

According to Ramsey, rich people ask, “how much?” but poor people ask “how much down, how much a month?” Here’s a look at exactly what Ramsey means by this and how you can apply the general lesson to your finances.

Sponsored: Owe the IRS $10K or more? Schedule a FREE consultation to see if you qualify for tax relief.

What’s the Difference Between ‘How Much?’ and ‘How Much a Month?’

It’s perfectly understandable how a first-time car buyer might conflate the questions “how much” and “how much a month.” After all, the friendly salesperson at your local car dealer will likely tell you that the car costs the same price regardless of how you pay for it.

But there’s actually a huge difference between the two, and as Ramsey explains, it helps differentiate the buying patterns of rich people and poor people. Rich people can afford to pay the full price of a car in cash upfront, without having to resort to monthly payments. As most poor people don’t have tens of thousands of dollars lying around, they borrow money and make monthly payments.

To help ease the burden as much as possible, poor buyers will often ask, “How much a month?” But here’s how that can be a financial trap.

ChatGPT Unveils: 5 Worst American Cars for Your Money

How Lower Payments Can Increase the Cost of a Car

On one level, it makes logical sense that you should seek the smallest monthly payment possible when it comes to buying a car. But when you do the math, it turns out you’re often increasing the cost of the car, in some cases dramatically. This is because to get a lower payment, you’ll likely have to extend the term of the loan, resulting in more total payments and much more interest. Here’s an example to clarify.

Imagine you’re buying a car with an agreed-upon price of $45,000 (excluding taxes and fees for simplification). If you’re a rich buyer paying cash, the total cost of your car will be $45,000. But if you have to finance your car payment, your total cost will end up being more.

Here are the monthly payments you’ll make on a 6% car loan over 36-month, 48-month, 60-month, 72-month and 84-month terms — with no down payment:

36 months: $1,369

48 months: $1,057

60 months: $870

72 months: $746

84 months: $657

At first glance, it might seem like the best choice to go with the seven-year loan, as it has by far the lowest monthly payments. But if you look at the total cost you’ll pay for that $45,000 car, you might change your mind:

36 months: $49,284

48 months: $50,728

60 months: $52,199

72 months: $53,696

84 months: $55,220

If you decide to go with the seven-year loan with the lowest monthly payments, you’ll end up paying a whopping $10,000 more for that $45,000 car, an increase of more than 22%.

This is the primary point Ramsey is trying to make when he says that you’ll likely stay poor by asking “how much a month.”

While your choice might seem like the more affordable option on the surface, in reality, you’re paying thousands of dollars more than the rich buyer. If you’re already struggling to get by, adding $10,000 to your car purchase will only keep you in the hole longer.

How Smaller Down Payments Can Be Risky

Besides making the price of a car more expensive, a smaller down payment can be a big financial risk. Since new cars depreciate rapidly, the value of your car may fall below the amount you owe on it if you’re only paying a small amount every month. If for some reason you need to sell your vehicle, you’ll have to pay for that privilege. The same is true if you have a serious accident that your insurance company doesn’t cover in full — you’ll have to pay money for the “privilege” of no longer having a vehicle.

Ways To Help If You Can’t Afford To Be a Cash Buyer

Ramsey suggests that if you can’t afford to pay cash for a car, you can’t truly afford it. While he relents in some broadcasts and suggests that putting down a bare minimum of 20% is acceptable, he stresses that you should do your absolute best to save until you can pay for a car in full.

One primary way that Ramsey suggests more Americans can be cash buyers is if they look at used cars instead of new cars. New cars lose 50% or more of their value in their first five years, so you can score some real bargains by looking at cars that are a few years old.

If you’re in a position where you have to finance a car, shop around to get the best interest rate you can. In some cases, you may be able to score a promotion that includes a 0% interest-rate loan, effectively making you a cash buyer who can still spread payments out over time.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: If You’re Asking This Question When Buying a Car, You’ll Likely Stay Poor

Credit: Source link