SUI price recently reached a new all-time high (ATH) earlier this month, driven by a wave of optimism among traders. However, the altcoin has since dropped by 21%, breaking through a key support level and triggering concern.

The altcoin is currently trading below this crucial support, which may challenge its bullish outlook. Despite the downtrend, market sentiment remains cautiously optimistic.

SUI Traders Have Hope

SUI’s macro momentum reflects a deepening bearish trend, highlighted by technical indicators such as the Relative Strength Index (RSI). Currently, at a two-and-a-half-month low, the RSI has dipped below the neutral level of 50, indicating that the altcoin’s price action is weakening. A low RSI following a steady decline often signals a strengthening bearish momentum, which could pressure SUI’s price further.

With the RSI showing consistent downward movement, this metric suggests that SUI may continue its current trend unless a significant shift in the market occurs. A prolonged dip in RSI below 50 may encourage cautious sentiment among traders, potentially affecting short-term demand. Unless SUI finds stronger support, further declines are likely.

Read More: Everything You Need to Know About the Sui Blockchain

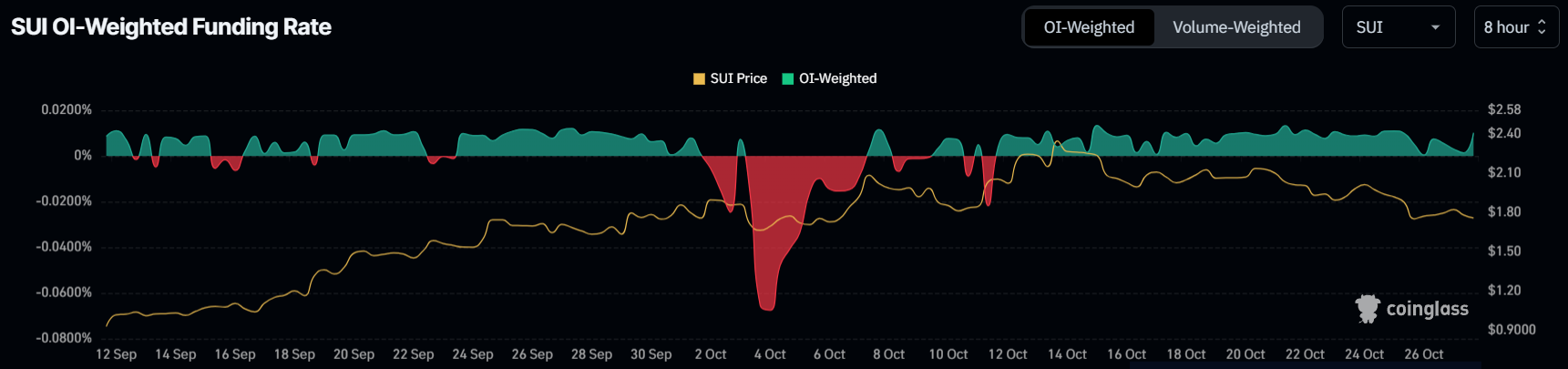

Despite the price drop, SUI’s funding rate remains positive, showing that traders are still hopeful for a recovery. A positive funding rate during a price downtrend often indicates underlying optimism, suggesting that many traders anticipate a potential rebound. This optimism may signal confidence among holders who believe SUI’s long-term value will prevail despite recent volatility.

However, the ongoing price drop challenges this optimistic outlook as traders await signs of stabilization. The positive funding rate reflects a divided sentiment: while the macro momentum leans bearish, some investors hold firm, betting on SUI’s eventual recovery. This cautious optimism could provide stability as the altcoin navigates through its current dip.

SUI Price Prediction: Maintaining the Support

SUI’s price has declined by 21% over the past week after reaching its ATH of $2.36. Given the current bearish cues, further decline could bring SUI down to $1.45, a level that previously acted as support. This would mark a critical point for the altcoin, testing investor sentiment.

While $1.45 has been a pivotal support level in the past, mixed signals from the market suggest that SUI may hover around this price. A potential recovery from this level remains possible, although macro conditions need to improve for sustained growth.

Read More: A Guide to the 10 Best Sui (SUI) Wallets in 2024

If SUI’s price fails to hold at $1.45, the altcoin could fall further to $1.16, marking a more pronounced downturn. This would deepen investor losses, signaling an extended bearish phase that may challenge long-term confidence in SUI.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Credit: Source link