An activist at the offices of Rep. Michelle Park Steel in Cypress, California, on Feb. 24, 2023

Araya Doheny | Getty Images

Social Security is essential to older Americans’ financial security, yet there always seems to be a new headline about how the benefits are at risk.

Douglas Boneparth, a certified financial planner and president and founder of Bone Fide Wealth in New York, said clients ask him how they can prepare for their retirement if Social Security benefits are slashed — or even eliminated.

“We work with a relatively young clientele, and they aren’t too confident today’s system will be the one they inherit when they retire” Boneparth said. “They want to hedge their bets.”

CNBC asked Boneparth, a member of CNBC’s Advisor Council, if he could provide an example of how much more people would need to save if they have to fund their retirement with a smaller Social Security benefit, or none at all.

Workers would need to triple savings

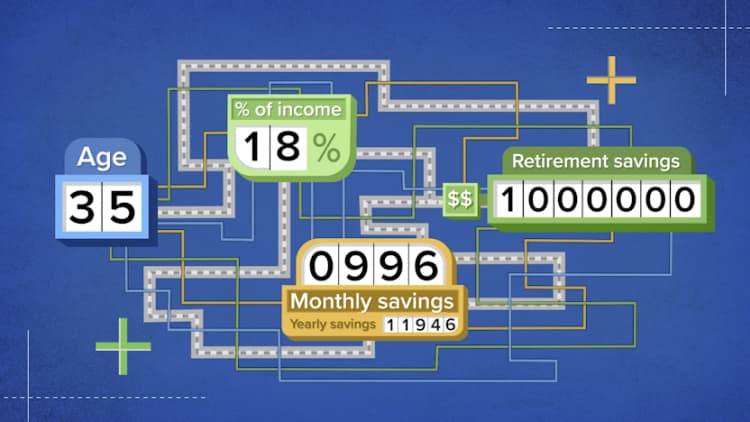

CFP Clifford Cornell, an associate financial advisor at Bone Fide Wealth, provided a scenario of a 30-year-old woman who earns $75,000 a year and already has $20,000 saved for retirement. The woman plans to leave the workforce at age 65 and to spend about $40,000 a year in retirement. Her life expectancy is 90.

In order not to run out of money in retirement, she’d need to save $375 a month in her workplace 401(k) plan — if the Social Security program remains fully in place. Cornell assumed a 6% annual return before retirement and 4% after.

More from Personal Finance:

Biden ESG rule survives challenge in court

IRS to target ‘unscrupulous’ tax preparers amid new crackdown

White House moves ahead with new plan to cancel student debt

The future of Social Security

As a result, without any action from lawmakers, the trust fund that supports Social Security benefits for retirees is estimated to run dry in 2033.

If the trust fund is depleted, it doesn’t mean benefits would go away entirely.

Congress will almost surely tweak Social Security to fix the solvency problem.

It’s likely to be a “last-second compromise” and “there are going to be losers,” said David Blanchett, head of retirement research at PGIM, the asset management arm of Prudential Financial, in September on “This week, your wallet,” an audio program produced by CNBC’s personal finance team.

Older people and current retirees likely won’t see a change to their benefits, Blanchett said. However, “I do believe younger Americans — if you’re maybe in your 40s — should count on a lower benefit,” he said.

— Additional reporting by CNBC’s Greg Iacurci.

Credit: Source link