After experiencing sharp declines in 2022, the capital markets have showcased unparalleled resiliency over the last 20 months or so. Since January 2023, the S&P 500 and Nasdaq Composite have boasted total returns of 48% and 66% respectively (as of the time of this article). While it may be tempting to let the good times roll, savvy investors know that now may be a good time to take some gains off the table and seek more reliable opportunities.

Why is that? Well, September is generally a poor month in the stock market — one that’s hallmarked by hefty selling activity. There are many factors that influence selling stocks toward the end of the year including tax planning or potential changes in monetary policy from the Federal Reserve. However, 2024 carries another variable: the upcoming presidential election. The common theme among these items is that widespread unpredictability pertaining to a number of important topics can result in abnormal levels of selling in the market.

For these reasons, investors might want to consider opting for more predictable opportunities over volatile growth stocks. A good example of this would be to allocate a portion of your portfolio to consistent dividend stocks. Below, I’ll share one ultra-high-yield dividend stock that I think should be on your radar and explain why September could be the perfect time to scoop up shares for this particular player.

This telecom stock sticks out for one big reason

I’ll concede right off the bat that the telecom industry is not nearly as exciting as other opportunities in the technology realm. Telecommunications businesses offer a commoditized set of products and services, ultimately forcing major players to compete for customers with price. This dynamic can take a toll on growth, which often leaves investors uninspired.

However, I see things differently with Verizon (NYSE: VZ) — and history suggests that September could be the perfect time to buy, especially for those seeking some passive income.

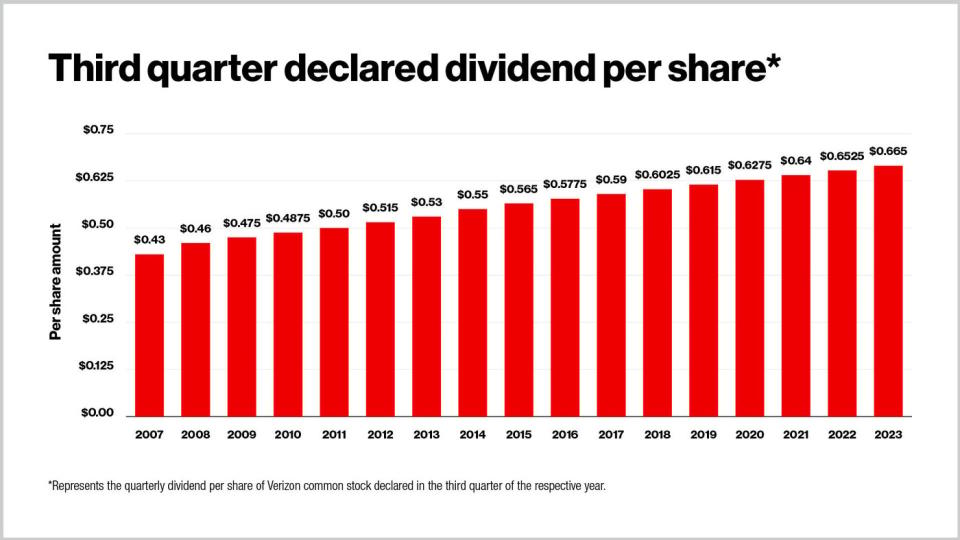

The chart below illustrates that Verizon has raised its dividend for 17 consecutive years. But so what? Many other companies raise their dividends each year.

While that’s true, Verizon tends to announce raises to its quarterly dividend in September.

Why Verizon might raise its dividend again

It’s interesting to identify a pattern regarding the timing of Verizon’s dividend raises. However, smart investors know that historical performance does not guarantee future outcomes. A close assessment of Verizon stock’s recent trading activity combined with a thorough analysis of its financial position will help us determine whether an upcoming dividend raise seems likely or not.

The table below breaks down Verizon’s revenue and free cash flow growth over the last few years. Clearly, there have been some inconsistencies in Verizon’s growth.

Growth Metric (Year-over-Year) | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

Revenue | (3%) | 4% | (2.4%) | (2%) |

Free Cash Flow | 32.4% | (18.3%) | (27%) | 33.1% |

Data Source: Verizon Investor Relations

While the trends above might make you skittish, it’s important to zoom out and look at the bigger picture. The company has consistently generated heaps of cash flow, and even during years when its growth decelerated, it still managed to sustain its dividend and raise it.

Through the first six months of 2024, Verizon has generated a total of $65.8 billion in total revenue. Considering this only represents about a 0.5% increase year over year, you might think the rest of Verizon’s financial profile is equally uninspiring. Yet despite this mundane level of acceleration across the top line, Verizon has done a respectable job growing its profitability. For the six months ended June 30, Verizon generated $8.5 billion in free cash flow — an increase of 6.9% year over year.

In my eyes, Verizon’s dividend looks safe right now.

Should you buy Verizon stock right now?

Right now, Verizon stock boasts an ultra-high dividend yield of 6.2%. By comparison, the SPDR S&P 500 ETF Trust has a dividend yield of just 1.2%. Moreover, Verizon’s forward price to earnings (P/E) multiple of 9.4 lags considerably from the S&P 500’s forward P/E of 22.4. While an upcoming dividend hike is speculation on my end, recent upticks in Verizon shares could suggest that I’m not the only one anticipating the company will continue rewarding shareholders and announce a dividend raise soon.

Historical trends suggest that prolonged hefty market sell-offs could be imminent, so I encourage investors to look for more insulated opportunities. Given Verizon’s consistent ability to generate cash flow, combined with its historical tendency to announce dividend raises in September and its noticeable valuation discount to the broader market, I think now is a great time to pounce and scoop up shares.

Should you invest $1,000 in Verizon Communications right now?

Before you buy stock in Verizon Communications, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Verizon Communications wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $661,779!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 3, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

History Says September May Be The Perfect Time to Pounce On This Ultra-High-Yield Dividend Stock was originally published by The Motley Fool

Credit: Source link