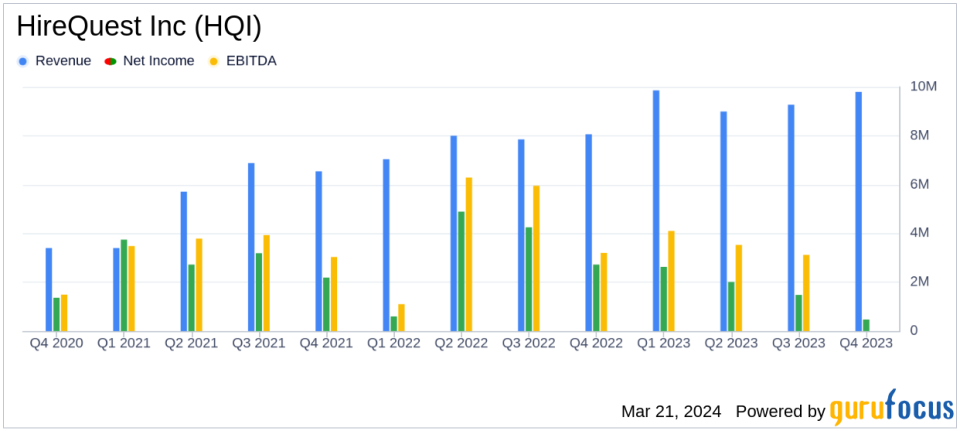

System-wide Sales: Increased to $143.5 million in Q4 and $605.1 million for the full year 2023.

Franchise Royalties: Grew to $8.9 million in Q4, contributing to a yearly total of $35.8 million.

Net Income: Decreased significantly to $467,000 in Q4, with an annual net income of $6.1 million.

Adjusted EBITDA: Remained stable at $4.3 million for Q4, totaling $16.5 million for the year.

Workers’ Compensation Expense: Increased to $1.3 million in Q4, impacting SG&A and profitability.

Dividends: Continued quarterly dividends with a payout of $0.06 per share on March 15, 2024.

On March 21, 2024, HireQuest Inc (NASDAQ:HQI) released its 8-K filing, detailing its financial results for the fourth quarter and the full year ended December 31, 2023. The company, a national franchisor of staffing services, reported an increase in system-wide sales driven by strategic acquisitions, including MRINetwork. However, the company faced increased workers’ compensation expenses, which impacted its profitability.

Company Overview

HireQuest Inc is a nationwide franchisor of offices providing direct-dispatch, executive search, and commercial staffing solutions in various industries. The company operates under multiple trade names and generates revenue primarily through royalty fees from its franchised offices.

Financial Performance and Challenges

The company’s financial performance in 2023 was marked by revenue growth, with system-wide sales reaching $605.1 million for the year, a significant increase from $472.2 million in 2022. This growth was primarily attributed to the acquisition of MRINetwork. However, existing operations saw a general decline in system-wide sales.

Despite the revenue increase, HireQuest faced challenges, particularly with workers’ compensation expenses, which surged to $1.3 million in the fourth quarter, contributing to higher SG&A expenses. President and CEO Rick Hermanns acknowledged these challenges but remained optimistic about the company’s strategic initiatives to mitigate these impacts in 2024.

Financial Achievements and Importance

HireQuest’s financial achievements in 2023 included a 21.3% increase in total revenue for Q4 and a 22.4% increase for the full year. These achievements are significant as they demonstrate the company’s ability to grow its top line through strategic acquisitions, an important aspect of resilience in the competitive business services industry.

Key Financial Metrics

Key metrics from HireQuest’s financial statements include:

“Franchise royalties in the fourth quarter of 2023 were $8.9 million compared to $7.7 million in the prior-year period. Service revenue was $871,000 compared to $378,000 in the prior-year period. Total revenue in the fourth quarter of 2023 was $9.8 million compared to $8.0 million in the year-ago quarter.”

These metrics are crucial as they reflect the company’s core revenue streams and the success of its franchise model. However, the increased SG&A expenses, primarily due to workers’ compensation, highlight the importance of managing operational costs to maintain profitability.

Analysis of Performance

While HireQuest’s revenue growth is commendable, the significant increase in SG&A expenses, particularly workers’ compensation, has led to a substantial decrease in net income from continuing operations, which fell by 82.3% in Q4. This underscores the importance of cost control measures and the potential impact of external economic factors on the company’s bottom line.

The company’s balance sheet remains strong, with total assets of $103.8 million and a working capital of $15.7 million as of December 31, 2023. The decrease in total liabilities from the previous year also indicates a solid financial position.

HireQuest’s commitment to shareholder returns is evident in its continued payment of quarterly dividends, with a total of $0.24 per common share paid in 2023. The company’s capital allocation strategy, focusing on earnings per share over absolute earnings, reflects a disciplined approach to driving long-term shareholder value.

For a more detailed analysis and commentary on HireQuest’s financial results, investors are encouraged to join the conference call scheduled for March 21, 2024, at 4:30 p.m. Eastern time.

In conclusion, HireQuest Inc’s 2023 financial results present a mixed picture of growth and challenges. The company’s strategic acquisitions have driven revenue increases, but profitability has been impacted by higher expenses. Looking ahead, HireQuest’s focus on cost control and strategic growth initiatives positions it to navigate the uncertain economic landscape and continue delivering value to its shareholders.

Explore the complete 8-K earnings release (here) from HireQuest Inc for further details.

This article first appeared on GuruFocus.

Credit: Source link