Summary of key points: –

- The Kiwi dollar displays renewed resilience amidst global volatility

- Fed member’s new “dot-plot” interest rate forecasts scare the horses

- “China risk” levels start to abate

The Kiwi dollar displays renewed resilience amidst global volatility

The NZD/USD exchange rate has had an interesting and volatile journey over this last week, flirting with 0.5900 on the bottom side mid-week, however also testing 0.5985 on the top side on two separate occasions as well.

Despite some global financial/investment market gyrations in currencies, equities and bonds following the Federal Reserve’s “hawkish pause” with interest rate settings on Thursday morning 21st September, the end conclusion is that the Kiwi dollar has remained very resilient in its newly established 0.5900 to 0.6000 trading range.

Until US 10-year Treasury Bond yields stop rising and reverse back downwards to below 4.00% and the US dollar follows the bond yields lower, it is going to be difficult for the NZ dollar to climb back above 0.6000. However, on the other side there does appear to be a reluctance by the speculative currency players to sell the Kiwi dollar below 0.5900. That reluctance to sell has nothing specifically to do with New Zealand or the NZ economy, more a situation of the forex speculators already being heavily “short-sold” the Aussie dollar against the USD and being unwilling to add to those positions at the lower 0.6400 AUD/USD exchange rate level. The longer the period of time that the AUD holds above 0.6400 (currently 0.6450), the greater the probability grows that the AUD punters will take their FX trading profits and buy the AUD back to close down their sold positions. It will require a weakening USD on the global stage to convince these speculators to reverse their positions to go long the AUD.

Fed member’s new “dot-plot” interest rate forecasts scare the horses

Despite the Fed leaving their interest rate unchanged at 5.50% but sending a clear “higher for longer for interest rates in 2024” message to the markets, the US Dollar Index ended last week at 105.28, which was close to the level it started the week. If US inflation and/or employment were showing signs of increasing again due to a stronger US economy, one could understand the US dollar continuing to make advances against other currencies as their interest rates would be staying higher for longer. However, that is not the case, with even the Fed admitting that the US labour market is no longer” robust” and has been softer over the last three months. US core inflation continues to trend sharply lower and there is nothing to suggest that the various services and goods prices that comprise the core inflation measure will be turning upwards again anytime soon. The demand and supply equations in the US economy are now much better back in balance and do not point to increasing demand or reduced supply to force prices upwards again.

The US bond market’s adverse reaction to the Fed statement last week, wherein 10-year bond yields jumped up from 4.30% to a high of 4.50% (now back at 4.43%), appears to be an extreme response by bond speculators to the Fed’s “interest rates higher for longer” message. That message was not really delivered through the Federal Reserve officials/economists on their outlook for the economy. However, the bond selling stemmed from a significant change in the “dot-plot” of personal and individual interest rate forecasts by the 18 members of the Fed’s FOMC committee.

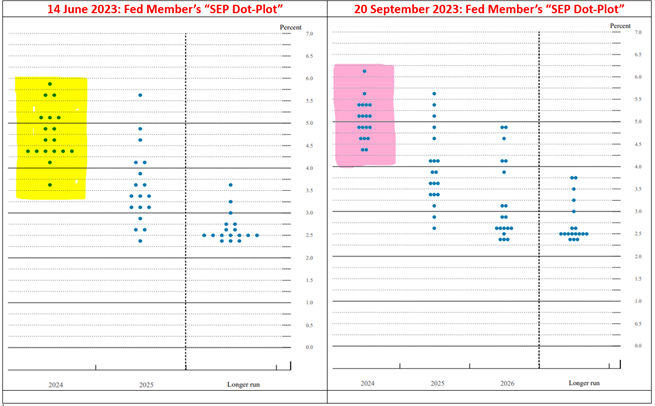

The graphic below compares the “dot plot” forecasts for the Fed funds interest rate in 2024 from the 18 individual Fed committee members on 14 June 2023 and 20 September 2023. Back in June, only six members forecasted the interest rate to be above 5.00% in 2024 (yellow highlight, left-hand side), whereas by last week that number above 5.00% in 2024 had increased to 10 (pink highlight, right-hand side). The additional four member who have changed their minds (these individual forecasts are anonymous) over the last three months and now see US interest rates “higher for longer” in 2024, must now view the US economy as being a lot stronger going forward and that prevents inflation falling further. Alternatively, those four members have changed their forecasts because market interest rates are higher today compared to 14 June and they are just reacting to market pricing! US interest rates are sharply higher due to elevated and concentrated Government debt issuance at this time, nothing to do with inflation and the Fed. Whatever the reason, the only conclusion one can draw is that these Fed committee members are themselves as volatile, changeable, and flaky as the financial markets.

Inflation and jobs data in the US has softened over the last three months, however more Fed members suddenly see the need for interest rates to be higher in 2024 than previously, their new forecasts really do not stand up too well to scrutiny against current economic trends.

The other very worrying aspect of the Fed member’s dot-plot forecasts is the extreme wide disparity between the highest and lowest interest rate forecasts for 2025 (from 2.50% to 5.50%).

It was tellingly instructive that Fed Chair, Jerome Powell constantly repeated the phrase “proceeding carefully” in his media conference last week. It means that he is becoming much more cautious about the need for additional interest rate increases. As always, the Fed’s actions and US interest rate market movements from current levels will be determined by the evolving economic data. Looking ahead, PCE inflation figures for August on Friday 29th September will be another low +0.20% result. Following that, the Non-farm Payrolls jobs data for September on Friday 6th October will be another soft outcome as well, below 150,000 new jobs likely.

In addition to the continuation of softer inflation and employment trends, the following collection of new risks impacting the US economy all point to lower interest rates and a lower USD currency value over coming weeks: –

- Higher gasoline pump prices hitting consumer sentiment and spending.

- The growing auto workers strike negatively impacting auto supply industries.

- Potential US Federal Government shutdown on 30 September being highly disruptive to parts of the economy.

- Sharply higher mortgage interest rates curtailing new home builds.

“China risk” levels start to abate

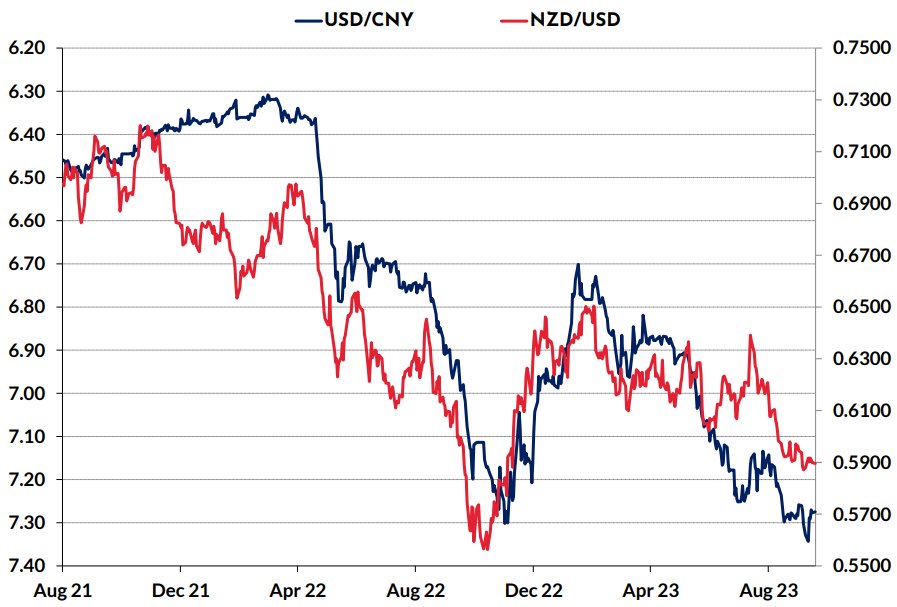

If you really believed all the financial media headlines a month ago that the Chinese economy was about to implode, you would have expected that their Yuan currency value would be plummeting in value as foreign investors pull all their funds out of Chinese markets. However, the Yuan has not depreciated any further over recent weeks, which tells you that the foreign investors who wanted to get out have already done so. The Yuan sell off from 6.7000 to the USD in January to 7.3000 today appears to have run out of momentum, very similar to the plunge to 7.3000 and subsequent reversal in October last year. Through the China/Australia dependency nexus, the NZD/USD exchange rate is directionally correlated to movements in the USD/CNY rate.

Chinese industrial production and retails sales data for August was not as weak as forecast, helping to stabilise the previous negative sentiment and economic trends. It will be mid-October before more meaningful Chinese economic data for the month of September is released, to confirm whether that stabilisation and therefore reduced risk has continued.

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

Credit: Source link