As CEO of Berkshire Hathaway, Warren Buffett has one of the most impressive investing track records on Wall Street. Since taking over the top position at Berkshire in 1965 through 2022, he and his team have delivered a total return of 3,787,464%, crushing the S&P 500 index’s total return of 24,708% — and of course, those results will be still higher by this year’s end.

One quality that makes Buffett a legend in the investing world is his ability to identify high-quality companies with strong competitive advantages that can thrive over long time horizons. When Berkshire finds such a company, it tends to hold on and not let go unless there’s a solid reason to do so.

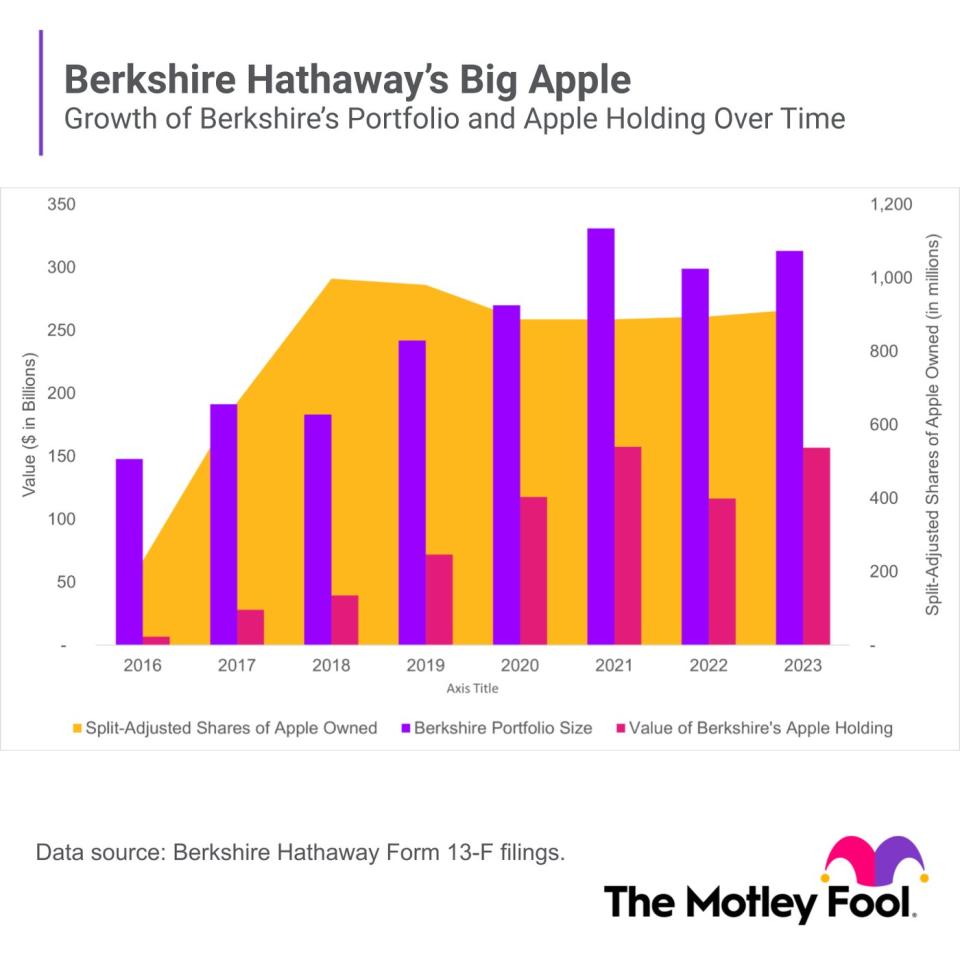

Apple (NASDAQ: AAPL) is one such company. First purchased by Berkshire in 2016, Apple is now the conglomerate’s largest publicly held stock, making up 50% of its $313 billion investment portfolio.

Having one stock make up such a large percentage of a portfolio would make most investors nervous. However, Buffett doesn’t sweat it. Instead, he believes that diversification makes little sense for a company like Berkshire. Here’s why.

Berkshire first bought a stake in Apple in 2016

As amazingly as Berkshire Hathaway has performed, it hasn’t been perfect. For many years, it avoided investing in technology stocks because Buffett said he didn’t like investing in companies he couldn’t understand. This prudence was appropriate in the early days when tech companies spent tons of money innovating but weren’t very profitable. However, winners eventually emerged, creating powerful companies with strong brands.

Apple is one such company with a strong brand, and in the first quarter of 2016, Berkshire finally took the plunge and bought 9.8 million shares of the tech giant. Interestingly, Buffett didn’t make that investment; instead, Berkshire’s portfolio managers Todd Combs and Ted Weschler made the move. After that initial purchase, Apple made up a measly 0.8% of Berkshire’s total holdings.

Over time, Berkshire added more Apple shares, and by the end of 2016, it owned 57 million. Two years later, it owned nearly 250 million. In August of 2020, Apple did a 4-for-1 stock split. Today, Berkshire holds nearly 916 million shares of Apple, which would have been about 229 million before the split.

A growing portion of Berkshire’s portfolio

Berkshire’s position in Apple hasn’t changed much since 2018. In the fourth quarter of 2020 Berkshire trimmed some of its position, selling around 57 million shares, which Buffett later admitted was “probably a mistake.” It’s added a few more to the position over the past few quarters, but the stake remains mostly unchanged.

Instead, Apple’s growing prominence in Berkshire’s portfolio is due to its stellar investment returns. In 2018, Apple stock was 22% of Berkshire’s portfolio. Since the end of 2018, Apple has delivered investors a total return of 423%, crushing the S&P 500’s 104% return over the same period. Today, Apple accounts for half of Berkshire’s entire portfolio even though Berkshire has slightly decreased its holdings:

Here’s why Buffett isn’t worried

Warren Buffett doesn’t worry about concentration risk in Apple stock. In fact, he doesn’t believe diversification is necessary for someone in his position. In Berkshire’s 1993 letter to shareholders, Buffett told investors:

If you are a know-something investor, able to understand business economics and to find five to ten sensibly priced companies that possess important long-term competitive advantages, conventional diversification makes no sense for you. It is apt simply to hurt your results and increase your risk.

Apple has been a quintessential Buffett stock. For one, it has one of the most valuable brands in the world in 2023, according to Interbrand. Strong brands give companies an economic moat, and Apple has one of the most robust competitive advantages globally. This competitive advantage can be seen in its strong gross profit margins, averaging around 40% over the last decade, and its free cash flow, around $100 billion last year.

Because Apple continues to outperform, Buffett and his team at Berkshire haven’t had much reason to sell. Not only that, but Apple makes up a much smaller portion of Berkshire Hathaway’s total assets. Berkshire owns numerous companies privately, including railroad and insurance companies, and it has over $1 trillion in assets on its balance sheet. So, with that perspective, Apple stock is only 15% of Berkshire’s total assets.

Investors can learn from Berkshire’s patience

Berkshire Hathaway’s growing Apple stake offers a valuable lesson about holding on to winning investments. Apple continues firing on all cylinders, delivering strong cash flow and thus strong returns for its shareholders. Because the company continues to perform, Berkshire apparently doesn’t feel it needs to sell off its stake. Also, Berkshire doesn’t need the cash — it’s sitting on $149 billion, the largest cash stockpile in its history.

Berkshire holds an aggressive stake in Apple because it can. However, as individual investors we may not want to make the same decision. There are valid reasons to trim a position. Perhaps a single stock dominates your portfolio and it keeps you up at night. Or you might want to free up cash for an upcoming large purchase you plan to make.

We may not operate on the same level as Berkshire. But regardless of portfolio size, the importance of patience and of letting winners run remains a valuable lesson.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 11, 2023

Courtney Carlsen has positions in Apple. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Half of Warren Buffett’s $313 Billion Berkshire Hathaway Portfolio is Invested in This 1 Stock. Here’s Why He’s Not Too Concerned About Concentration Risk. was originally published by The Motley Fool

Credit: Source link