In the wake of the COVID pandemic, global health is finally getting on the radar of asset managers of large equity and investment funds – as an option for promoting social responsibility objectives among investor clientele.

At a Geneva Graduate Institute session Wednesday on Investors and Civil Society Working Together, two path-finding institutions – one a for-profit equity fund and the other a foundation – described the new territory that they are charting in collaborations and partnerships that funnel private sector assets into companies and strategies supporting health.

“Innovative finance as a topic in Global Health Geneva, and more broadly, is a kind of holy grail at the moment because so many international organizations and Product Development Partnerships are suffering from a withdrawal of funding from governments, which are under budget pressures. So the creation of instruments to bring money into global health,” can make a big difference, said Nadya Wells, a senior research advisor at the Global Health Center, which sponsored the discussion.

“We know in the retail investment space, meaning all of us as individuals, there is a huge desire to contribute to improving outcomes, but we don’t really have the way as an individual to find a way in. So maybe if we can come together, we can have these avenues and instruments created,” said Wells.

Investing in healthier sustainable food production

With yawning needs for more equitable and sustainable public health investments, from nutrition to medicines, civil society and private sector actors have taken a page from the playbook of the climate and sustainability movement, to find creative new ways of working together.

The aim is to promote investments that can still make money – while prioritizing longer term social benefits over short-term profits, said Maria Ortino of Legal and General Investment Management (LGIM), one of the world’s largest asset management firms and part of a larger conglomerate managing over $1 trillion in assets.

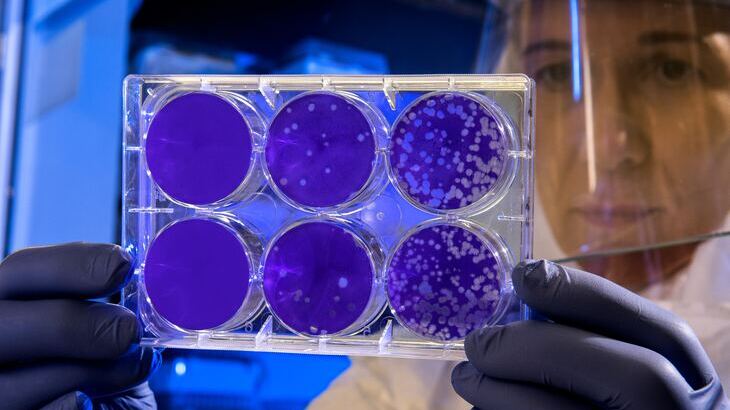

Ortino heads LGIM’s health team in its department of Environmental, Social and Governance (ESG) stewardship. The team is charting a course towards more responsible investment in two areas that they have identified as “systemic” risks to global health – antimicrobial resistance and nutrition.

“What do I mean by systemic risks, it’s risks that cause a breakdown or impairment of the financial system and negatively impacts the real economy,” she said.

The aim is both to promote healthier nutrition as well as reducing risks of antimicrobial resistance (AMR) from overuse of antibiotics and other antimicrobial agents – particularly in livestock.

“AMR in 2019 caused 1.27 million deaths on a global level,” she noted, referring to a Lancet study, published in 2022. A WHO study published in early 2023, estimated that some 4.9 million deaths annually are somehow associated with AMR. “The cost of not taking action on AMR, according to the World Bank, is an impact that’s equivalent to that of the 2008 financial crisis – so a decrease of global GDP of 3.8%.”

As for nutrition, “we look at the interconnected challenges of obesity, undernutrition and micronutrient deficiencies. Their costs in surveys have been estimated to equal $US 3.5 trillion on an annual basis. Looking just at OECD countries, the [attributable] health cost expenditures to those individual countries. is around 8%. And that is why we look at these two risks.”

Long term investment horizon

The long-term horizon is particularly appealing to large institutional investors such as pension funds, which have a long-term outlook anyway, and can mobilize millions to more socially responsible strategies, Ortino stressed.

“Our clients have a long term time horizon, for example, pension funds. The fast return on investment, they’re not interested. You can say we are accepting that in the short term, it [a new policy] might likely, or will likely, have a long-term cost to the investments that we are making. But we are looking at long-term results.”

So when such clients signal their interest in supporting public health objectives as part of a socially responsible investment portfolio, the health team swings into action.

And insofar as LGIM is invested in almost every publicly listed company in the world, “we see it as a concern for us when certain behaviors are not or not in consistent with what we would be expecting,” she added.

“The reason for that is the financial implication, in the long term, for the investment.”

Using shareholder and bondholder levers with McDonald’s

The most obvious way to wield influence is voting of large blocks of shares or bonds at investment meetings on shareholder resolutions calling for corporate policy reforms. But the vote at the annual shareholder meeting is usually the outcome of a much longer process, she explained.

“We engage in dialogue with the companies in which we are investors. We speak publicly on our concerns that are related to these two areas, we seek policy changes at a national or international level,” she said.

As one example, the LGIM has used its investment clout with the fast-food multinational McDonald’s to support shareholder resolutions seeking disclosures on its AMR stewardship in its meat production and supply chain.

It’s estimated that some 70% of global antimicrobial use is in animals – not humans – where the misuse and overuse of such agents contributes to AMR, undermining their effectiveness in human healthcare. Cleaning up practices in flagship companies like McDonald’s, the largest US beef purchaser and one of the largest in the world, can therefore provide an example to others.

“We have supported all of those resolutions and been public that we do support them – to make it clear to the companies in which we are invested that we’re looking ,” Ortino said. “We have also engaged in a one-on-one dialogue with McDonald’s raising concerns over AMR and wanting to see change.

“And last year, we co-filed a shareholder resolution that will seek McDonald’s to require the entire supply chain to apply the WHO guidelines on the use of medically important antimicrobials in food-producing animals.

“So in a sense, we are using the WHO guidelines to put pressure on the companies in which we are invested,” said Ortino, who in May 2023, published a blog on the LGIM company website: “McDonald’s can do more to tackle the growing threat of AMR.”

Leveraging investor clout for healthier foods

With regards to healthier nutrition goals, LGIM has collaborated with the Access to Nutrition Initiative and the Share Actions Healthy Markets Initiative to hold conversations with big food – including the world’s 20 largest food and beverage corporations – in which its shareholders are all invested as well.

“What we are seeking from these conversations is disclosures on nutrition in their product portfolio. How they evaluate the full product portfolio and how that product portfolio looks when it comes to healthy foods.

“There are different types of [healthy food] models that have been government approved, and we encourage strongly encourage the companies to all use these models and disclose them so that we as investors, and the public. can actually see how their entire product portfolio looks like when it comes to health, health, healthiness or lack thereof.

“We also look at the marketing policies that they have when it comes to marketing to children at various level and as well as the kind of targets that they are setting internally to increase the level of healthiness of the foods that they are marketing.”

Persuasion and voting leverage are two key levers that social responsible investors can use to promote change when they are managing “index funds” that is funds that their clients wish to hold onto, no matter what, for the long term.

Selling stock holdings – or threatening to do so – is another lever that equity managers can leverage when they are managing “active funds” – that is funds that can be bought or sold if corporate managers fail to respond to other forms of pressure.

Ultimately, both forms of pressure can be useful in different settings, she noted.

In the case of index funds, “it also means that we maintain our seat at the table with the company and so we can continue to put pressure on the company to make those changes rather than selling it and another investor just picks up those shares,” Ortino said.

I would say all these levers have their use. But when we are an eternal shareholder, we say, ok, we will sit at the table and continue banging on it. We see that as a great advantage rather than saying that we will sell and somebody else will buy them.”

Need more global health engagement officials in asset firms

“Global asset managers are increasingly focused on the ‘S’ in ESG, that is social responsibility goals as part of their environment, social and governance engagements,” noted Wells. But not so many of them have engagement professionals with a specific focus on global health.

“But not so many have engagement professionals with a specific focus on global health challenges. This is something we have been calling for, including in research from 2018 which we did in collaboration with WHO, and which was published in The BMJ.

“We would like to see more people like Maria with this specific mandate. But coalition building is also a way to grow the impact. Thus our call for building a community of practice around this topic and crowdsourcing a toolkit for stakeholders to use in further coalition-building.

Adds Ortino, “from an AMR perspective, I think we are where climate change was 10 years ago. We are a few investors that are looking at, or focusing efforts or research on this, which is better than zero. And I’m hoping that we will have the same trajectory as climate change. You can’t speak to any asset manager big or small, that doesn’t have at least one person who is dedicated to climate change.

“I would hope that we will see that in 3-5 years when it comes to AMR.”

Coalition-building amongst investors – and monitoring corporate performance

The Access to Medicines Foundation offers another model for engagement with the private sector – but from the civil society side of the room.

“If we can compare a pharma company to a large tech company, we can see that tech companies generally love to go on about how their products are also enhancing people’s lives, said Bram Wagner, investment engagement officer with Foundation. Based in The Netherlands, it is funded by the United Kingdom and Dutch governments, the Bill and Melinda Gates Foundation, other charities and AXA Investment managers .

“And as society and as investors we demand that tech firms take their corporate responsibility in terms of climate change in terms of their supply chains, and also how they treat their employees. But the affordability and accessibility of their products is not necessarily a demand that we make.

“For pharma companies, selling a product that can literally give you the ability to live comes with different ethical considerations than selling a phone or a laptop.

“And fortunately, many pharma companies and also many investors are already recognizing this.

“But access to medicine is a complex and multifaceted issue. And there are many stakeholders involved…In order to get these companies to move, it is essential to get all stakeholders on board including investors. It has to be a collective effort.

Access to Medicines Index

The Access to Medicines Index which systematically ranks performance of the 20 leading pharma companies worldwide, was one of the first tools created by the Foundation to leverage action, nearly 20 years ago.

“It involves ranking companies in line with their efforts to do more for access and for people living in LMICs. We assess the performance of companies, but also benchmark them against each other and against the industry averages,” Wagner said..

“And importantly for investors it also contains report cards, which are report cards that have real company-specific analysis but also concrete opportunities for companies to improve their efforts.”

But we are much more than just a research organization that publishes reports. We have the expertise and also the convening power to bring different stakeholders together.

We identify specific opportunities for companies to improve. We are building consensus for making changes…. We then track their progress and we also make sure to highlight best practices so other companies can learn from them. And by engaging them directly with the companies. We’re also improving buy-in at the CEO and board level of these companies to solve access issues.

Empowering investor coalitions

One key element of the Foundation’s formula involves collaborations with the internal access teams of pharma companies – to empower those teams to promote access strategies that are naturally well-tailored to the firm in question.

“We’re also influencing companies indirectly by engaging with other stakeholders such as global health organizations, governments and investors.”

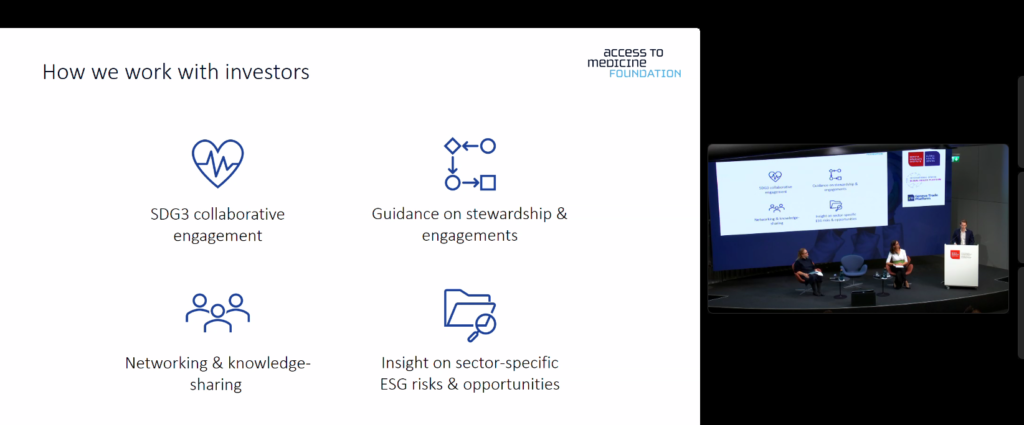

In terms of investors, the Foundation’s signatory base has grown to 138 large investment houses, which together manage some $US 22 trillion of assets.

“And this is in the form of a coalition of investors that has a clear objective to move pharma companies towards the achievement of the United Nations Sustainable Development Goal 3, which is to ensure healthy lives for all people.

“We empower investors to do that by supporting them in their preparations for engagements and also their voting practices.”

“So when we are empowering internal access teams at pharma companies to drive change, a discussion that is then subsequently taking place in a boardroom can really tip things the other way if shareholders have a voice – they find the issue is important and they want it to be managed effectively.

He underlines that in order for an investor to successfully engage with a company on access issues, “they do need to understand the issue at hand and they do need to understand the company’s specific situation. They can’t just simply declare that things need to change.”

As a result, the Foundation’s interventions, however disruptive, may also be appreciated by pharma management which might otherwise “get frustrated when shareholders are engaging them on issues that they don’t quite understand or they are not accounting for the company’s specific circumstances,” Wagner said.

“So the investor engagement team takes our technical knowledge from our independent research, and we present it to investors in a way that is useful and relevant for them. We do this for example, in investor briefings, which are sessions that we organize for our signatories, where we do a real deep dive into the performance of a company and opportunities that we have identified for them.

Benefits for investors as well

And this has benefits for the investors as well – facilitating cooperation that is particularly important in the case of access to medicines, where systemic change is required to have real meaning.

Finally, the foundation’s investor briefings, consultations as well as the company report cards complement investors’ own internal resources and expertise.

“We enable investors to pool their resources together, and ‘take turns’ as to who is physically engaging with what company,” said Wagner..

“Imagine you are an investor and you’re holding 100, maybe 1000 companies. How are you going to prioritize? And how are you going to choose which company to which companies to engage? And how do you familiarize yourself with the issue at hand? Our coalition does exactly that by focusing on the most dominant and influential companies when it comes to access to medicines and in LMICs.”

Image Credits: International Federation of Red Cross and Red Crescent Societies / The Kenya Red Cross Society, Van Boeckel et al, Ortino/LGIM, Scott Warman/ Unsplash, Getty Images .

Combat the infodemic in health information and support health policy reporting from the global South. Our growing network of journalists in Africa, Asia, Geneva and New York connect the dots between regional realities and the big global debates, with evidence-based, open access news and analysis. To make a personal or organisational contribution click here on PayPal.

Credit: Source link