- Investors waited for more clues on the Fed’s policy outlook in the US inflation report.

- Business data suggested Britain’s economy was more resilient than feared in December.

- Data on Friday revealed a mixed picture of the US economy.

Monday witnessed a bearish GBP/USD outlook, influenced by a stronger dollar, as investors breathed for additional insights into the Fed’s policy stance through the US inflation report. This crucial report keeps investors from risk assets, supporting the dollar. Moreover, investors are still absorbing data released Friday in the US and the UK.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Business data suggested Britain’s economy was more resilient than feared in December. The UK’s construction sector showed a possible recovery from a decline caused by a surge in interest rates to a 15-year high of 5.25% in August. Notably, the S&P Global/CIPS UK construction Purchasing Managers’ Index for December rose to 46.8 from November’s 45.5. However, it remained below the 50.0 growth threshold for a fourth consecutive month.

Additionally, data from mortgage lender Halifax revealed an annual rise in British house prices in December. It is the first in eight months, indicating stabilization in the property market. As a result, traders reduced their expectations of BoE rate cuts. Currently, they anticipate around 120 basis points of cuts in 2024, compared to the 140 bps expected on Thursday.

Meanwhile, in the US, employment came in higher than expected while the unemployment rate fell. However, the US services sector weakened significantly last month, showing a mixed picture of the US economy.

GBP/USD key events today

Investors do not expect any key events today from the US or The UK. As such, they will continue absorbing Friday’s reports.

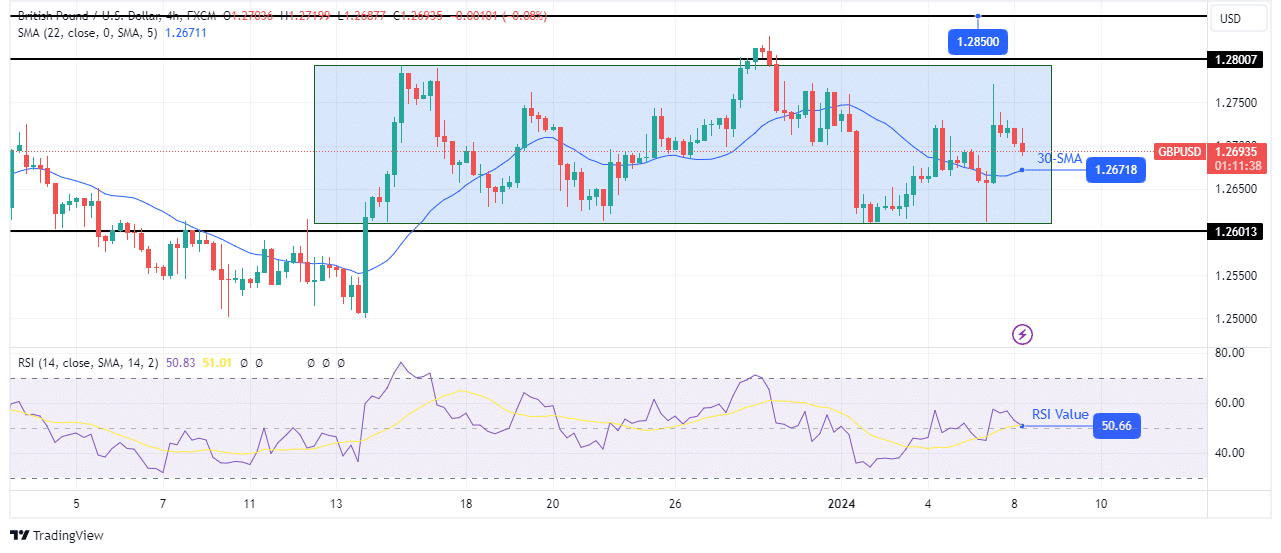

GBP/USD technical outlook: Bulls take the lead within a range

On the technical side, the pair oscillates between the 1.2800 resistance and the 1.2601 support levels, with no clear direction. However, bulls are ahead inside the range as the price sits above the 30-SMA. Moreover, the price made an engulfing bullish candle after breaking above and retesting the 30-SMA. This indicates strong bullish momentum that might propel the price to retest the range resistance near the 1.2800 level.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

Still, the pair will likely continue in its sideways move until either bears or bulls break out of the range. A bullish trend will emerge if the price pushes above the 1.2800 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Credit: Source link