Ford Motor Company (NYSE: F) just released its fourth-quarter sales data for investors to chew on before the company releases its fourth-quarter and full-year 2023 results later this month. The good news is that the company posted a record quarter for electric vehicle (EV) sales, but the bad news is that means billions of losses in the near term.

Here’s why it’s still a positive development for Ford investors.

Devil in the details

Ford’s 2023 U.S. sales jumped 7.1% to nearly 2 million vehicles, led by strength in its F-Series full-size trucks, commercial vehicles, and a record year with electric vehicles.

Let’s start with the company’s most important product, the truck that hauls profits for the folks at the Blue Oval. Ford’s F-Series was America’s best-selling truck for the 47th consecutive year and the best-selling vehicle for the 42nd consecutive year. In fairness, it’s a title Ford will likely continue to hold, as its prime competitor, General Motors, arguably splits some of its sales between two brands of trucks, the Chevrolet Silverado and the GMC Sierra.

What’s encouraging for investors is that the F-150 Lightning was the No. 1-selling electric truck and the F-150 Hybrid the No. 1-selling full-size hybrid truck for the full year. It’s important for investors to see that Ford’s strength in full-size gasoline-powered trucks can transition to EVs, because full-size trucks are a critical component for a fatter bottom line.

Speaking of EVs…

That’s a nice transition to another critical component of Ford’s fourth-quarter and full-year sales: electric vehicles. Ford’s EVs posted record fourth-quarter sales to drive a record full year. More specifically, the Detroit icon sold nearly 26,000 EVs during the fourth quarter, up 24% compared to the third quarter, to help drive an 18% gain for the full year.

Much of Ford’s EV sales gain was driven by the previously mentioned F-150 Lightning, which recorded a 74% sales increase compared to the prior year’s fourth quarter, and a 55% increase for the full year. Between the F-150 Lightning, Mustang Mach-E, and the E-Transit, Ford secured America’s No. 2 EV brand for 2023.

The bad news

Here’s the kicker about Ford’s record EV sales: The company is still burning cash on each EV that rolls off its production line. In fact, Ford previously estimated its EV business unit, Model e, would lose roughly $4.5 billion in 2023.

Management believes Ford will bring costs down enough and accelerate production to churn profits from its Model e unit by the end of 2026, but for now a record quarter in EV sales also means a less lucrative full-year earnings result.

But as they say, the night is darkest just before dawn. Ford has to achieve these quarterly records for EV sales in order to reduce overhead and costs eventually and reach profitability. Essentially, quarterly record EV sales means short-term pain for long-term gains.

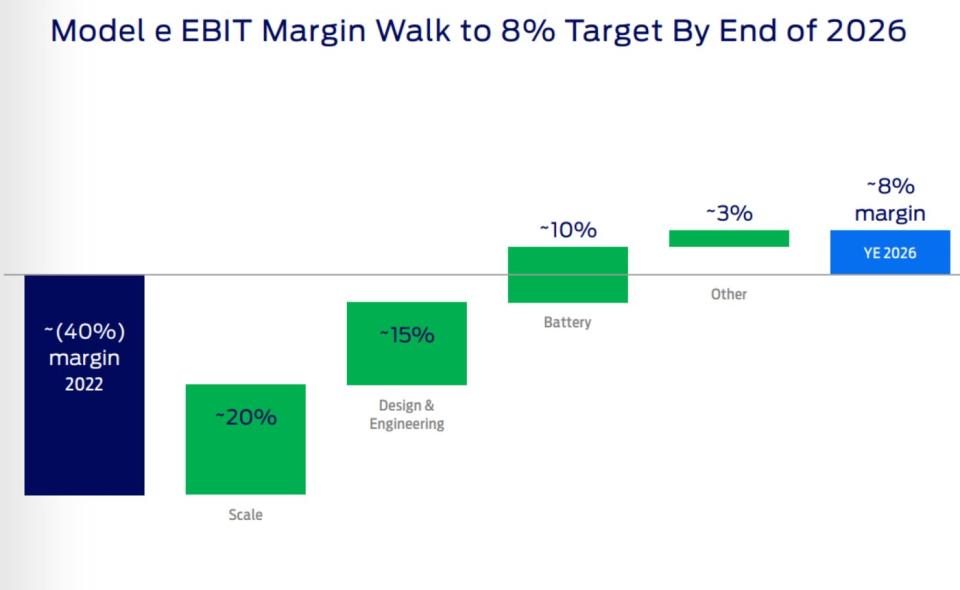

On Ford’s presentation for its pathway to 8% EBIT margins by the end of 2026, the biggest chunk of margin gains will come from scaling production/sales, with the rest coming from a combination of design and engineering, as well as lower battery costs.

What’s next?

Ford closed the 2023 chapter with a little sales momentum, but management believes the company is still poised for growth in 2024, driven by its strength in full-size trucks and SUVs. In fact, Ford will unleash new F-150s, Rangers, Explorers, and Expeditions, as well as Lincoln Aviators, Navigators, and Nautilus.

Most importantly, even though headlines will tout Ford’s large losses with EVs currently, Ford needs to keep posting record EV sales to reach profitability sooner rather than later.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Ford Just Lost Billions of Dollars on EVs. Here’s Why That’s Good News. was originally published by The Motley Fool

Credit: Source link