Investor Insight

Given its quick transition from ASX listing to gold production in just three years, and a significant exploration upside at its world-class assets in Western Australia’s prolific goldfields, Auric Mining is well-worth a good deal of consideration for sophisticated investors.

Overview

Auric Mining Limited (ASX:AWJ) is a gold exploration and mining company based in Western Australia. In three-and-a-half years since its ASX listing, Auric has become a gold producer in this premier jurisdiction.

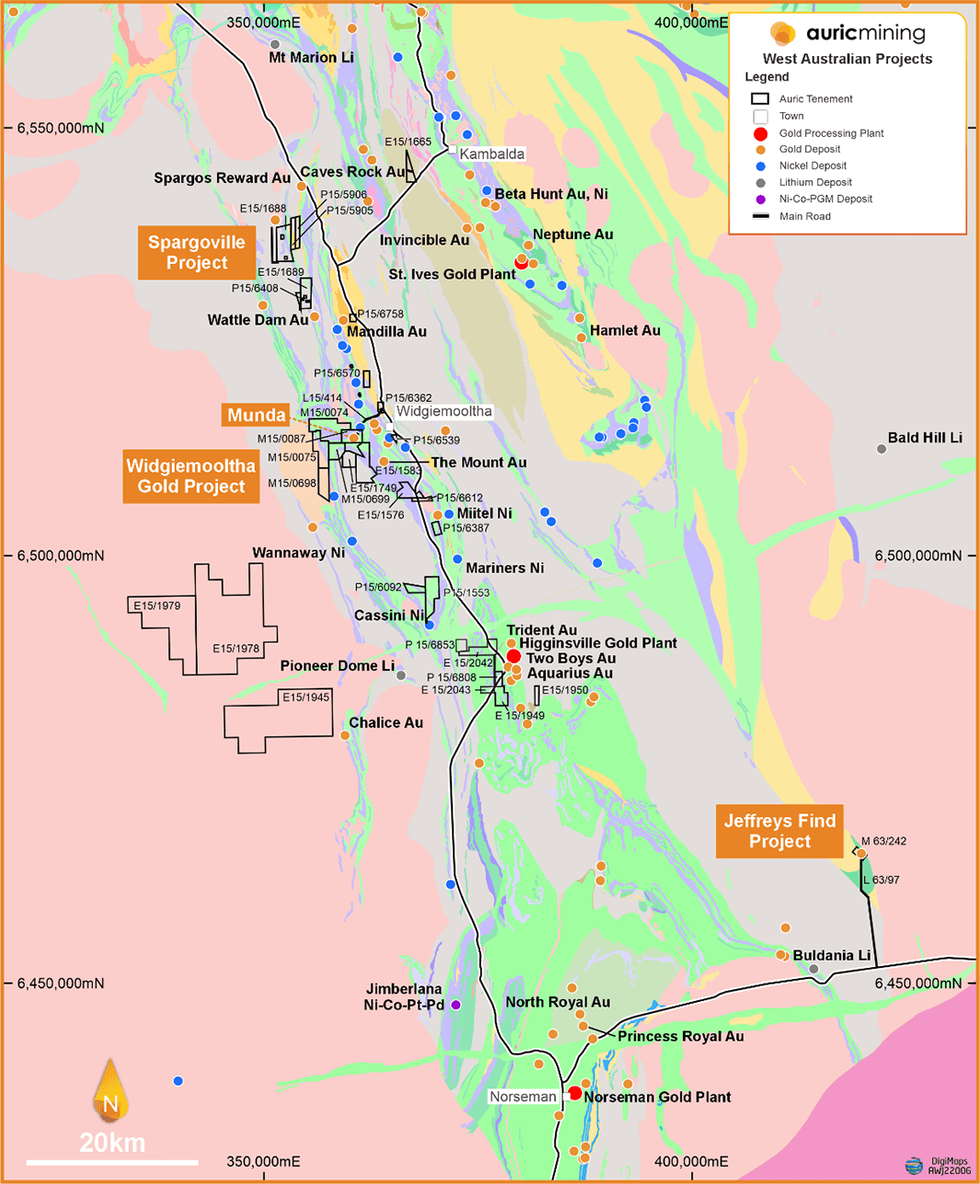

Since incorporation, it has moved from zero to 250,000 ounces of gold resources and zero to 282 square kilometers of tenements. Auric Mining is in the company of some of the biggest gold projects in the Goldfields, including the St Ives Gold Mine, Karora Resources’ Higginsville Operations & Beta Hunt Mine, all multi-million-ounce mines.

Besides gold, there are numerous precious metals being mined in the area with world-class deposits of nickel, lithium and rare earths. Auric is gold-focused and has the potential to become a significant producer in the region.

The Jeffreys Find Pit as of 16 July 2024

Partnering with Auric in its Jeffreys Find Project is BML Ventures of Kalgoorlie (BML), a well-known and adept Kalgoorlie contractor. BML is a specialist mining contractor. It has particular expertise in shallow, open-pit mining with short duration projects in The Goldfields.

The Jeffreys Find Project commenced in May 2023 and is due for completion in the first quarter of 2025. The joint venture is partially exploiting 47,000 ounces of gold resources.

Gold ore on the ROM Pad at Jeffreys Find, Norseman. Ore was hauled to Coolgardie for milling in 2023.

Stage One is now complete and Auric has commenced its second gold milling campaign for 2024 of 150,000 dry metric tonnes from the Jeffreys Find gold mine on 24 July 2024.

Success for Auric at Jeffreys Find means the company is self-funding for 2024 and able to sustain its exploration and development activity without need for additional capital raising. Auric now has a road map for five years of continuous mining and profits.

Grade control drilling at Munda was completed in January 2024

Auric’s primary focus continues to be on the company’s flagship asset – The Munda Gold Project.

To date almost 200,000 ounces of gold resources have been identified at Munda, the asset being part of the wider Widgiemooltha Gold Project, encompassing 22 tenements.

Munda is one of the largest deposits in the Widgiemooltha area having the potential to become a significant gold project.

In mid-year 2023 the company released to the ASX a third-party scoping study on the economics and potential of open-pit mining at Munda.

The scoping study estimates the mining of up to 120,000 ounces of gold over a three-year mine life. It is envisaged gold ore would be toll-processed at a nearby Coolgardie Mill. The study projects free cash profits of between $50 million and $100 million, based on various gold prices.

Production from Munda could commence in the fourth quarter of 2024.

Auric also announced the execution of a binding term sheet for the partial purchase of Win Metals’ nickel and lithium rights within the Munda gold project area including seven tenements or applications. Auric further plans to mine a trial pit at Munda Gold potentially in Q1 2025.

Auric is also planning to progress its Spargoville Project, where it has tenements ideally positioned along strike from the Wattle Dam gold mine, a prolific mine which produced 268,000 ounces of gold at 10 g/t, between 2006 and 2013.

An experienced and savvy management team leads Auric Mining towards its vision of becoming a significant gold producer in Western Australia. With the three directors owning approximately 17 percent of the company, they are focused and motivated for success.

Auric Mining’s board of directors: Mark English, Managing Director; Steve Morris, Chair; and John Utley, Technical Director

Steve Morris, non-executive chairman, has more than 25 years of experience in financial and natural resources markets.

Mark English, managing director, has a 40-year career as a chartered accountant and is at ease with all facets of running a public company on the ASX including major equity and debt raisings.

John Utley, technical director, has 35 years of experience in gold exploration and development.

This range of expertise offers a high level of confidence that the company will achieve its goals.

Company Highlights

- Auric Mining is a publicly listed company with a market cap of around $13m.

- Its flagship asset is the 200,000-ounce Munda Gold Project at Widgiemooltha, just 100 kms from Kalgoorlie. It has an aim to begin production in 2024 before more intensive mining from 2025 onwards.

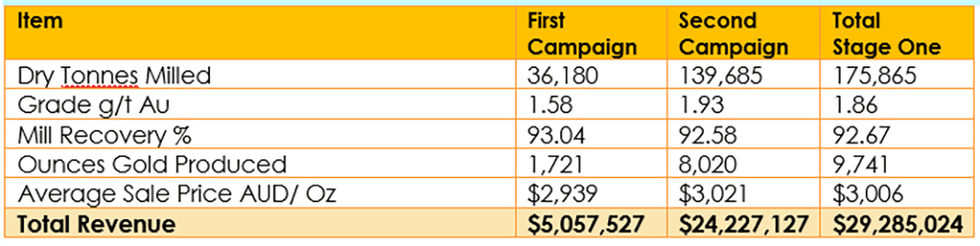

- During 2023 the focus was on mining at its Jeffreys Find Gold Mine, near Norseman. Stage One mining between May and November 2023 produced 9,741 ounces of gold, creating almost $30 million in gross revenue.

- A final reconciliation saw surplus cash of $9.5 million generated. Auric banked $4.78 million, being 50% of the surplus cash as agreed with its JV partner, BML Ventures of Kalgoorlie.

- Auric has commenced the second gold milling campaign for 2024 of 150,000 dry metric tonnes from the Jeffreys Find gold mine.

- The company executed a binding term for the partial purchase of Win Metals’ nickel and lithium rights within the Munda Gold Project area further improving the pathway to mining a trial pit at Munda gold project, potentially in Q1 2025.

- As an explorer, Auric has accumulated 282 square kilometers of tenure as it looks to find and mine a million ounces of gold between Kalgoorlie and Norseman.

- The area hosts some of the richest mineral deposits and mines in the world. In addition to gold, Auric also has opportunities for discovery of lithium, rare earths and nickel.

- Auric has three main projects: The Munda Gold Project which is part of the Widgiemooltha Gold Project; Jeffreys Find Gold Mine; The Spargoville Project.

- The company has a board and leadership team with a track record of delivering success for shareholders, particularly in discovering and bringing to production gold projects.

Auric’s tenements are between Norseman and Kambalda in Western Australia.

Key Projects

Widgiemooltha Gold Project & Munda Gold Project

Progression to open-pit mining is gathering momentum with a plan to commence gold production via a starter pit in the last quarter of 2024 at the Munda Gold Project.

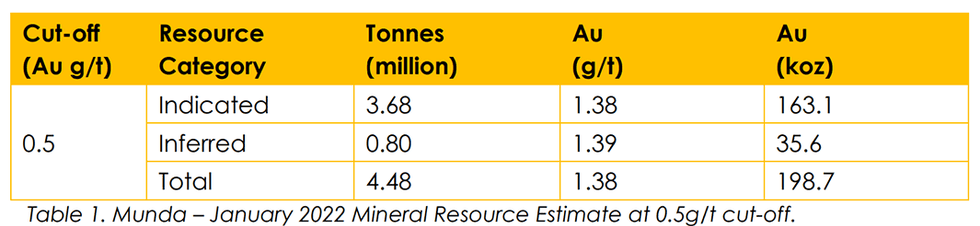

The Widgiemooltha Gold Project combines 22 tenements of highly prospective gold country near Widgiemooltha and includes the Munda Gold Project. Since acquiring the Munda tenements, drilling results confirm indicated and inferred gold resources of almost 200,000 ounces (4.48 mt @ 1.38 g/t with 0.5 g cut off).

The Widgiemooltha tenements have substantial coverage at the north end of the Widgiemooltha Dome.

Even with the extensive mining history in the area, considerable exploration prospectivity remains. Several significant gold projects discovered or developed in the past ten years, including:

- Karora Resources (TSX:KRR); Higginsville Gold Operations (resources of 38.08 Mt @ 1.7 g/t for 2,015,000oz Au);

- Karora Resources; Beta Hunt (resources of 29.32Mt at 2.5g/t for 2,403,000oz Au); and

- Astral Resources (ASX:AAR); Mandilla Project (resources of 30.0Mt @ 1.1g/t for 1,030,000oz Au).

Auric Mining is now fast-tracking development at Munda. With a number of gold processing mills in the vicinity, the move to production is now gathering momentum.

In mid-2023 a Scoping Study on Munda produced a positive result. The study proposed a shallow open gold mine. At gold prices from $2,400/oz to $2,800/oz, the Production Target for the Project ranges from approximately:

- 1.67Mt at 2.2g/t producing 112.0koz gold, to

- 2.18Mt at 1.9g/t producing 129.1koz gold.

The Production Target generates an undiscounted accumulated cash surplus after payment of all working capital costs, but excluding pre-mining capital requirements, of between approximately $54.7m to $101.4m.

Mining is contemplated over an approximately 3-year period (13 calendar quarters).

Pre-mining capital and start-up costs are estimated to be approximately $0.8m to $1.7m.

Working capital requirements of approximately $3.9m to $8.1m were estimated based on a Stage 1 starter pit design.

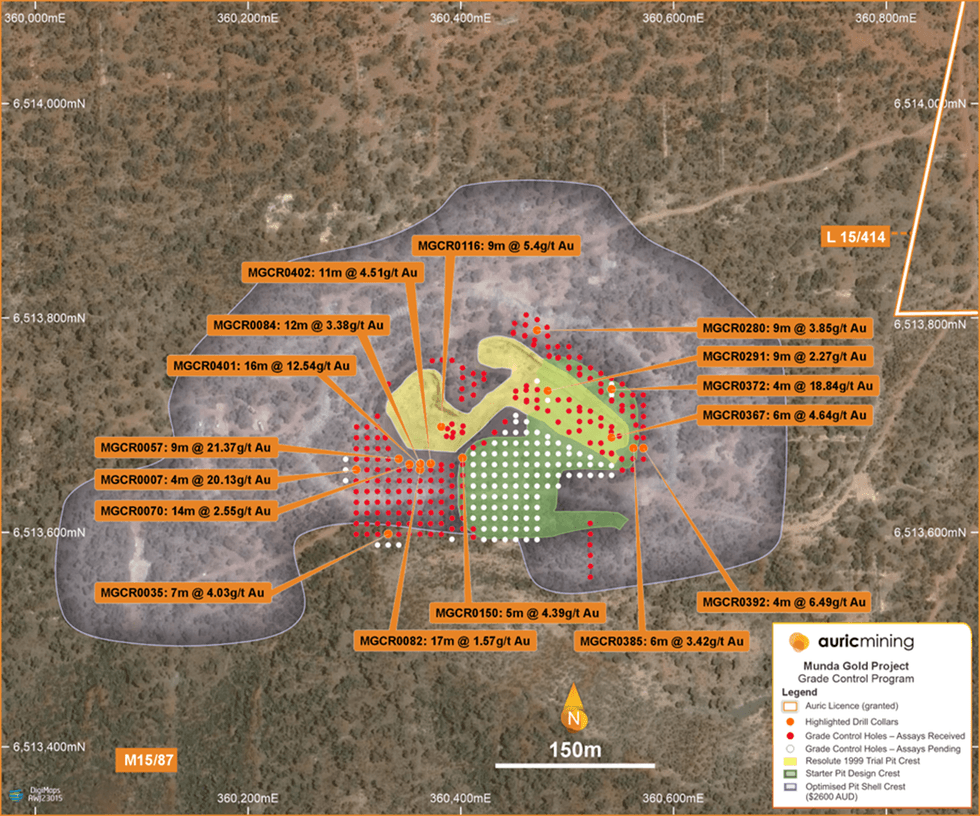

Grade Control Program results at Munda.

To further advance the project, Auric completed a grade control drilling program at Munda in January 2024. In total 351 holes were sunk on a 10m x 10m grid over a potential starter pit.

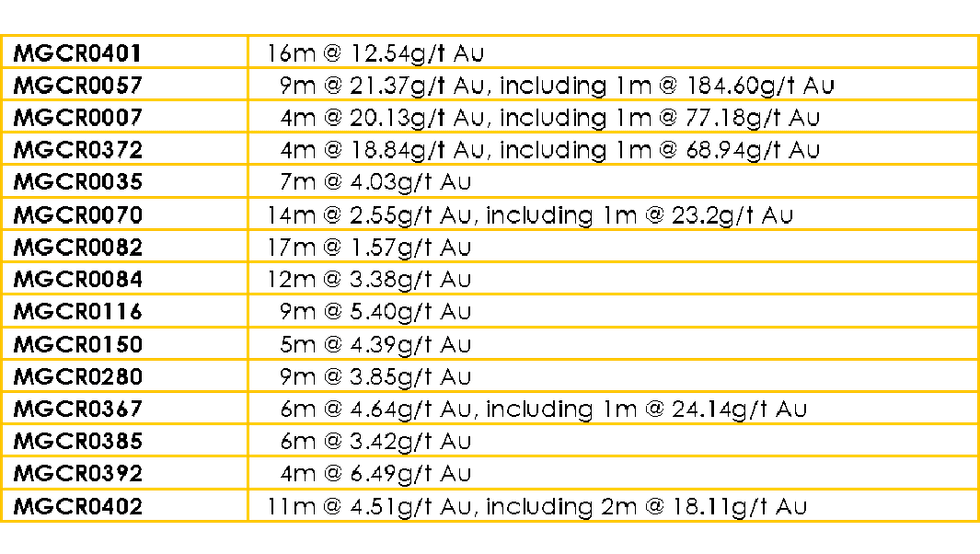

Assay results include numerous significant intercepts at a 0.5g/t cut-off with high grade or broad intercepts such as:

Further grade control drilling is envisaged as the company hones in on this high grade deposit.

A starter pit lasting about three months is envisaged in the last quarter of 2024. More intensive mining would follow in the period 2025-2027.

In all, Munda is projected to be a short-life project, able to produce exceptional cash profits with a gold price continuing at above $3000 an ounce.

Jeffreys Find Gold Mine

Fresh from mining almost 10,000 ounces of gold in 2023, Jeffreys Find’s Stage Two is certain to be significantly greater in scope.

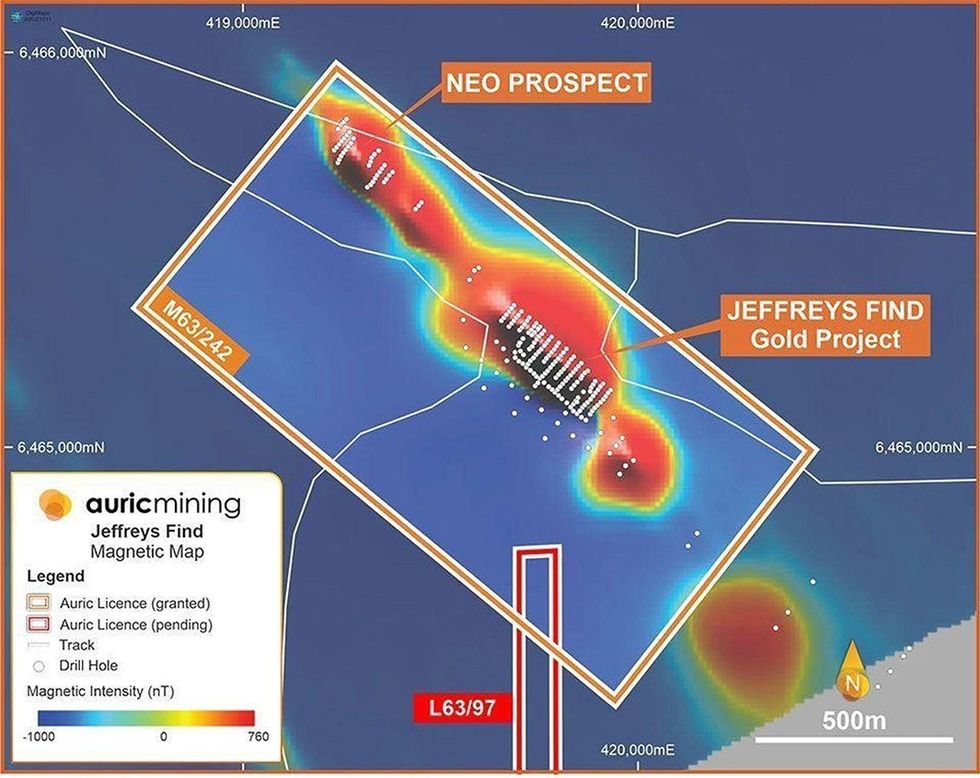

The Jeffreys Find Gold Mine is located approximately 45 kilometers northeast of the town of Norseman and 12 kilometers off the main Eyre Highway via a haul road.

Jeffreys Find is a short-life mine with a total gold-resources estimate of nearly 50,000 ounces.

Magnetic image of the gold resource at Jeffreys Find

The company has performed remarkably well with this mine, having acquired the tenements just 3.5 years ago.

Stage One mining took place over six months, from May to November 2023 with about 175,000 tonnes of gold ore hauled to the Greenfelds Mill at Coolgardie where it was processed. Final refining and sale of gold bullion produced took place at the Perth Mint.

Stage One – Production & Revenue Statistics

The project is a joint venture undertaking between Auric and well-known Kalgoorlie contractor BML Ventures Pty Ltd (BML).

Auric’s risk is mitigated by BML who assume all operating costs including mining and haulage. Gold processing costs are recovered from the sale of gold bullion. After all costs have been deducted surplus cash is split equally between the partners.

For final mining in 2024 Auric has contributed $1 million in cash towards working capital which will be repaid towards the end of the final phase of mining.

The final pit shell at Jeffreys Find Gold Mine will be premised on a gold price of $2,900 an ounce, compared to the Stage One pit which was designed on the basis of gold at $2,600 an ounce. As a result the tonnage of ore being hauled to the mill will be substantially higher in 2024.

Equipment is being mobilised to the mine site in February and mining will recommence in March 2024. A continuing higher gold price has placed the joint venture in a solid position to throw off surplus cash well in excess of what was achieved in 2023.

Auric’s MD Mark English, Chairman Steve Morris and Technical Director John Utley at the Perth Mint with Auric gold bars from its Jeffreys Find Gold Mine.

Spargoville Project

Highly prospective tenements as company looks for gold on strike to Wattle Dam

Located approximately 35 kilometers southwest of the mining town Kambalda, the Spargoville Project is an underexplored asset with partially tested or entirely untested gold, nickel and lithium anomalies.

The asset sits north of the Wattle Dam gold mine. The Wattle Dam gold mine produced 268,000 oz of gold at an average grade of 10 g/t between 2006 and 2013.

While only partially drilled, initial exploration results from the Fugitive Prospect include an intercept at 14 meters with a grade of 2.51 g/t gold, indicating the asset’s promising potential.

Auric’s tenements at The Spargoville Project.

Management Team

Auric Mining’s Management and Board of Directors have a wealth of experience in gold discovery, in mine operations and across the full spectrum of finance and administration. That experience stretches to all parts of the globe.

Board of Directors

Steven Morris – Non-executive Chairman

Steve Morris is a well-known financial markets executive with more than two decades experience at a senior level. He garnered industry respect as head of private clients for Patersons Securities, now Canaccord Genuity, and has also been managing director of Intersuisse. Mr. Morris has served as a senior executive of the Little Group. From 2014 to 2019, Morris was a non-executive director of De Grey Mining (ASX:DEG), a gold company now with a $2.4 billion market capitalization. Mr. Morris is well connected in finance circles and was a board member of The Melbourne Football Club for nine years including three years as the vice chairman.

Mark English – Managing Director

Mark English is a Chartered Accountant with more than 40 years’ experience in business. English was the founding director of Bullion Minerals Ltd, now DevEX Resources (ASX:DEV) a company he managed for seven years before taking it to an IPO. Mr. English has considerable experience with major equity and debt raisings. He currently sits on the Board of WA integrated agricultural company Moora Citrus Group, one of the nation’s largest citrus producers and processors.

John Utley – Technical Director

John Utley has a 35-year career in mining and exploration with a dominant focus on gold assets. He holds a master’s degree in Earth sciences from the University of Waikato in New Zealand. Mr Utley has worked in Australia, South America, Papua New Guinea and most recently in Canada where he was the Chief Geologist for Atlantic Gold Corporation, a company now owned by St Barbara (ASX:SBM). He spearheaded exploration and development of the Touquoy Gold Mine in Nova Scotia, Canada, prior to being acquired by St Barbara. Mr Utley previously worked with Plutonic Resources (ASX:PLU) and was head of the exploration team at the Darlot Gold Mine during the discovery and development of the 2.3-million-ounce Centenary gold deposit.

Credit: Source link