What GAO Found

The Department of Education is designing and testing a new model to estimate future costs of the William D. Ford Federal Direct Loan (Direct Loan) program, which provides financial assistance to students and their parents for postsecondary education. Education aims to begin using the model with the President’s fiscal year 2028 budget. Education officials said the new model is being designed to better reflect the complexity of both borrower behavior and the Direct Loan program. Decisions about data, analytical design, technology, and staffing will influence the model’s long-term operation and the quality of future cost estimates.

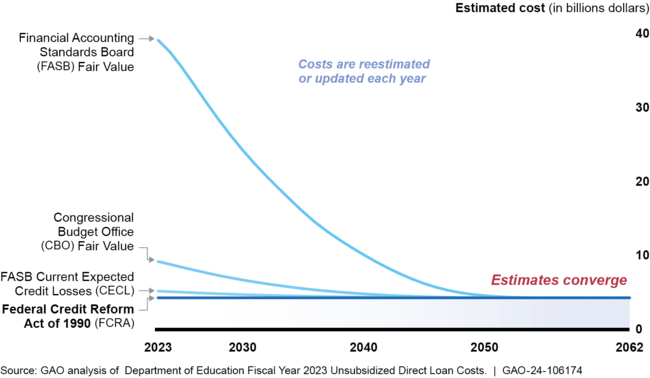

Education is required to develop cost estimates for the President’s budget in accordance with the Federal Credit Reform Act of 1990 (FCRA). FCRA reflects Education’s borrowing from the Department of the Treasury to finance lending. GAO compared FCRA with three federal and private sector alternative approaches that could be used to develop cost estimates. These approaches were the Congressional Budget Office fair value (federal), Financial Accounting Standards Board (FASB) Current Expected Credit Losses (private sector), and FASB fair value (private sector).

These four approaches do not affect the eventual budgetary costs over time but do result in different initial cost estimates. Estimated initial costs under the non-FCRA approaches will generally be higher than what is initially estimated under FCRA due to a variety of factors, such as the addition of market risk and other risks. Regardless of the approach used, how well an agency is able to predict future cash flows is fundamental to calculating reliable cost estimates.

Illustration of Overall Budgetary Cost Estimates for a Group of Direct Loans Converging over Time as Costs are Updated

Note: The graphic assumes that actual cash flows will equal estimated cash flows over time.

Education publishes information about the Direct Loan program’s performance and risks that is generally consistent with guidance, but there are areas where the department could enhance its reporting by expanding the sensitivity analysis to cover a wider range of economic circumstances. Such information is particularly important given the size and complexity of the Direct Loan program.

Why GAO Did This Study

Over the last 3 decades, the Direct Loan program has grown in size and complexity, with over $1.3 trillion in outstanding loans as of September 2023. This program provides financial assistance to help students and their parents pay for postsecondary education. GAO was asked to review issues related to Education’s Direct Loan program cost estimates.

This report examines (1) the status of Education’s planned model for estimating Direct Loan costs; (2) how certain federal and private sector estimation approaches would affect Direct Loan budgetary costs over time; and (3) the extent to which Education provides key information about the performance and risks of the Direct Loan program.

GAO reviewed documentation on Education’s current student loan model and plans for its new model. GAO analyzed the potential budgetary impact over time of four approaches for estimating the cost of a selected group of loans. GAO identified relevant reports, reviewed reporting guidance for federal loan programs, and interviewed officials from Education, other agency officials, and stakeholders with relevant expertise.

Credit: Source link