Franklin Resources Inc (NYSE:BEN), a global investment management organization operating as Franklin Templeton, recently witnessed a significant insider sell by EVP, Head of Global Operations, Alok Sethi. On December 14, 2023, Sethi sold 22,000 shares of the company, a move that has caught the attention of investors and market analysts alike.

Who is Alok Sethi at Franklin Resources Inc?

Alok Sethi has been a key figure at Franklin Resources Inc, serving as the Executive Vice President and Head of Global Operations. His role at the company involves overseeing the operational aspects of Franklin Templeton’s global investment management services. Sethi’s experience and leadership have been instrumental in the company’s efforts to streamline operations and enhance the efficiency of service delivery to clients worldwide.

Franklin Resources Inc’s Business Description

Franklin Resources Inc, known as Franklin Templeton, is a premier investment management firm that offers a wide range of financial services including mutual funds, asset management, and retirement plans. With a history dating back to 1947, the company has grown into a global entity, managing investments across various asset classes such as equity, fixed income, alternative investments, and multi-asset solutions. Franklin Templeton is known for its disciplined approach to investment and commitment to delivering exceptional value to its clients.

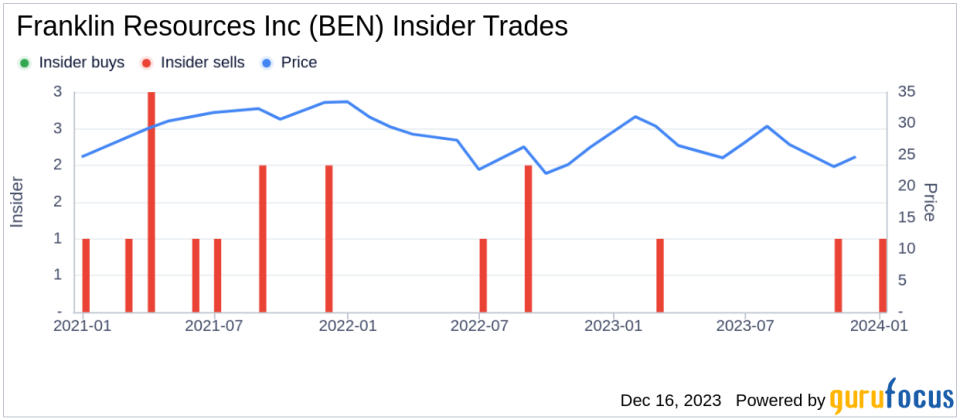

Analysis of Insider Buy/Sell and Relationship with Stock Price

The insider transaction history for Franklin Resources Inc reveals a pattern of more insider sells than buys over the past year. Specifically, Alok Sethi has sold a total of 76,503 shares and has not made any purchases. This could be interpreted in several ways; insiders might sell shares for personal financial needs, diversification, or because they believe the stock may not have much upside potential in the near term.The absence of insider buys could suggest that insiders are not seeing the stock as undervalued or that they are not expecting significant price appreciation. However, it is important to note that insider selling does not always indicate a lack of confidence in the company. Insiders might have various reasons for selling that do not necessarily reflect their outlook on the company’s future performance.

The insider trend image above provides a visual representation of the insider transactions, highlighting the recent sell by Alok Sethi.

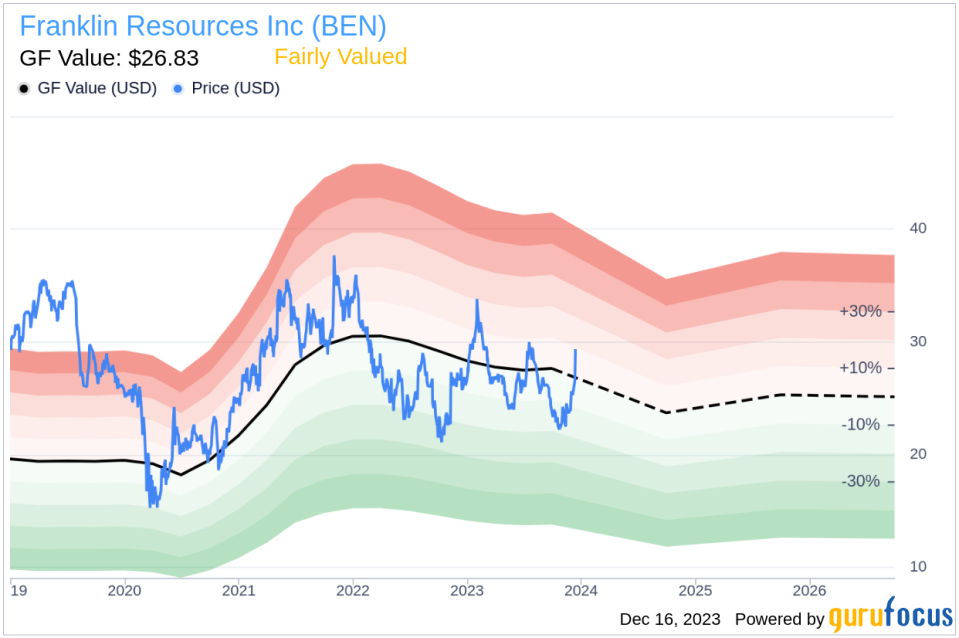

Valuation and Market Reaction

On the day of Sethi’s sell, Franklin Resources Inc’s shares were trading at $29.27, giving the company a market cap of $14.54 billion. The price-earnings ratio stood at 17.09, which is higher than the industry median of 13.33 and also above the company’s historical median price-earnings ratio. This indicates that the stock is trading at a premium compared to its peers and its own historical valuation.The price-to-GF-Value ratio of 1.09 suggests that Franklin Resources Inc is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The GF Value image above provides insight into how the stock is currently valued in relation to its estimated intrinsic value.

Conclusion

The recent insider sell by Alok Sethi at Franklin Resources Inc is a significant event that warrants attention from investors. While the company is currently deemed Fairly Valued according to the GF Value, the insider selling trend, particularly by Sethi, may raise questions about the stock’s potential for near-term growth. Investors should consider the broader context of the market, the company’s performance, and other insider activities when evaluating the implications of this insider sell. As always, it is crucial to conduct thorough research and consider multiple factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link