Buy the rumor; sell the news. You’ve probably heard that old saying before, and maybe you’ve fallen victim to a sell-off that typically occurs after a rumor-based hype phase passes. Today, a similar event occurred with Marathon Digital Holdings (NASDAQ:MARA) stock. In hindsight, it feels like stock traders should have seen this coming. This may just be the beginning of a much deeper drawdown, so I am bearish on MARA stock.

I’m actually bullish on crypto and Bitcoin (BTC-USD) for the long term. Bitcoin hasn’t even reached its all-time high yet, so there may be more room to run in the next year or two.

This doesn’t mean you have to buy every Bitcoin mining stock right now. As we’ll discover, Marathon Digital Holdings is a highly-active cryptocurrency miner, so that’s part of the bullish argument for MARA stock. Nevertheless, after an eyebrow-raising hype phase in crypto-related assets, it’s time for stock traders to take a sobering look at Marathon Digital.

Marathon Digital and the Crypto Event of the Year

If a rising tide lifts all boats, then 2023’s rising tide of crypto hype definitely lifted Marathon Digital Holdings stock. If you can believe it, MARA stock catapulted from $4 to $24 dollars last year.

This share price performance certainly wasn’t based on Marathon Digital’s earnings growth. In fact, the company is unprofitable and doesn’t have a good track record of quarterly EPS beats.

Could MARA stock’s stunning rally be due to Marathon Digital’s aggressive Bitcoin mining pace? I’ll admit that the company has kept up a fast production pace, having mined 12,852 Bitcoins last year. Furthermore, Marathon Digital Holdings CEO Fred Thiel expects the company to “target 30% growth in energized hash rate in 2024” and “reach 50 exahashes in the next 18 to 24 months.”

That’s ambitious, but it hardly justifies last year’s moonshot in MARA stock. The reality of the situation is that Bitcoin’s rising tide lifted all crypto-stock boats in 2023 as the media chatter got louder about an anticipated spot Bitcoin exchange-traded fund (ETF).

It’s no exaggeration to call this the biggest cryptocurrency market event of the year and maybe even the decade. For years, the U.S. Securities and Exchange Commission (SEC) refused to approve any applications for a spot Bitcoin ETF. A couple of days ago, there was a hack and a false alarm, but the SEC still hadn’t approved a Bitcoin ETF.

Finally, the SEC announced yesterday that it had approved the launch of 11 spot Bitcoin ETFs. It’s a big deal because now, a slew of pension plans, retirement accounts, and institutional funds can more easily (albeit indirectly) invest money in Bitcoin.

MARA Stock Pops and Drops

Today’s initial reaction from the financial markets was positive, as you might have expected. After all, this is a historic event. Yet, oftentimes, the first move is the wrong one, and this concept seems to have applied to MARA stock today.

Marathon Digital Holdings stock closed yesterday at $25.62 and quickly gapped up this morning to a peak of $29.18. That pop was short-lived, though, as the stock dropped to $22 and change, finishing the day 12.6% lower.

This isn’t exactly an instance of “Buy the rumor; sell the news.” It’s more like, “Buy the rumor; sell the fact.” Day after day, rumors had swirled in 2023 and early 2024 about the SEC’s inevitable Bitcoin-ETF approval – the timing of it, how many ETFs would be approved, and so on.

These topics reached the front pages of the financial media, and there was no shortage of chatter on social media. Bitcoin jumped to more than $46,000, and the percentage gain in MARA stock far outpaced Bitcoin’s gain during this time.

That’s the problem, though. Marathon Digital Holdings stock got ahead of itself, especially compared to Bitcoin’s rise. Besides, the market is highly efficient and already priced in the anticipated Bitcoin ETF approvals; that’s the “buy the rumor” phase in action.

Now, it appears that the “sell the fact” phase has commenced. It could easily accelerate since retail traders’ stop-loss sell orders are probably being triggered. Moreover, MARA stock is particularly vulnerable since it recently went parabolic.

Is MARA Stock a Buy, According to Analysts?

On TipRanks, MARA comes in as a Hold based on two Buys, three Holds, and one Sell rating assigned by analysts in the past three months. The average Marathon Digital Holdings price target is $14.58, implying 34.9% upside potential.

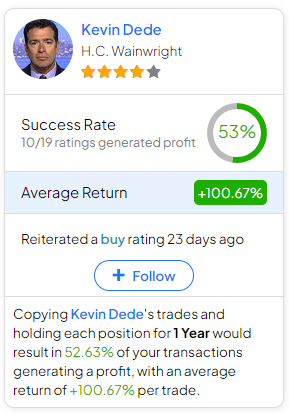

If you’re wondering which analyst you should follow if you want to buy and sell MARA stock, the most profitable analyst covering the stock (on a one-year timeframe) is Kevin Dede of H.C. Wainwright, with an average return of 100.67% per rating and a 53% success rate. Click on the image below to learn more.

Conclusion: Should You Consider MARA Stock?

Frankly, Marathon Digital Holdings stock is too hot to handle right now. It’s volatile and could jump or dump from here.

Plus, while Marathon Digital is an active and ambitious crypto miner, last year’s rally in MARA stock had little to do with the company’s actual value. Therefore, I anticipate more volatility and share price losses, and I’m definitely not considering a position in Marathon Digital Holdings.

Disclosure

Credit: Source link