Dan Preston, a Director at Dave Inc (NASDAQ:DAVE), has sold 12,000 shares of the company on March 5, 2024, according to a recent SEC Filing. The transaction was executed at a price of $32.02 per share, resulting in a total sale amount of $384,240.

Dave Inc (NASDAQ:DAVE) is a financial technology company that offers a range of products and services designed to help customers manage their personal finances. The company provides tools for budgeting, building credit, finding side gigs, and accessing cash advances to cover immediate expenses.

Over the past year, the insider has engaged in the sale of 12,000 shares and has not made any purchases of the company’s stock. The recent sale by the insider is part of a series of transactions in the company’s shares by insiders.

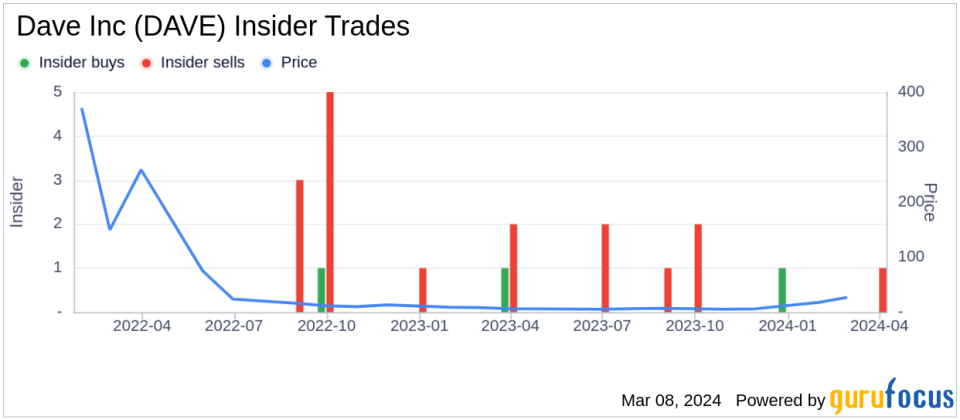

The insider transaction history for Dave Inc (NASDAQ:DAVE) indicates a pattern of insider activity. There have been 2 insider buys and 7 insider sells over the past year. This activity provides a glimpse into the sentiment insiders have about the stock’s future performance.

On the date of the insider’s recent transaction, shares of Dave Inc (NASDAQ:DAVE) were trading at $32.02, giving the company a market capitalization of $454.065 million.

Investors often monitor insider buying and selling as it can provide insights into a company’s internal dynamics and potential future performance. However, insider transactions are not always indicative of future stock movement and can be influenced by a variety of factors, including personal financial needs and portfolio diversification strategies.

The information provided in this article is based on regulatory filings and is intended for informational purposes only. It does not constitute financial advice or an endorsement of the company or its stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link