The “Magnificent Seven” — Microsoft, Alphabet, Amazon, Apple, Nvidia, Meta, and Tesla — garner the lion’s share of the buzz around artificial intelligence (AI). But savvy investors understand that there is a whole host of other opportunities outside of megacap tech.

One of Wall Street’s most polarizing tech stocks, Palantir Technologies (NYSE: PLTR), has seemed to enter the AI arms race out of nowhere. Given its close ties to the U.S. government, the company has widely been hailed by skeptics and bears as no more than an IT consultant for the public sector.

But after a stellar performance in 2023, one Wall Street analyst in particular is pounding the table for Palantir and its AI capabilities.

Dan Ives of Wedbush Securities dubbed the company the “Messi of AI” (a nod to soccer superstar Lionel Messi). Following its impressive fourth-quarter earnings report, Ives upgraded his price target to $30, which implies about 40% upside from the stock’s trading levels as of Feb. 7.

Let’s dig into Palantir’s business and analyze how the company is disrupting big tech’s pursuit of AI. And a look at its valuation compared to its peers might suggest that now is a lucrative opportunity to buy the stock.

Palantir’s incredible run in 2023

For many years, Palantir sold its software products under three labels: Foundry, Gotham, and Apollo. Each of these suites assists in complicated data analytics and synthesis for large enterprises.

Back in April, it unveiled its fourth flagship product, the Palantir Artificial Intelligence Platform (AIP). The release of AIP was largely overshadowed by big tech’s aggressive moves in the AI field, headlined by billion-dollar investments in ChatGPT developer OpenAI and its competitor Anthropic.

To get the word out about AIP, Palantir began hosting what it calls “boot camps” — immersive seminars during which prospective customers could test and demo the company’s software. This strategy to generate sales leads has proved to be more than just a creative way to bolster Palantir’s customer pipeline.

In 2023, Palantir increased its customer base by 35% year over year. More important was the company’s penetration of the private sector. Its commercial customer count grew by 44% year over year in 2023, and during the fourth quarter specifically, revenue from U.S. commercial customers increased 70%.

This highlights Palantir’s transformation from primarily a government contractor to a more diversified, prolific developer of enterprise software.

Palantir’s future looks bright

The impressive customer acquisition numbers above translated to top-line growth of 17% year over year in 2023. If this appears muted, consider the following:

First, Palantir has been around for nearly two decades. The company reached $1 billion in revenue for the first time in 2020, mostly through large deals with government agencies. And yet, just three years later, it exceeded $2 billion in revenue.

Moreover, the macroeconomic picture has been cloudy for the last few years, plagued by lingering inflation and high interest rates. This has taken a toll on corporate budgets, and demand for software has waned across the board.

It’s clear that Palantir is using the boot camps as a low-cost way to spur customer acquisition. Management is playing the long game by focusing on the rapid adoption of its software now to build momentum through upselling and cross-selling to these new customers in the future. For this reason, I would expect revenue to accelerate significantly in the coming years.

But even so, the company’s overall financial profile appears rock solid. In 2023, operating margin expanded from 22% to 28%. This fell directly to the bottom line as free cash flow of $730 million, an increase of 260% year over year.

Even with revenue growth in the mid-teens throughout 2023, Palantir has been consistently profitable based on generally accepted accounting principles (GAAP), making the company eligible for inclusion in the S&P 500.

Should this occur, I would not be surprised to see more institutional investors beginning to take a closer look at Palantir in relation to its big tech counterparts.

Should you invest in Palantir?

One thing investors should be aware of is that Palantir is a growth stock, and it tends to experience some pronounced volatility.

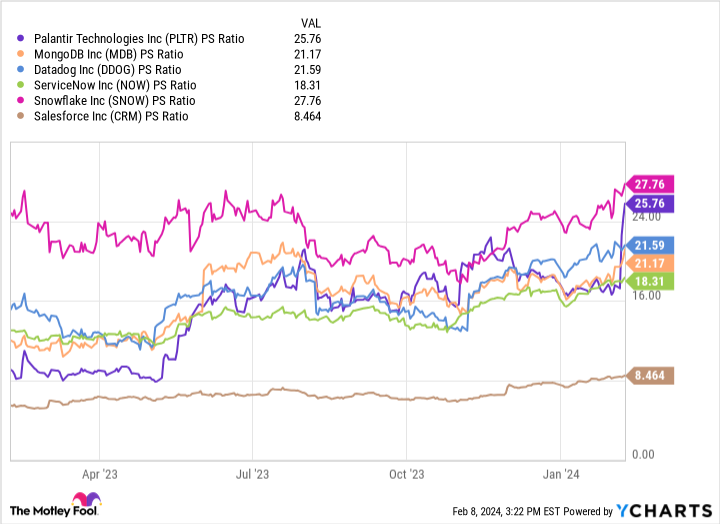

The chart above benchmarks Palantir against a cohort of other enterprise software businesses developing AI on a price-to-sales (P/S) basis. At a P/S of 25.7, Palantir stock is trading at a premium compared to many of its peers.

However, there is a clear caveat illustrated above. Palantir’s valuation has surged dramatically over the last week, following the release of fourth-quarter earnings. Investors can see the exponential rise in its P/S multiple in just the last few days.

While the stock is certainly enjoying a moment right now, I’d caution investors against waiting for a dip. Trying to time the market is often an exercise in false precision. Instead, slowly accumulating shares through a strategy of dollar-cost averaging could be the prudent option in the long term.

I see Palantir’s strong performance in 2023 as a preview of what’s to come. While the long-term benefits of AI-powered services are likely still years away, the company appears to be emerging as a leader. Now could be a terrific time for new and existing investors to scoop up some shares and hold on for the ride.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool has a disclosure policy.

Dan Ives Sees Over 40% Upside in This Artificial Intelligence (AI) Stock. Time to Buy? was originally published by The Motley Fool

Credit: Source link