Summary of key points: –

- “Blockbuster” US jobs report defies all prior predictions

- Looking ahead at likely future forces in FX markets

“Blockbuster” US jobs report defies all prior predictions

The view and outlook that the US dollar will weaken against all currencies this year is now under some scrutiny and pressure, following the US Non-Farm payrolls employment report for January.

The reported increase in jobs of 353,000 was totally “out of the blue”, catching financial and investment markets unaware and therefore some significant shifts in pricing followed. Earlier market expectations that the US Federal Reserve could be cutting their interest rates as early as March have been completely dashed by the unexpected strength in the labour market. Most of the talk is now of the first interest rate cut coming in May or June.

There would be some danger in labelling the January 353,000 increase in jobs as a total “outlier” or “rogue” number.

The number of jobs added in the US economy in the month of December was also revised materially higher form the originally reported 217,000 to 333,000. The massive jump in new jobs during January was again largely in the services and government sectors with professional/business services up 74,000, healthcare up 70,000 and government up 36,000.

The real surprise in the detail of the numbers was the almost unbelievable 45,000 new jobs added in the retail sector. Employment growth in the retail sector had been flat through all if 2023 with minimal changes to employment levels. Just why and how suddenly 45,000 new retail jobs would be added in the depths of winter snow and ice in January is a real head-scratcher. There is something really screwy in the recording and in the historical seasonal and other adjustments to the figures that suggest they do not accurately represent the true picture of current hiring and firing in the US economy.

The January 2023 Non-Farm Payroll result was also an unexpected massive increase that the economic forecasters and the markets did not anticipate.

There is something quirky and unexplainable around how the data collectors at the US Bureau of Labour Statistics make widespread adjustments every January that creates an unease on the reliability of the figures. To be fair, US consumer spending did hold up better than most expected through the second half of 2023, however analysis of increasing and record high credit card debt would suggest the spending was “on tick” for the most part.

The big increases in retail and services jobs just does not add-up, especially when you consider that another labour market measure, the ADP Employment Change survey of private sector companies (released two days prior on Wednesday 31st January) recorded only 107,000 net new jobs in January against a prior forecast of +145,000.

The conflicting employment data does put into question the accuracy of the Non-Farm Payroll jobs report and therefore any conclusion that the US economy is suddenly surging on a wave of hiring more workers due to strong demand, should be taken with a great deal of caution and scepticism. The second measure of employment released alongside the Non-Farm Payrolls, is the Household Survey Labour Force Status. That survey recorded little change in employment and unemployed levels over the month of January. A very confusing and complexing picture, delivered in a convoluted way that only the Americans seem able to do!

Adding to the US economic data confusion was an unexpected jump in wages in January, the Average Hourly Earnings measure increasing by 0.60%, well above prior forecasts of +0.30%. On an annual basis, wages increased from 4.40% in December to 4.50% in January. Again, the increases were at odds with Unit Labour Cost data released the day before, which recorded a very modest 0.50% increase in the December quarter and a revised 1.1% reduction in the September quarter.

The US Federal Reserve will not be reacting to one month’s employment and wages numbers, no matter how stunningly strong the figures were. The market reaction, however, was immediate and significant as you would expect. US 10-year bond yields reduced sharply from 4.10% before the Fed’s Monetary Policy meeting on Wednesday 31st January to a low of 3.84% ahead of the jobs report on Friday 2nd February. The surprisingly strong jobs data forced the bond yields back up again to 4.02% as the bets on the timing of Fed rate cuts were pegged back.

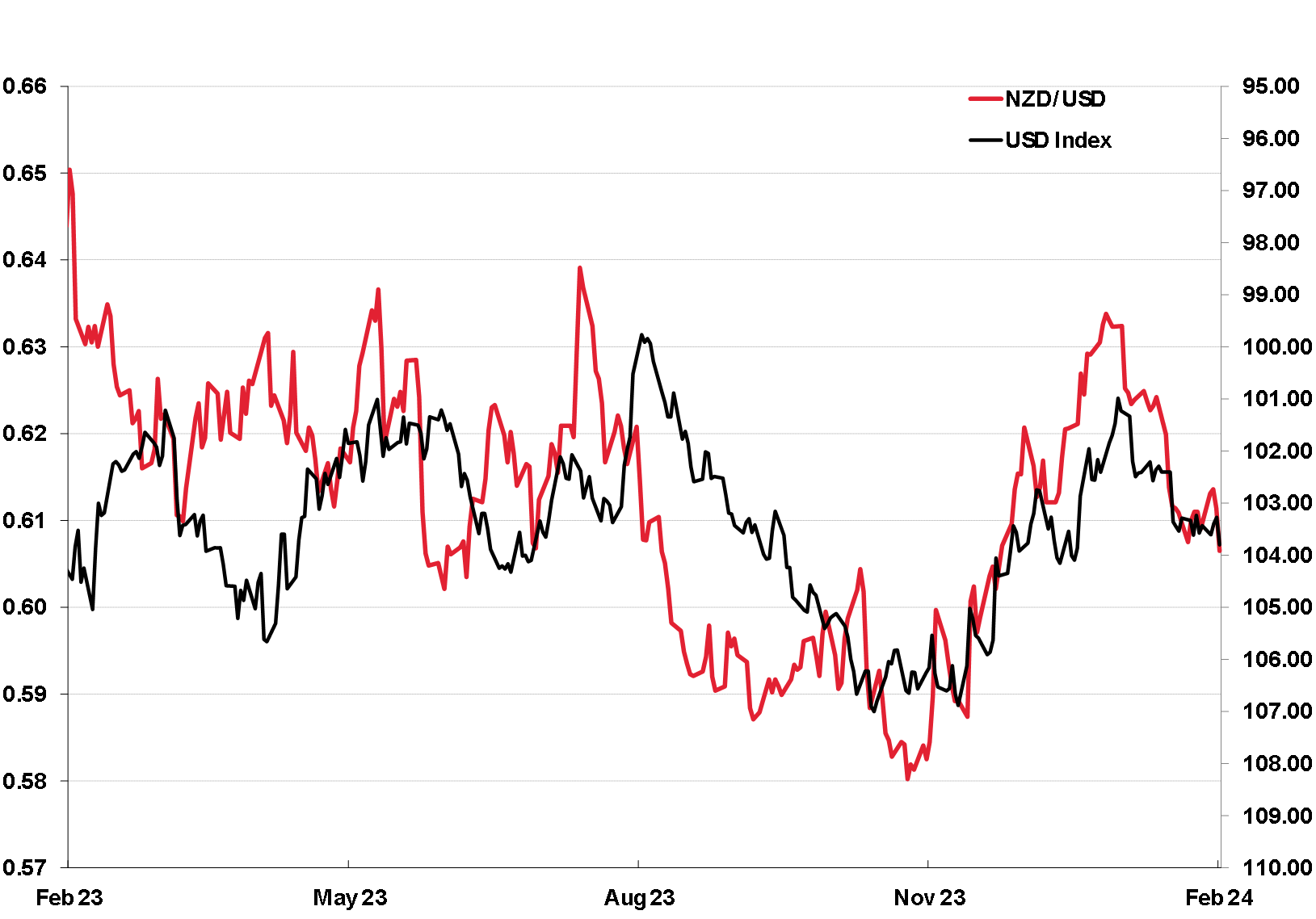

The US dollar depreciated in something of a delayed fashion to the Fed’s Wednesday statement from 103.50 (USD Dixy Index) on 1st February to a low of 102.80 before the jobs report. The employment stunner, however, pushing back the timing of interest rate cuts, subsequently reversed the USD’s direction to a much stronger 103.82 by the market close on Friday. As a consequence of the rebound upwards in the USD, the NZD/USD exchange rate dropped one cent from 0.6160 to 0.6065 in Friday trading after the jobs report was released.

All of the above commentary is what has already happened. Whilst it is hopefully informative as an explainer, it is not that necessarily helpful to FX decision-makers in respect to “where to from here” questions.

Looking ahead at likely future forces in FX markets

The latest US employment data may slightly delay the timing of interest rate reductions this year, however the now consistently low inflation outcomes still point to US interest rates decreasing well ahead of other major economies in 2024. The next pointer for the FX and interest rate markets will be the US inflation numbers for January released on Tuesday 13th February. Another low monthly increase in the headline inflation rate of 0.20% (or lower) will pull the annual inflation rate down to close to 3.00% (from 3.40% for the year to 31 December 2023). The members of the Fed are seeking more confidence that their lower inflation is here to stay, upcoming January and February inflation results should provide that confidence as the annual inflation rate marches progressively lower to their 2.00% target.

The same confidence cannot be attached to the trend of New Zealand’s inflation rate in 2024. The RBNZ are forecasting the annual inflation rate to decrease to 2.50% by 31 December 2024 from the current 4.70% rate. That forecast looks increasingly hard to achieve. Whilst there were large increases in the June and September quarters last year that will drop out of the annual inflation figures and pull the annual rate sharply down this year, the high 5.90% domestic/non-tradable inflation rate will be difficult to reduce quickly. Without significant NZD appreciation and/or oil price decreases to reduce tradable inflation, a more realistic inflation forecast for 31 December 2024 is somewhere around 3.50%. Therefore, as the RBNZ are forced to revise their 2024 inflation forecast upwards, our interest rates will be staying higher for longer this year and widening the interest rate differential gap to US interest rates.

The Reserve Bank of Australia meet this Tuesday 6th February and are likely to deliver a marginally more “hawkish” tone to their commentary on bringing their inflation rate down. Australia’s annual inflation rate to 31 December 2023 at 4.10% was below consensus forecasts of 4.30%, however the RBA are very conscious of continuing wage increases in the economy holding inflation higher than they desire. An example of higher wage settlements is DP World agreeing to a 23% wage increase over four years for Aussie dockworkers, which will increase import costs.

Escalating global geo-political event risks in the Middle East are always positive for the US dollar. It will be interesting to see if the recent US retaliation against Iran-backed militia groups is effective in reducing attacks from these terrorists. It does appear that the Israel/Hamas situation is finally reducing in intensity, so a reduction in geo-political tensions/risks appears more likely over coming months than further increases.

Contrarian global investors reducing allocations to over-valued US equities are likely to be eyeing undervalued sharemarkets in China and emerging markets this year. Such potential movement of investment capital has direct implications for currency values, with the strong US dollar being utilised to buy into undervalued currencies, bond and equity markets.

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

Credit: Source link