Investors love a good stock split. Those events don’t do anything more than split the same-sized pie into smaller pieces, but they only occur after a company’s share price has soared, which generally indicates that the business is doing quite well. Even better, when management decides to split a company’s stock, it implies that it thinks there’s more growth coming.

Chipotle Mexican Grill (NYSE: CMG) wowed Wall Street back in March with the announcement of a stock split with one of the biggest multiples ever: Each current share will be split into 50 new shares. The change is set to go through on June 25 for shareholders of record as of June 18.

So is now the time to buy Chipotle?

Chipotle stock looks unstoppable

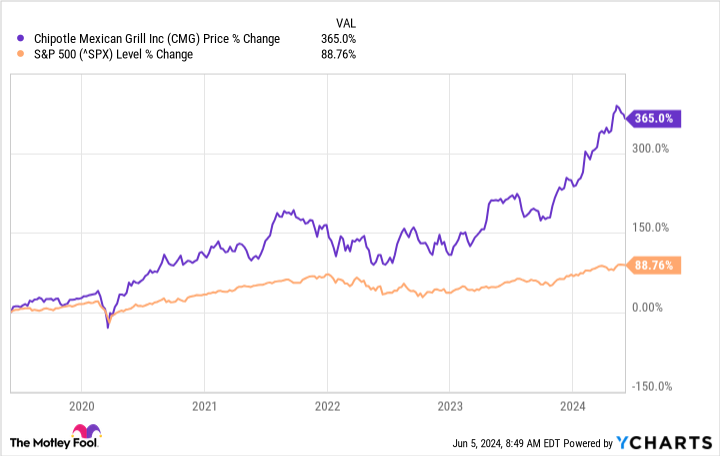

Chipotle has been an incredible stock to own over its time as a public company, and while it has had some rough patches, it has absolutely crushed the S&P 500 over the past five years as well as most other time periods.

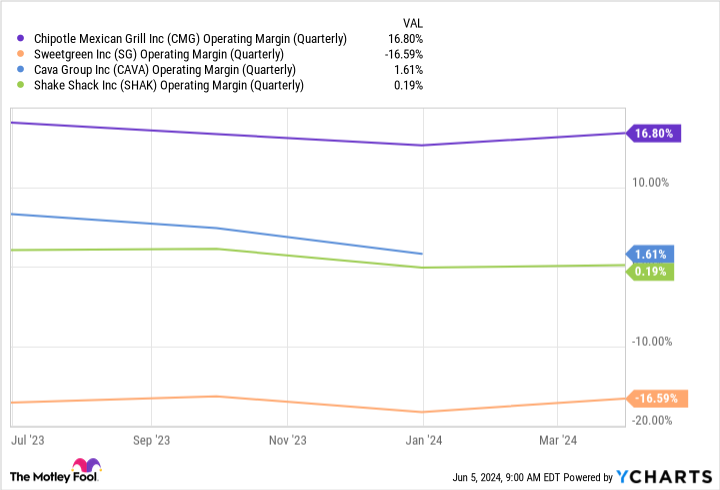

It has created a fast-casual model that generates incredible customer loyalty, sales, and profits — and that has been hard to replicate. It’s known for selling healthy, fresh Mexican-style fare at midlevel prices; it’s more expensive than the typical fast-food chain, but significantly cheaper than the standard sit-down restaurant. It targets a more affluent clientele that tends to be more resilient during periods of economic volatility, and it has demonstrated strong performance over the past few years despite a pandemic and the surge of inflation that followed it. It is also incredibly profitable, with high and increasing margins and net income.

Other chains have attempted to mimic its model and performance, and many new contenders have been touted as “the next Chipotle.” But whatever its secret sauce is, it continues to stand out from its peers. As CEO Brian Niccol recently quipped: “The next Chipotle is Chipotle.”

Consider its operating margins compared with those of Sweetgreen, Shake Shack, and Cava Group.

What’s coming next?

Chipotle already has more than 3,000 restaurants, but it’s aiming to eventually have 7,000 in North America alone. It’s fairly saturated in large urban markets, so now it’s going after the smaller towns and suburban areas where many of its affluent customers live. It’s also intensifying its push into Canada.

It already has some stores in select European markets, so it has plenty of opportunity to expand internationally, and it recently launched its first franchise partnerships for stores in the Middle East. Otherwise, all of its locations are company owned.

Management also sees a flywheel effect in its business that creates opportunities for leverage and efficiency. As it retains a strong cadre of employees and trains them in leadership roles, its stores perform better, with faster service and higher transaction rates.

Is now the time to buy?

Since investors love stock splits, Chipotle stock rose in the wake of the news that this one was coming. But Chipotle stock tends to rise all the time, and it headed even higher after its outstanding first-quarter earnings report.

Stock-split stocks do seem to rise after they split, lending support to the argument that investors should buy them beforehand. But nobody can reliably “time the market,” and there’s no need to try. If you see the opportunity in buying Chipotle stock, it won’t matter much in the long term whether you bought it before or after the split. What could matter is that the earlier you buy it, the longer you have for its growth to compound, maximizing your overall gains.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 3, 2024

Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool recommends Cava Group and Sweetgreen. The Motley Fool has a disclosure policy.

Chipotle Is Splitting Its Stock 50-for-1 This Month: Should You Buy Now? was originally published by The Motley Fool

Credit: Source link