Chipotle Mexican Grill (NYSE: CMG) has been one of the best-performing stocks on the market since its initial public offering (IPO) in 2006, but despite gaining more than 5,000%, the stock had never once split.

That’s about to change. The burrito roller said after hours on Tuesday that its board of directors had approved a 50-for-1 stock split, which it said would be one of the biggest stock splits in the history of the New York Stock Exchange. The split is subject to shareholder approval at the company’s annual meeting on June 6. If it’s approved, the stock will begin trading on a post-split basis on June 26.

CFO Jack Hartung said the stock split “will make our stock more accessible to employees as well as a broader range of investors,” and noted that the stock is at an all-time high due to record revenue, profits, and growth. Chipotle also announced a special one-time equity grant for all restaurant general managers and crew members with more than 20 years of service.

What Chipotle’s stock split means for investors

Chipotle’s shares jumped 5% after hours on the news, indicating that investors are clearly pleased with the stock split. However, investors should understand that a stock split doesn’t do anything to change the fundamentals of the stock. It simply splits the pie into more pieces. Investors’ individual holdings will remain the same, and they will have the same claim to Chipotle’s profits that they did before.

There is some evidence that stocks outperform following a stock split, but that’s not necessarily a direct consequence of a split. Stock splits tend to come when a business is already performing well as a split happens after a stock has risen enough to justify it in the eyes of the board of directors. Stock splits can also attract momentum investors as it acts as something of a milestone for the stock’s growth.

In some ways, Chipotle’s stock split seems like it’s overdue. The stock was approaching $3,000 a share when the news was announced, giving it one of the highest individual share prices on the S&P 500. A 50-for-1 split will bring that price below that of many of its peers, to around $60 if its current price holds.

Is Chipotle stock a buy?

Except for a few difficult years in the wake of its E. coli outbreak, Chipotle has been a phenomenal business and stock over its history. The company pioneered the fast-casual restaurant segment, and it has spawned a raft of imitators with similar concepts but different cuisines. That’s because Chipotle has built a great business model, especially after having adapted to the digital era, and its customers love its product.

Chipotle generates strong profit margins and the company continues to grow both through the addition of new locations and through same-store sales growth. Average unit volumes have now topped $3 million, meaning the average Chipotle restaurant brings in more than $3 million annually, which is among the best in the fast food industry.

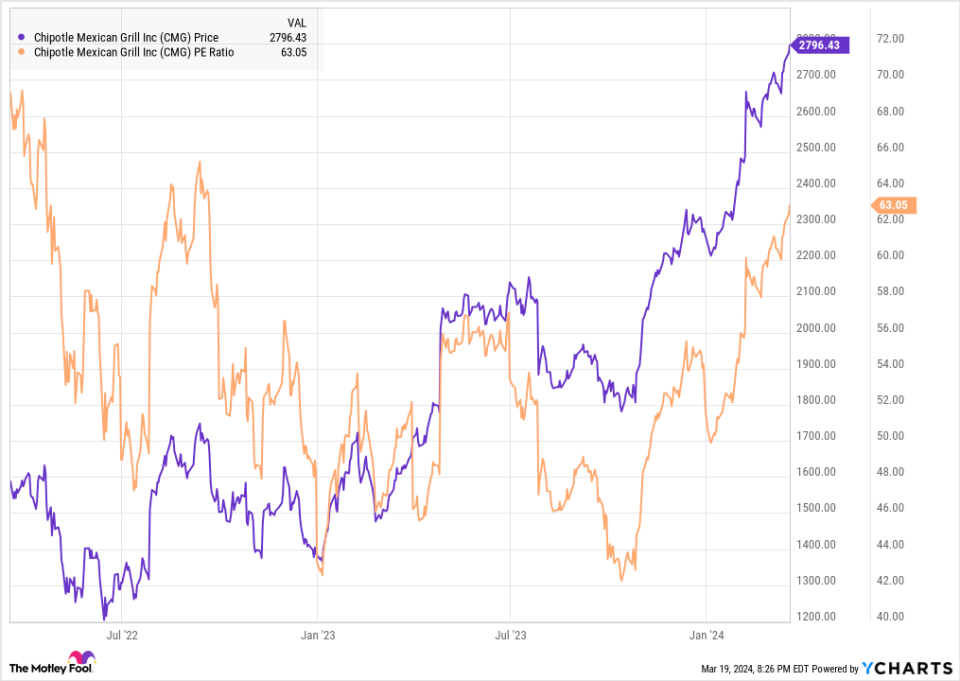

It’s hard to find fault with Chipotle as a business, but its success has driven its stock’s valuation higher recently, as the chart below shows. Chipotle’s price-to-earnings ratio is as high as it’s been in a year and a half now, and there’s no longer any impact on its profits from the pandemic, which had artificially elevated its P/E ratio.

Given the strength of the business, the stock still looks like a good bet for long-term investors, but they should also temper their expectations for near-term growth, considering the current valuation as the stock’s 44% gain over the last six months will be difficult to repeat.

Chipotle investors who have benefited from the stock’s impressive gains in recent years might also want to consider diversifying into other promising restaurant stocks such as Cava Group, Sweetgreen, or Kura Sushi, who are borrowing from Chipotle’s business model.

Interest in Chipotle stock is likely to be elevated in anticipation of the stock split, but buying it for the stock split alone would be misguided. Investors should instead keep their focus on Chipotle’s long-term prospects, which continue to look promising.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 21, 2024

Jeremy Bowman has positions in Chipotle Mexican Grill. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool recommends Cava Group and Sweetgreen. The Motley Fool has a disclosure policy.

Chipotle Is Finally Splitting Its Stock. Is It Time to Buy? was originally published by The Motley Fool

Credit: Source link