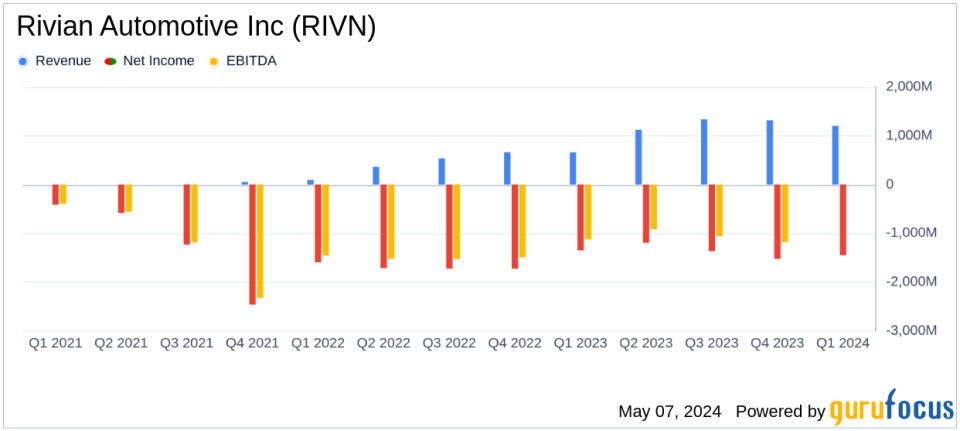

Revenue: Reported at $1,204 million in Q1 2024, surpassing the estimated $1,163.40 million.

Net Loss: Increased to $(1,446) million in Q1 2024 from $(1,349) million in Q1 2023, exceeding the estimated $(1,079.37) million.

Earnings Per Share (EPS): Recorded at $(1.48) per share, below the estimated $(1.17).

Gross Profit: Negative gross profit improved slightly to $(527) million in Q1 2024 from $(535) million in Q1 2023.

Operating Expenses: Grew to $957 million in Q1 2024, up from $898 million in the corresponding quarter last year.

Adjusted EBITDA: Improved to $(798) million in Q1 2024 from $(1,020) million in Q1 2023.

Liquidity: Ended Q1 2024 with $9,053 million in total liquidity, including cash and available credit facilities.

On May 7, 2024, Rivian Automotive Inc (NASDAQ:RIVN) disclosed its first quarter financial results through an 8-K filing. The company, known for its innovative electric vehicles including the R1T truck and the R1S SUV, reported a net loss of $1,446 million for the quarter, which although significant, shows a moderated deterioration compared to the previous year. Rivian’s revenue for the quarter stood at $1,204 million, surpassing the analyst estimates of $1,163.40 million.

About Rivian Automotive Inc

Rivian Automotive Inc designs and manufactures category-defining electric vehicles and accessories. The company’s focus on the R1 platform has positioned it as a leader in the high-end EV market, particularly with the R1S model becoming the top-selling EV in the US above $70,000 during the quarter.

Operational Highlights and Strategic Advances

The quarter was marked by several operational successes, including a 49% increase in vehicle production and a 71% increase in deliveries compared to the same period last year. Rivian also celebrated the production of its 100,000th vehicle. Strategic advancements were notable with the unveiling of a new midsize platform and the transition to a more cost-efficient production model expected to save over $2.25 billion.

CEO RJ Scaringe highlighted the quarter’s achievements and the company’s focus on “continued demand generation, delivering cost and plant efficiency improvements, and driving towards profitability.” The retooling of Rivians Normal, Illinois plant is set to enhance manufacturing efficiency significantly.

Financial Performance Analysis

Rivian’s financial health showed mixed signals. The gross profit per vehicle delivered was negatively impacted by $9,346, attributed to supplier and integration costs, resulting in a negative gross profit of $(527) million. However, this was an improvement from the $(535) million recorded in the first quarter of 2023. Operating expenses saw a rise primarily due to increased stock-based compensation and depreciation costs.

The company’s adjusted EBITDA improved to $(798) million from $(1,020) million year-over-year, reflecting some level of cost management effectiveness. Capital expenditures remained stable, and liquidity was robust with $7,858 million in cash and equivalents, ensuring operational runway amidst ongoing investments in expansion and technology.

Challenges and Market Position

Despite these progresses, Rivian continues to face significant challenges, particularly with its high burn rate and ongoing losses. The path to profitability is critical as the company scales up production and sales. Market conditions and supply chain dynamics also remain pivotal factors that could influence Rivian’s operational strategies and financial outcomes in upcoming quarters.

Investors and stakeholders are likely to keep a close watch on Rivians ability to manage costs and scale operations efficiently. The company’s strategic decisions, particularly around production and technological innovation, will be crucial in determining its long-term financial health and market position.

For more detailed information, Rivian invites stakeholders to view its latest shareholder letter and join its upcoming webcast, details of which are available on the companys Investor Relations website.

Explore the complete 8-K earnings release (here) from Rivian Automotive Inc for further details.

This article first appeared on GuruFocus.

Credit: Source link