In a notable insider transaction, CFO Sandeep Nayyar of Power Integrations Inc (NASDAQ:POWI) sold 14,652 shares of the company’s stock on November 30, 2023. This move has caught the attention of investors and analysts, as insider sales can provide valuable insights into a company’s financial health and future prospects.

Who is Sandeep Nayyar?

Sandeep Nayyar serves as the Chief Financial Officer of Power Integrations Inc, a position that places him in charge of the company’s financial operations and strategy. His role includes overseeing accounting, financial planning and analysis, treasury, tax, and investor relations. Nayyar’s insights into the company’s financials are crucial, making his trading activities particularly noteworthy for investors.

About Power Integrations Inc

Power Integrations Inc is a leading innovator in semiconductor technologies for high-voltage power conversion. The company’s integrated circuits (ICs) are used in a wide array of electronic products, from mobile devices to industrial equipment. Power Integrations prides itself on energy-efficient solutions, with its products playing a critical role in reducing global energy consumption by improving the efficiency of electronic power supplies.

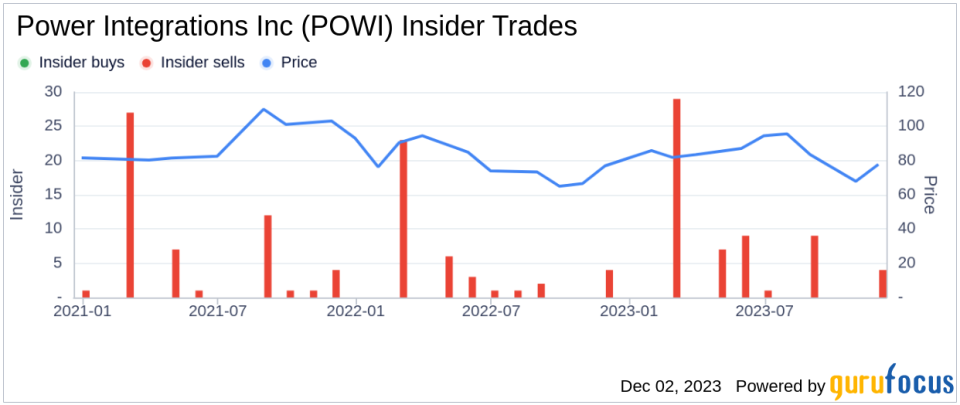

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by the insider, CFO Sandeep Nayyar, is part of a broader pattern observed over the past year. Nayyar has sold a total of 36,328 shares and has not made any purchases. This one-sided activity could signal a lack of confidence in the company’s future growth or simply a personal financial decision.The overall insider transaction history for Power Integrations Inc shows a significant imbalance, with 60 insider sells and no insider buys over the past year. This trend could be interpreted as a bearish signal, suggesting that those with the most intimate knowledge of the company’s workings are choosing to cash out rather than invest.

Valuation and Market Response

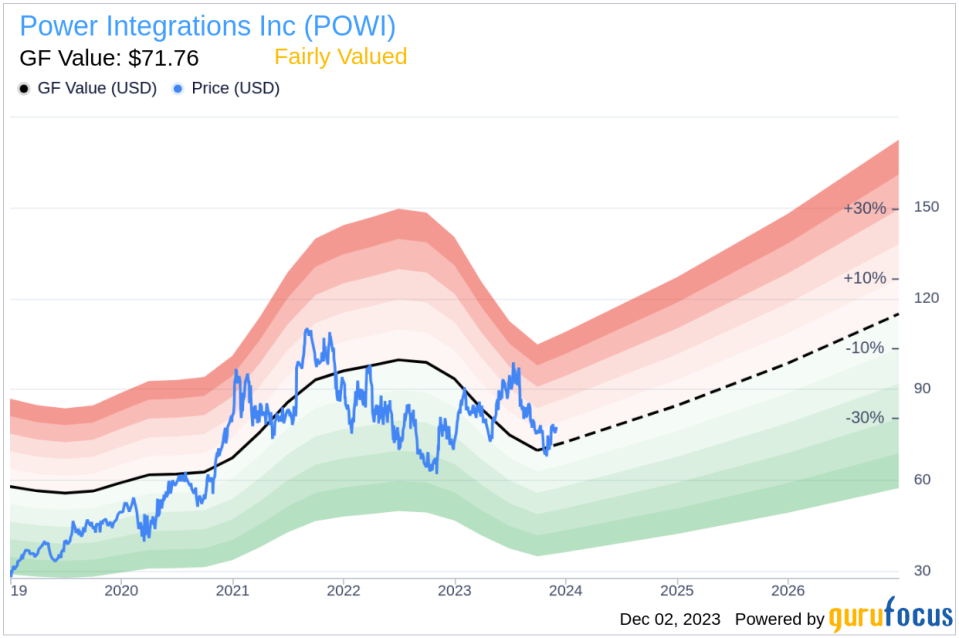

On the day of Nayyar’s recent sale, shares of Power Integrations Inc were trading at $76.22, giving the company a market cap of $4.413 billion. The price-earnings ratio stands at 69.30, significantly higher than the industry median of 27.1 and above the company’s historical median. This elevated P/E ratio could suggest that the stock is overvalued relative to its peers and its own trading history.However, when considering the GuruFocus Value (GF Value) of $71.76, Power Integrations Inc appears to be Fairly Valued with a price-to-GF-Value ratio of 1.06. The GF Value is a proprietary intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

Conclusion

The insider selling activity, particularly by CFO Sandeep Nayyar, raises questions about the valuation and future prospects of Power Integrations Inc. While the company’s stock is deemed fairly valued based on the GF Value, the high P/E ratio and the pattern of insider selling could be a cause for investor caution. As always, it’s important for investors to conduct their own due diligence and consider the broader market context when evaluating insider transactions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Credit: Source link