This past week has been a doozy. We’ve got the usual headwinds piling up, with sticky inflation, a 1-in-3 chance for another Fed interest rate hike this year, and rising bond rates putting pressure on stocks. And if that wasn’t enough, the geopolitical situation has heated up, with a major war in the Middle East as Israel goes to war in retaliation for Hamas’ latest atrocities.

But there are opportunities in the market, and investors should not lose hope, despite the headwinds. The strategists at investment powerhouse BlackRock put it in clear terms: “A challenging macro backdrop doesn’t mean a dearth of investment opportunities. Quite the opposite, in our view. Higher macro volatility is translating into greater divergences in security performance relative to broader markets. That calls for much greater selectivity and more granular views. Harnessing the mega forces shaping our world will also offer abundant investment opportunities. It all boils down to what’s priced in.”

Turning those words into action, BlackRock, the world’s largest asset manager with $9.42 trillion in assets under management as of the end of Q2, has been actively seeking out these opportunities. It has recently made significant purchases of two high-yield dividend stocks, with one boasting a yield as high as 9%.

We ran these tickers through TipRanks’ database to determine whether the Street’s analyst corps agrees that these are ripe for the picking at present. Let’s take a closer look.

Hannon Armstrong (HASI)

We’ll start with Hannon Armstrong, a company that’s been putting its money where its mouth is when it comes to climate change. This Annapolis-based firm leads the way in climate-positive investments and green initiatives, funding ventures in energy efficiency, renewable energy, and sustainable infrastructure. The company has a coherent vision for its investments, that every one will improve our collective climate future.

Getting into some specifics, Hannon Armstrong’s investment portfolio currently totals some $4.9 billion. Of this, 51% is put into ‘behind-the-meter’ projects, or energy efficiency, distributed solar power, and power storage initiatives. Another 42% of the total is in ‘grid connected’ power assets, particularly in wind and solar power generation and in power storage. And finally, 7% of the portfolio is put into fuels, transport, and nature: that is, renewable natural gas, fleet decarbonization, and ecological restoration.

While there has been some controversy over the quality of ‘green’ economic and infrastructure initiatives, Hannon Armstrong has made careful selections in its portfolio investments to return consistent quarterly profits. Part of the company’s goal is to show that climate-friendly investments can provide sound returns for investors. In the last reported quarter, 2Q23, the company continued on this path, with a top line of $74.33 million. This was up more than 18% year-over-year, and beat the forecast by over $43 million. The firm’s 53-cent non-GAAP distributable EPS figure was in-line with expectations.

This gets us into HASI’s dividend figure. The company’s most recent dividend declaration, made on August 3 for an October 11 payout, was for 39.5 cents per common share. At this rate, the dividend annualizes to $1.58 per share and has a robust forward yield of 9.3%.

BlackRock is clearly impressed by Hannon Armstrong, and is showing that in the most direct way possible. The firm has, since the end of Q2, purchased almost 9.05 million shares in HASI, and now has a total holding in the company of 17,750,428 shares. The stake represents an ownership share of 16.5% in Hannon Armstrong, and is worth $298.38 million at current share price.

HASI shares have been volatile recently, and they are down some 31% since the middle of last month. However, Baird analyst Ben Kallo thinks the size of the drop is unjustified and points out that the stock has plenty for investors to like.

“HASI’s recent selloff was partially in response to peer NEP reducing its dividend growth outlook and citing a more challenging environment amidst higher interest rates. In our view, weakness in HASI shares due to NEP’s outlook does not give credit to HASI’s differentiated portfolio and strong financial position. HASI’s projects also consist of operating assets vs peers which include assets in development in many cases, and we view this as a competitive advantage,” Kallo opined.

“Higher interest rates and worsening consumer health have raised concerns about near-term growth opportunities. Despite the uncertain outlook from others in the space, we believe HASI is set up for a strong Q3 and see a clean quarter as a potential catalyst,” Kallo goes on to add.

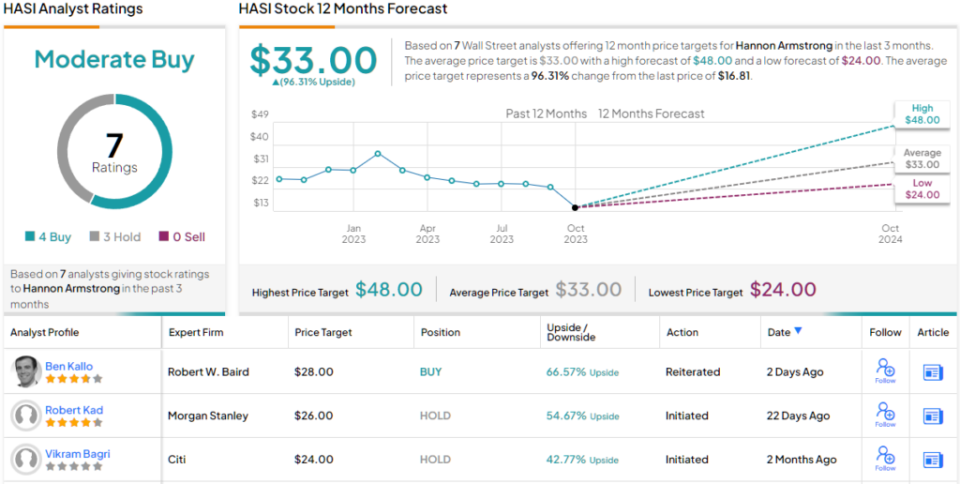

In Kallo’s view, these facts support an Outperform (i.e. Buy) rating, and while his $28 price target makes room for ~67% growth over the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~76% potential total return profile. (To watch Kallo’s track record, click here)

Overall, the 7 recent analyst reviews on Hannon Armstrong break down to 4 Buys and 3 Holds, for a Moderate Buy consensus rating. The shares are trading for $16.81, and their $33 average price target suggests a one-year gain of 96% for the stock. (See HASI stock forecast)

Gaming and Leisure Properties (GLPI)

Next on our list is a REIT, a real estate investment trust, but one with a twist. Gaming and Leisure Properties, as its name suggests, focuses its investments on the acquisition, financing, and ownership of real estate properties which are then leased out to gaming and casino operators. The company’s usual lease is a triple-net lease arrangement, making the tenant responsible for facility maintenance, insurance, utilities, and property taxes.

The expansion of legal casino gaming in the US in recent years has been beneficial for Gaming and Leisure, and at the end of 2Q23 the company had 59 gaming properties and related facilities spread across 18 states. These facilities total more than 30.2 million square feet of improved gaming space.

The company’s Q2 report also showed total revenues of $356.59 million, up more than 9% from the previous-year quarter. This total, which beat expectations by almost $1.3 million, included rental income of $319.24 million, for a 10% y/y increase. The company’s bottom line figure, an EPS of 59 cents per share, was 7 cents better than expected.

Of particular interest to dividend investors, GLPI also showed an adjusted funds from operations (AFFO) of 92 cents per share. This metric, which directly supports the quarterly dividend payment, beat the forecast by a penny. The stock dividend, of 73 cents per common share, was declared on August 30 and paid on September 29; the 73-cent payment represented a 1.4% increase from the previous quarter. At the new rate, the dividend annualizes to $2.92 per share, and yields 6.2%.

Turning to BlackRock’s stance on GLPI, we find that the asset manager has acquired 12,230,081 shares of the REIT since the end of Q2. BlackRock now holds a total of 30,622,204 shares in the company, which have a total value of nearly $1.43 billion – and which give BlackRock an 11.7% ownership in the company.

The stock has gotten positive attention from the Street’s analysts, too. Mitch Germain, writing from JMP, sees plenty to appreciate here, writing, “We are constructive on the company’s embedded growth pipeline, while adding a new tenant to the portfolio only enhances the potential for future investment opportunities. We continue to view the company in a positive light, as rental income stream offers consistent cash flow with predictable growth, management’s reputation in the industry is unparalleled, thereby providing it a look into all deals in the space, while alignment is a positive. The diversification of GLPI’s investment strategy to encompass growth funding has produced more proprietary deal flow and supports forward growth prospects at elevated returns, in our view.”

“GLPI’s shares currently trade half a turn below the net-lease REITs average at 12.4x, which we view as unwarranted, as it does not appropriately credit the company’s high-quality durable cash flows, above-average growth prospects, and historically low leverage,” Germain summed up.

These bullish comments back up Germain’s Outperform (i.e. Buy) rating on the stock, while his $57 price target implies ~21% one-year upside potential. (To watch Germain’s track record, click here)

All in all, GLPI gets a Moderate Buy rating from the Street’s consensus, based on 13 recent reviews that include 9 Buys to 4 Holds. The stock’s average price target of $54.21 suggests it will gain ~15% from the current share price of $47.21 over the coming year. (See GLPI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Credit: Source link