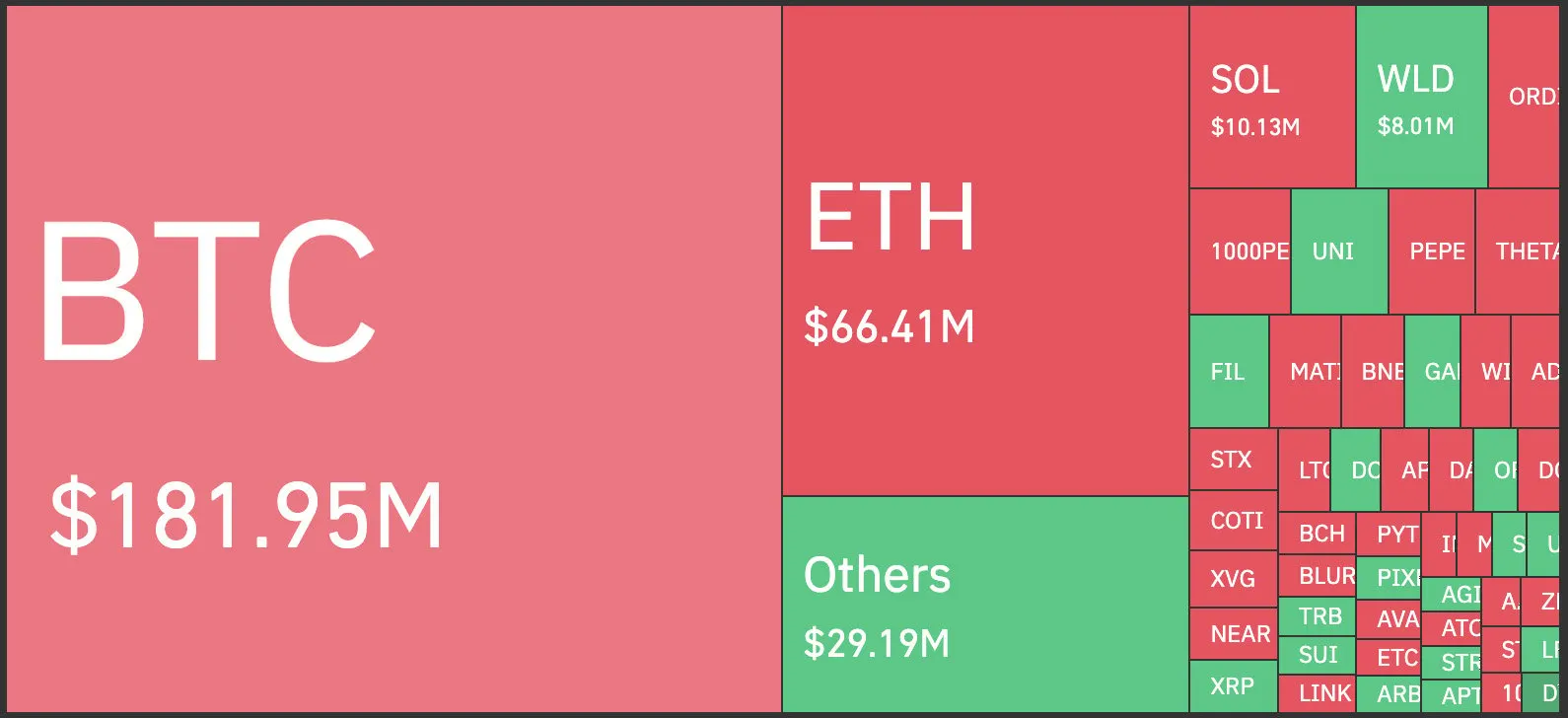

After flirting with $55,000 for much of the day, the price of Bitcoin didn’t hesitate to leap comfortably above $56,000 late Monday—$56,700 as of writing—reaching heady altitude despite more than $157 million in Bitcoin shorts being liquidated over the last 24 hours, according to CoinGlass.

The milestone comes only hours after BTC surged over $53,000, already seeing heights not seen since 2021.

Investors who took a short position on Bitcoin—betting that its price would go down from when the option to buy was secured—are liquidated when the price rises instead, triggering automated actions by exchanges to prevent further losses.

BTC has logged, then, an intra-day increase of about 10%—a return that would look great as an annual return for conventional investment vehicles. And the green candles are being driven by tradfi hunger for Bitcoin spot ETFs, which also saw record inflows today.

Top institutional Bitcoin holder MicroStrategy had just grown its Bitcoin holdings to 193,000 BTC. That stash was worth $10.28 billion when founder Michael Saylor tweeted about the acquisition of 3,000 Bitcoin this morning. It’s now valued at $10.9 billion, a $620 million single-day bump.

The firm has paid an average of $51,813 per Bitcoin, Saylor notes.

It was October 2021 when crypto watchers were similarly breathless, watching Bitcoin rise above $57,000—again, as that figure represented its all-time high at the start of that year—as it continued a two-week rally. It eventually $69,000 in November.

Today was a good day for Ethereum as well, with the price of ETH peaking at $3,273 about an hour prior to Bitcoin’s breakout. It’s a number last seen in April 2022 when its value was on the way down from its all-time high of $4,878 in Nov 2021.

Stay on top of crypto news, get daily updates in your inbox.

Credit: Source link