Both SoundHound (NASDAQ: SOUN) and Nvidia (NASDAQ: NVDA) are direct beneficiaries of AI. One produces the chips necessary to make our AI future possible. The other developed its own proprietary AI platform that could power everything from cars to drive-through windows.

If you want to bet on AI, it would make sense to buy stock in both companies. But some serious differences should guide your investment strategy.

Want maximum growth potential?

If you want maximum growth potential, the clear choice is SoundHound. The math isn’t complicated. SoundHound’s market cap is currently around $1.3 billion. Nvidia’s valuation, meanwhile, is closer to $3 trillion. Simply due to size, SoundHound stock has a much better chance of rising another 1,000% than Nvidia. For its stock to rise 10 times in value, Nvidia would need to add more value than Microsoft, Meta Platforms, Apple, and Amazon combined — and then some. SoundHound, meanwhile, would only need to add 0.3% of Nvidia’s current value.

Put simply, SoundHound’s diminutive size gives it more potential upside than Nvidia. But will SoundHound actually be able to realize that potential upside? One factor works heavily in its favor. And that is SoundHound’s platform relevance to a large number of industries.

At its core, the company’s technology enables sound and voice recognition, plus natural language understanding that allows responses via AI. Imagine ordering food through an AI-powered drive-through, chatting with your car about maintenance issues, or simply selecting a song. You might also want to discuss with your television which shows you should watch next. SoundHound actually has contracts with companies working on these very issues, with a total backlog valued at nearly $700 million — that’s up from around $330 million just a year ago.

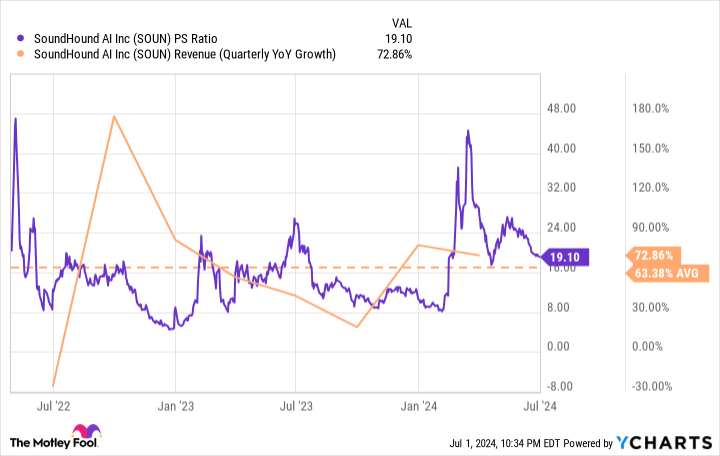

For all its potential, SoundHound stock isn’t priced for perfection. Shares trade at a lofty 19 times sales, but revenue growth rates have averaged roughly 60% per year. There’s a good chance double-digit growth rates will be sustained for another decade or more, a future that would make today’s premium valuation look reasonable in hindsight. Emerging tech companies like this typically show a lot of short-term volatility, but patient investors looking for maximum growth potential should like what they see.

Go all-in on artificial intelligence

Nvidia has very little to prove at this point. Over a very short time span, the company has become the largest AI stock in the world, with a huge percentage of its business dependent on growth in the AI industry.

“Back in fiscal 2022 (which ended in January 2022), Nvidia generated 46% of its revenue from its gaming GPUs, 39% from its data center GPUs, and the rest from its professional visualization, auto, and OEM chips,” explains fellow Fool contributor Leo Sun. Oh, how quickly that breakdown changed. For the first fiscal quarter of 2025, Nvidia generated 87% of its revenue from data center chips and just 13% from everything else, gaming included.

“It generated $22.6 billion in data center revenue in that single quarter compared to its total revenue of nearly $27 billion for all of fiscal 2023,” observes Sun. “That breakneck expansion transformed Nvidia from a more diversified GPU maker to an all-in play on AI chips.”

This all-in approach certainly has its risks. Over the past five years, Nvidia’s valuation has gone from around 10 times sales to nearly 40 times sales. The company’s growth rates — revenue grew by 262% year over year last quarter (Q1 of FY 2025) — have more than justified the rise in its multiple. Yet there’s no denying that Nvidia’s stock price is now dependent on two things. First, a continued massive increase in AI spending. Second, its ability to maintain its dominant market lead.

Over the decades, chip wars have produced many repeat winners and losers. Just check out the long-term price charts of AMD, Intel, and Nvidia. The winners and losers of today don’t necessarily stay that way forever, even if it takes years for the transition to occur. AMD’s MI300 Instinct GPUs are already beating Nvidia’s H100 GPUs on several benchmarks, as are Intel’s Gaudi 3 AI accelerators. Nvidia’s next-generation Blackwell chip is heading into the market as we speak, perhaps stemming the tide of rising rivals.

Make no mistake: Nvidia is still a great investment for those bullish on AI. But if you’re looking for the best bang for your buck, don’t ignore lesser-known stocks like SoundHound.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Better Artificial Intelligence Stock: Nvidia vs. SoundHound was originally published by The Motley Fool

Credit: Source link