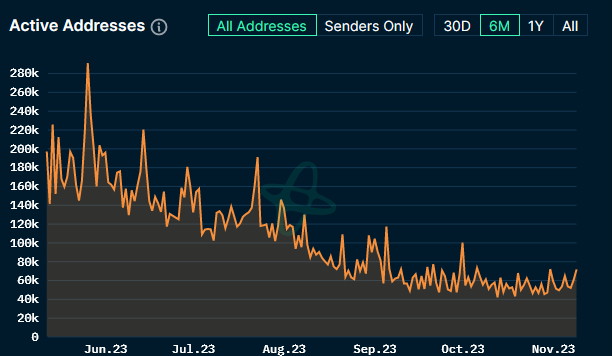

Activity declined on Avalanche last quarter, with both transaction volume and active addresses on Avalanche’s flagship “C-Chain” receding compared to Q2 2023.

According to data from Nansen, daily active users peaked at 86,000 in Q3, compared to 117,000 during the previous quarter. Daily active transactions also dropped from between 200,000 and 550,000 to range between 136,000 to 504,000, with the metric sinking to a low of 110,000 on Oct. 15.

Data from DeFi Llama shows Avalanche’s total value locked (TVL) also slumped 27% from $706m to $512M in Q3. Avalanche’s TVL has since rebounded 10% to $564M while daily transactions remain low at 232,000.

“The network experienced a downward trend in user activity throughout the quarter,” Nansen said.

Avalanche struggled to regroup amid the market downturn, with its TVL plummeting from an all-time high of $11.5B in December 2021.

The once dominant Layer 1 has struggled to carve out a unique identity, with Ethereum’s growing Layer 2 ecosystem offering low fees while tapping into Ethereum’s security and undermining the value-proposition of the alternative Layer 1 networks that outperformed during the previous bear market.

Avalanche has since sought to focus on building out its subnet architecture to attract developers building appchains — specialized blockchains dedicated to hosting a single decentralized application. However, Avalanche also faces significant competition from Ethereum Layer 3s and “Layer 0” protocols like Cosmos and Polkadot for appchain market share.

The project also allocated $50M for purchasing Avalanche-based tokenized assets to support Avalanche developers bringing real-world assets on-chain.

Earlier this week, Emin Gun Sirer, the founder of Avalanche’s development team, Ava Labs, announced that the company had laid off 12% of its staff.

Start for free

Avalanche’s AVAX token is down 3.5% in the past 24 hours, but gained 49% in three weeks alongside the broader crypto rally, according to CoinGecko.

Credit: Source link